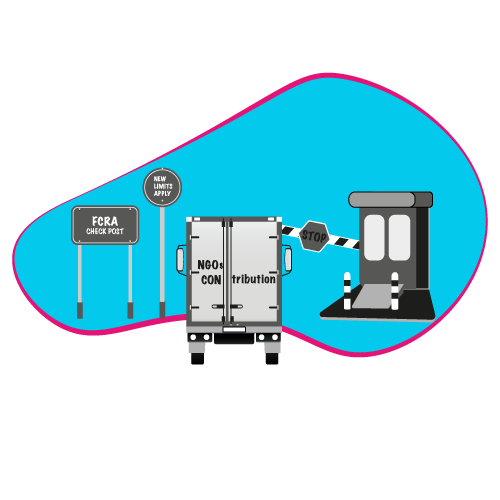

FCRA: Regulating the ‘Con’tribution

Recent development

On 29th September 2020, the Central government notified the Foreign Contribution (Regulation) Amendment Act 2020 (Amendment Act) to amend some provisions.

These amendments were initiated in response to growing instances of organizations especially Non-government organizations (NGOs) misusing funds and or carrying on unlawful, anti-government activities using such funds.

The website of the Ministry of Social justice and empowerment contains an exclusive page showcasing list of organizations which have been blacklisted and or whose license has been cancelled or suspended. From NGOs running schools and medical centers to old age homes and orphanages, several NGOs have been blacklisted. The reasons – forging signatures on application to procure grants, failure to utilize grants for the purpose for which it was procured, diverting funds for protests and other anti-establishment activities. The list is only growing.

The amendment to Foreign Contribution Regulation Act (“FCRA”) in 2020 was enacted to address the growing concerns of misuse / misappropriation of foreign funds and strengthen compliance and transparency and accountability of such organizations.

Background

The Foreign Contribution Regulation Act 1976 (FCRA)was enacted with the objective of governing the acceptance and utilization of foreign contribution and foreign hospitality by persons and associations working in the important areas of national life. Further the Act seeks to regulate flow of foreign funds to voluntary organizations to prevent any possible diversion of such funds towards activities detrimental to the national interest and national security.

Foreign funds are granted to registered voluntary associations which are involved in promoting specific cause / purpose – education, health care, charitable, religious, and developmental which develop the society. While organizations must be registered with the concerned government and prove a consistent track record in their chosen field, even newly established organizations are eligible to receive foreign funds subject to registration and prior permission of receipt of such funds.

FCRA – through the decades

Year

1976

Particulars

Foreign Contribution Regulation Act (FCRA)1976 was enacted

Salient Features

The objective of the legislation was to govern the acceptance and utilization of foreign contribution/hospitality by persons and associations working in the important areas of national life. The Act sought to regulate flow of foreign funds to voluntary organizations to prevent any possible diversion of such funds towards activities detrimental to the national interest and national security.

1986

Amendment to FCRA 1976

The amendment made it mandatory for all non-government organizations (NGOs) to get themselves registered with the Ministry of Home Affairs.

2010

FCRA, 2010 enacted. (FCRA 1976 repealed)

The objective of the legislation was to regulate foreign contribution/ hospitality in the by companies, associations, individuals in the interest of national security. Salient features:

- The FCRA 2010 is mandatory for any “person” (entity) having a definite cultural, economic, educational, religious objective that receives or seeks to receive foreign contribution.

- Such entity must either obtain a one-time FCRA registration (valid for 5 years) or seek prior permission from the Central government every time when it receives foreign contribution.

- Certain “persons” were prohibited from receiving foreign contribution – candidate contesting election, publishers of registered newspaper, Judges, government employees, Member of legislature, Political parties.

- It is mandatory for Organizations receiving foreign funds to maintain a separate Bank account to receive foreign contribution.

- Separate accounts and records were to be maintained, exclusively for foreign contributions received and utilized.

- The foreign contribution received must be utilized exclusively for the purpose for which it was received.

2015

FCR Amendment Rules 2015

These Rules basically addressed process related issues, technical and online payment facilities to the Organizations. Key highlights:

- Prior to the 2015 amendments, there were separate forms for applying – registration or priori permission. The 2015 amendments have consolidated and simplified the application process by integrating into one application / registration Form.

- Previously any organization receiving foreign funds / contribution more than INR 10 million would have to disclose it in the public domain. Consequent to the 2015 amendment, irrespective of the amount of funds received, all organizations must place in the public domain a statement of audited accounts on receipt and utilization of foreign contribution, including income and expenditure statement, receipt and payment account within 9 months of the closure of the financial year on its official website or on website as specified by the Central Government.

