Bank Must Grant Hearing to Person Before Declaring as Wilful Defaulter

IN THE HIGH COURT OF JUDICATURE AT BOMBAY, NAGPUR BENCH

Writ Petition No.6434 OF 2019

MANISH MEHTA ….. PETITIONER

VS

- THE GENERAL MANAGER,

Central Bank of India having its Zonal Office at Nagpur

- THE CHIEF MANAGER,

Central Bank of India having its Main Branch at Nagpur ….. RESPONDENTS

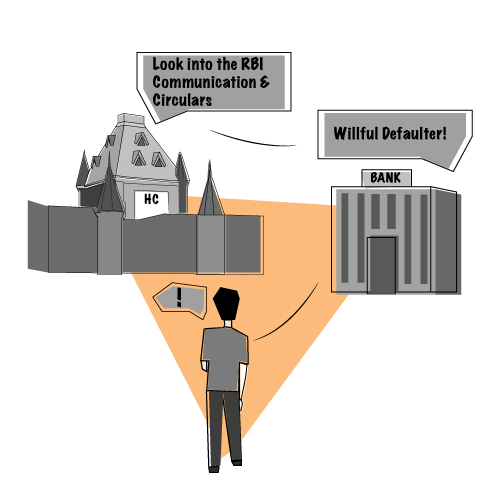

In April 2022, a division bench of the Nagpur High Court, comprising Justice A.S Chandurkar and Justice Mukulika S Jawalkar observed that any financial institution must grant hearing to a person before declaring him wilful defaulter and making public his/ her name.

A brief analysis of the case:

Facts:

- Manish Mehta (“Manish”) was a director of a company – M/s Munis Forge Limited, (“Company”) incorporated in 1995. The company obtained financial assistance from the Central Bank of India (“Bank”) wherein Manish furnished his personal guarantee for repayment of the credit facilities availed. Manish resigned as director of the Company on 14.09.1998 and informed the same to the Bank.

- Since the Company account was not maintained properly, the Bank declared the Company account as Non-Performing Asset (“NPA”). Recovery proceedings were filed by the Bank against the company and its directors / guarantors before the Debt Recovery Tribunal (“DRT”). Though the DRT allowed the original application filed by the Bank in August 2005, the recovery of the entire due amount was not made. Manish submitted a proposal to the Bank for discharging his personal liability, but the Bank did not accept the request.

- On 29.06. 2019, the Bank published a public notice in the “Times of India” Nagpur edition newspaper declaring the Company, its director / guarantors as wilful defaulters. The date of NPA was shown as 31.03.1998. Manish’s name figured as director and guarantor.

Aggrieved by this, Manish filed a writ petition under Article 226 of the Constitution of India challenging the actin of the Bank in publishing his name as wilful defaulter.

Contention(s)

Manish Mehta (Petitioner)

- Counsel for Manish declared that he was declared wilful defaulter without granting him any opportunity of being heard. The action was without any prior notice and was in breach of principles of natural justice.

- The procedure for declaring as a wilful defaulter was governed by various circulars issued by the Reserve Bank of India (RBI). The procedure prescribed in the RBI Master Circular dated 01.07.2015 was not followed by the Bank. Judgment(s) passed in Erusian Equipment and Chemicals Ltd. vs. State of West Bengal and anr. AIR 1975 SC 266, State Bank of India vs. M/s. Jah Developer Pvt Ltd and ors AIR 2019 SC 2854 and Writ Petition (L) No.1630 of 2019 (Kailash Shahra Vs. IDI Bank Ltd.) decided on 16.10.2019 and Writ Petition No.1958 of 2020 (Shri Gunwant Deopare and anr. vs. The Branch Manager, Bank of Maharashtra and ors were relied upon.

- There was no material on record to indicate that the Bank had followed any procedure before declaring the petitioner to be a wilful defaulter. It was thus submitted that the impugned publication of public notice dated 29.06.2019 was liable to be set aside.

The Central Bank of India (Respondent)

- Manish had submitted a proposal for one time settlement and had requested for removal of his name from the list of wilful defaulters. This itself indicated that Manish was aware that he had been a wilful defaulter even prior to publication of notice dated 29.06.2019. Neither the adjudication by the DRT in 2001 nor the recovery certificate in 2005 was challenged by Manish. Therefore, Manish was declared wilful defaulter after due notice and hence the publication of the public notice dated 29.06.2019 was justified. Judgment passed in the Kotak Mahindra Bank Limited vs Hindustan National Glass & Industries Ltd. and others (2013) 7 SCC 369 was relied upon.

- The company was declared NPA in 1998. The company and its directors / guarantors were declared wilful defaulters by the Bank again in 2002. Until 2003, the RBI guidelines relating to personal hearing for wilful defaulters was not in existence. Therefore, the grievance of Manish that he was not given personal hearing is without any ground as such procedures was not in existence at the time of declaring him as wilful defaulter. On this basis, they continued to be declared wilful defaulters in 2004 as well.

Judgment

In arriving at the decision, it was observed that from 20.02.1999 to 23.07.2004 various guidelines were issued by the Reserve Bank of India in the matter of identifying wilful defaulters and expressing caution by putting in place a transparent mechanism to ensure that the discretionary powers of declaring a borrower as wilful defaulter was kept at barest minimum. This would mean that before making such declaration a notice to the borrower who is proposed to be declared as a wilful defaulter has been contemplated. This would provide an opportunity to the defaulter to put forth his say in the matter.

In Jah Developers Private Ltd.(supra), it has been held by the Honourable Supreme Court that whether default is intentional, deliberate and calculated is a question of fact which the lender may put to the borrower in a show cause notice to elicit the borrower’s submissions on the same. Though these observations have been made in the context of the revised RBI Circular dated 01.07.2015, the aspect of default to be categorised as wilful must be intentional deliberate and calculated.

In the RBI communication dated 20.02.1999 itself it has been stated that wilful default would cover deliberate non-payment of dues despite adequate cash flow and good net worth. Whether a default is wilful or not can be gathered only after he is granted an opportunity to be heard. Even under the RBI Circular dated 30.05.2002 it has been stated that banks should ensure that a solitary or isolated instance is not made the basis for imposing penal action.

The Court also noted that the above stated RBI communication and Circulars were issued prior to 31.12.2004 when according to the Bank, the Company as well as the petitioner were declared as wilful defaulters. Clear wordings of the RBI communication referred to hereinabove including the Circular dated 30.05.2002.

On the basis of the above, the Court held that Manish has declared as wilful defaulter without being given an opportunity of being heard. Accordingly, the publication of him being a wilful defaulter is being set aside. The Court directed the Bank to follow the prescribed procedure in declaring a person as wilful defaulter.

Full text of the Judgment: