Debt in Balance Sheet: Damocles Sword

Background

In the April 2020 edition of the Law Tree, the decision passed in the case V. Padmakumar v. Stressed Assets Stabilisation Fund Company Appeal (AT) (Insolvency) No. 57 of 2020 was reported.

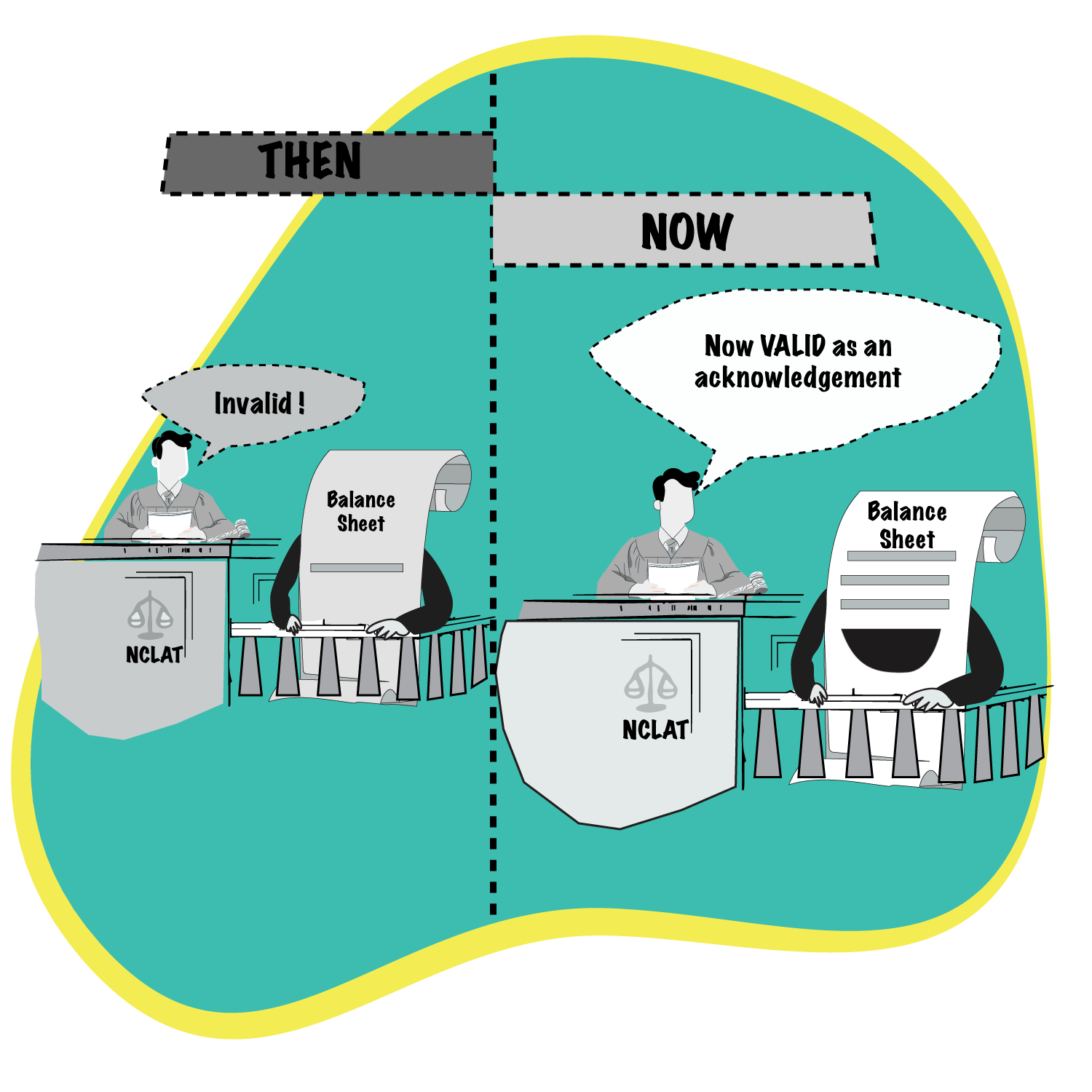

In the said case, a 5-member bench passed a majority 4:1 judgment that held that entries in balance sheet would not amount to acknowledgement of debt for the purpose of extending limitation under Section 18 of the Limitation Act.

Later developments

In September 2020, a 3-member bench, doubting the correctness of such judgment, referred the matter to the Chairman of the NCLAT to constitute a Bench to reconsider the judgment in the V. Padmakumar case (supra).