- Previously Banks had to report within 30 days from receipt of foreign funds/ contribution. The amendments have made it mandatory for Banks to report within 48 hours from receipt of foreign funds/contribution.

2016

Amendment through the Finance Bill, 2016

The amendment allowed foreign-origin companies to finance NGOs. Further definition of “foreign companies” was amended to pave the way for donations to political parties. Foreign donations received after 2010 (date of enactment of FCRA 2010) were considered valid.

2018

Amendment through the Finance Bill, 2018

Foreign donations received from 1976 (date of original enactment of FCRA 1976) itself was considered valid. The amendment was made with respect to the repealed Act 1976).

2020

FCRA, 2020

Key highlights of the 2020 amendments:

- FCRA, 2010 prohibited certain “persons” from accepting any foreign contributions such a candidate for elections, Judge, Government employee etc. The latest 2020 amendment includes “Public servant” to the list of prohibited persons from accepting foreign funds. Public servant as defined under Indian Penal Code includes any person who is in service or pay of the government or remunerated by the government for the performance of any public duty.

- The Act prohibited transfer of foreign contribution to any other person “unless such person is also registered under FCRA or has obtained prior permission. The Bill amends this to prohibit the transfer of foreign contribution to any other person. The term ‘person’ under the Act includes an individual, an association, or a registered company.

- The Bill adds that any person seeking prior permission, registration or renewal of registration must provide the Aadhaar number of all its office bearers, directors or key functionaries, as an identification document.

- Previously the Act allowed up to 50% of the foreign contribution received to be utilized towards expenses for administrative purposes. This cap is now reduced to 20%. This means only 20% of the foreign contribution received can be utilized towards administrative expenses. This will make more funds available towards the objective of the NGO.

- The amendments 2020 allows for a Bank account designated as “FCRA account” opened in a branch of the SBI at New Delhi. The Act allows for additional accounts to be opened in any other scheduled bank. But the main FCRA account shall be maintained in SBI New Delhi.

- If a person accepting foreign contributions is found guilty of violating any provisions of the Act, the unutilized or unreceived foreign contribution could be received or utilized only with the prior approval of the Government. A proviso has been added to the Section include that the Government may also restrict usage of unutilized foreign contribution if, based on a summary inquiry the Government believes that such person has contravened provisions of the Act.

- The Government could suspend the registration of a person for a period not exceeding 180 days. The 2020 Amendment Act now gives the Government power to suspend the registration certificate of a person for up to 360 days.

- The amendment Act provides the government shall renew the license after may conducting an inquiry before renewing the certificate to ensure that the person making the application: (i) is not fictitious/ benami, (ii) has not been prosecuted or convicted for creating communal tension or indulging in activities aimed at religious conversion, and (iii) has not been found guilty of diversion or misutilization of funds, among others conditions.

- The government allow for surrender of certificate, if, post an inquiry, it is satisfied that such person has not contravened any provisions of the Act, and the management of its foreign contribution (and related assets) has been vested in an authority prescribed by the government.

- The Act allows for suspension of registration of a person for a period not exceeding 180 days. The amendment has extended it up to an additional 180 days.

The amendment effects

The response to the latest amendment of FCRA 2020 has been mixed. Certain provisions have been received positively with a view to enhance transparency to ensure that funds be utilized towards the main purpose of the NGOs / Organizations. Fixing a limited cap on spending foreign contribution towards recurring administrative expenses will encourage more individuals / organizations to contribute more funds as towards philanthropic activities / objectives. Renewal of license subject to background checks will ensure only the genuine organizations / NGOs get funds.

However, certain provisions like giving powers to the government to suspend license for additional periods of time and suspend functioning of organizations for 360 days (more than a year) gives more arbitrary powers to the government to deal with organizations / NGOs. By doing so, it will deter funds from coming into such organizations. Further, it contradicts the objective of the amendment to streamline process and registrations within limited timelines.

The road ahead

The amendments have been necessitated due to increasing cases of Organizations / NGOs found violating statutory compliances and being used as channels to fund protests and activities which are anti-government, anti-national and not in interests of national security.

As recently as in September 2020 Amnesty International India’s license was suspended and their Bank accounts frozen after investigation agencies alleged of financial irregularities and misconduct. In 2015, Greenpeace India faced the same action.

In the last 5 years, there have been increasing number of scams relating to misusing of foreign funding being received by NGOs and other organizations. The government has adopted a proactive approach in tackling such issues. The amendments 2020 is a step towards weeding out the illegal, benami organizations and ensuring the genuine and needy Organizations / NGOs benefit from the foreign funding / contribution.

The FCR Amendment Act 2020 seeks to ensure greater transparency and effective monitoring of the inflow of foreign funds and the utilization for the activities set out in their registration. Only time will tell of the effectiveness of these amendments.