However, in December 2020 the 5-member Bench that was constituted refused to adjudicate on the matter, stating that the reference itself was incompetent. They refused to re-examine the correctness of the judgment in the Padmakumar case. It dismissed the case.

Consequently, the present appeal was preferred in the Supreme Court. A three Judge bench consisting of Mr. Rohinton F Nariman, BR Gavai and Hrishikesh Roy heard the matter in Asset Reconstruction Company (India) Limited Vs Bishal Jaiswal & Anr (Civil appeal No.323 of 2021) and passed the Judgment in which the Padmakumar case was cited as a precedent.

Facts of the Asset Reconstruction Company case (supra):

- In 2009, Corporate Power Limited (“CPL”) was setting up a thermal power project in Jharkhand. It availed loans from a number of financial institutions including State Bank of India (SBI).

- In 2013, CPL was declared as non-performing asset (“NPA”). Loan recall notice was issued. CPL owed approximately Rs. 5,997 Crores to a consortium of lenders. In 2015, the group of original lenders assigned the loan recovery to Asset Reconstruction Company (India) Limited (“ARC”). In 2016, ARC took physical possession of properties / assets of CPL.

- In 2019, ARC filed for insolvency under the IBC code. The application u/s 7 was admitted observing that the Balance sheets contained the amounts of debt were signed before the expiry of 3 years from the date of default. Entries in balance sheet amount to acknowledgement of debt due for the purpose of section 18 of the Limitation Act 1963.

- An appeal was filed by CPL against the admission of application under IBC on the grounds that CPLs account was declared as NPA in 2014. However, the application u/7 of the IBC was filed in 2019. Hence the same was barred by limitation.

- Further it was contended by CPL that as per the judgment in the V. Padma Kumar case (supra) entries in the Balance sheet of the company would not amount to acknowledgement of debt.

- An appeal was preferred before the Hon’ble Supreme Court.

Analysis

The 3 -Judge Bench of the apex court had to deliberate on two issues –

- Whether any entry made in the balance sheet of a corporate debtor would amount to acknowledgement of debt

- Whether Section 18 of the Limitation Act, which extends beyond the period of limitation is applicable in case of acknowledgement of debt in the Balance sheet

The apex court considered at length various precedents relating to this issue:

On the issue of whether an entry in the Balance sheet would amount to acknowledgement of a debt, the SC considered an array of previous judgments. Some of the cases considered:

While referring to the judgment in Mahabir Cold Storage v. CIT, 1991 Supp (1) SCC 402, the apex court noted that entries in the books of account of the appellant would amount to an acknowledgement of liability within the meaning of section 18 of the Limitation Act, 1963 and extend the period of limitation of the discharge of the liability as debt.

In the A.V. Murthy v. B.S. Nagabasavanna, (2002) 2 SCC 642 case, it was held that as per Section 25(3) of the Indian Contract Act 1872, a promise made in writing and signed by the person or his duly authorized agent to pay wholly or in part a debt of which the creditor might have enforced payment but for the law of limitation of suits is a valid contract. If the appellant has submitted that the respondent has availed loan and has shown the same in his subsequent balance sheets, it may amount to acknowledgement and the creditor might have a fresh period of limitation from the date on which the acknowledgement was made. A similar judgement was passed in the case S. Natarajan vs. Sama Dharman, Crl. A. No. 1524 of 2014

In the Bengal Silk Mills Co. v. Ismail Golam Hossain Ariff, 1961 SCC OnLine Cal 128: AIR 1962 Cal 115 [“Bengal Silk Mills”] case, it was argued that the balance sheets could not be acknowledgement of debt as they were prepared under compulsion of law. However, the court did not agree with this contention stating that there was compulsion to prepare balance sheet but not the content or admission of content including acknowledgement of debt in the balance sheet. However, such admission is to be evaluated on a case-to-case basis. This will establish whether an acknowledgement of debt has been made which merits extension of limitation u/s18 of the Limitation Act.

In all the above cases, the judgments clearly indicated that an entry in the balance sheet would amount to acknowledgement of liability within section 18 of the Limitation Act 1963.

Based on the above cases, the apex court was of the view that judgment in the V Padma Kumar case did not consider the above judgments. It was contrary to the above decided case laws.

The 3 Judge bench of the apex court concurred with the view taken by the dissenting judge in the V. Padma Kumar case (supra). Accordingly the judgment passed in the case was set aside.

The apex court further held that the entry in the balance sheet could amount to acknowledgement of debt / liability within section 18 of the Limitation Act, 1963.