The Triumvirate: Changing the Face or Facing the Change

Professional trio

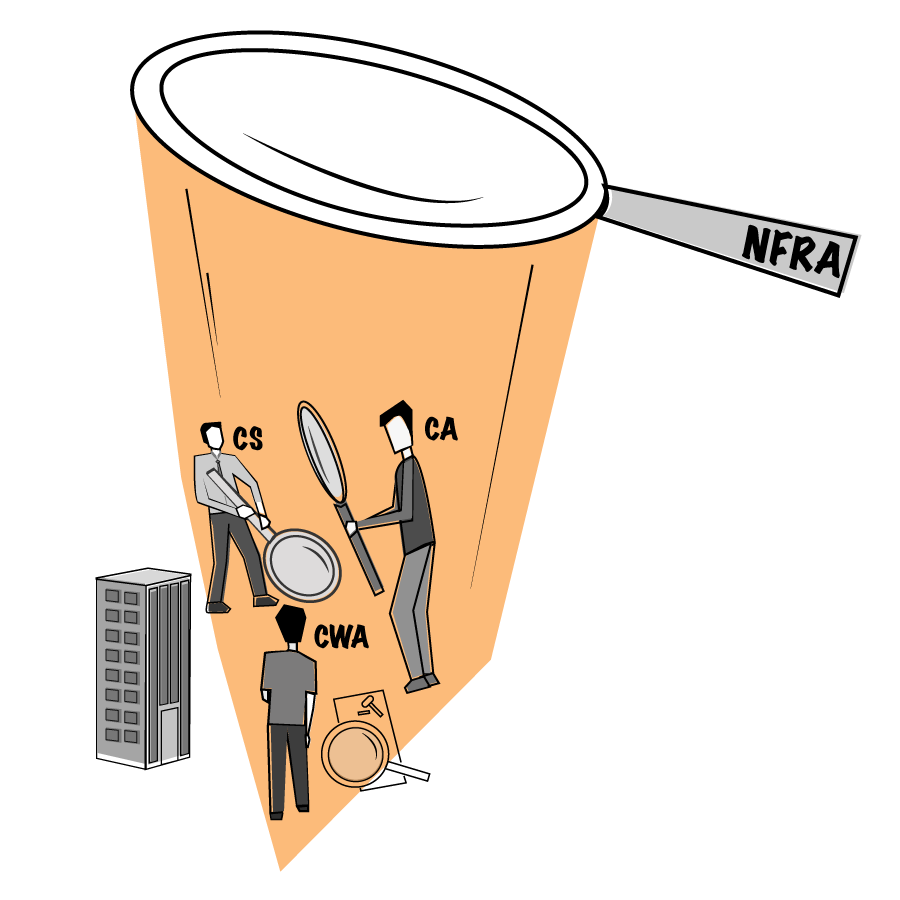

The Chartered Accountants (CA), Cost and Work Accountants (CWA) and Company Secretaries (CS) are key professionals in upholding compliance aspects of the corporate sector / industry. Each of these professions is governed by their own Regulations – The Chartered Accountants Act, 1949, The Cost and Works Accountants Act, 1959 and The Company Secretaries Act 1980 respectively. Such Acts expressly lay down their duties, responsibilities, ethics, guidelines for professional misconduct and related aspects. Each of these institutes is self-regulatory. Their affairs are managed by their respective Councils.

The latest

In the last decade, there has been a spate of frauds in the corporate world which has sharply turned the focus on the credibility and integrity of the CA, CWA & CS fraternity.

In this backdrop, the Finance Ministry introduced The Chartered Accountants, the Cost and Works Accountants and the Company Secretaries (amendment) Act, 2022 in the Lok Sabha on 17th December 2021. It was passed in the Lok Sabha on 30th March 2022. The Bill was passed in the Rajya Sabha on 5th April 2022. Thereafter, the Bill received the Presidential assent on 18th April 2022 and became an Act.

The Amendment(s)

The amendment Act 2022 contains amendments which are exclusive to each of the Chartered Accountants, Cost & Works Accountants and Company Secretaries Act respectively.

However, there are several amendments which are common to all three Acts. An insight into such common amendments

1. Insertion of new definitions

(Section 2) The following new terms have been inserted

- Board of Discipline,

- Director (Discipline)

- Disciplinary Committee

- Director, Disciplinary Committee

- Disciplinary Directorate

- Fellow, Standing Committee

2. Modification / replacing / substitution of existing definitions

(Section 4) The following terms have been modified/substituted under various sections of the Acts.

- Register to be replaced with “Register of Members” of the Institute or Register of Firms maintained by the Institute.

3. Amendment in powers of the Council of the Institute(s)

(Section 6) The Council of respective Institute(s) shall be empowered to:

- decide fee required for entry of names in the Register of members.

- Decide fee for grant of the Certificate of Practice (COP). Obtaining prior approval of the Central government by the Council has been dispensed with.

4. Amendment in grounds for disqualification of a member from the Institute

(Section 8) “Undischarged insolvent” or person declared “insolvent” under the Insolvency Bankruptcy Code 2016 (IBC) then such person shall be disqualified from becoming a member of the ICAI, ICWAI and ICSI.

5. Amendment in the period of disqualification from contesting elections

(Section 9, insertion of Section 9A) Any member of the institute found guilty of professional or other misconduct and whose name is removed from the Register or has to pay penalty shall not be eligible to contest election for a period of:

4 years (as against 3 years) for misconduct falling under First Schedule and

8 years (as against 6 years) for misconduct falling under Second Schedule.

The new section 9A provides for setting up a Co-ordination Committee headed by the Secretary of the Ministry of Corporate affairs. The President, Vice- ‘president and Secretary of each of the three institutes shall be members of the Co-ordination Committee. The Committee shall ensure:

- quality improvement of the academics, infrastructure, research and all related works of the Institute;

- focus on the coordination and collaboration among the professions, to make the profession more effective and robust;

- align the cross-disciplinary regulatory mechanisms for inter professional development;

- make recommendations in matters relating to regulatory policies for and perform related / incidental activities.

6. President of the Council to be the “Head”

(Section 12) the President of each Institute shall be the “Head” of the Council (as against the “Chief Executive Authority”). He/ she shall along with the Vice President exercise powers and perform the functions as may be prescribed. The President shall ensure implementation of the decisions taken by the Council.

7. Duration of period of Council

(Section 14) the period of duration has been extended to 4 years (as against 3 years)

8. Enhancing powers of the Council of the Institute(s)

(Section 15 including insertion of new sections 15A & 15B)

The Council of each Institute has been granted power to undertake additional functions to:

- the prescribing of fees for the examination of candidates for enrolment;

- the granting or refusal, of registration of a firm;

- the prescribing of guidelines for grant or refusal of certificates of practice under this Act;

- issue guidelines for the purpose of carrying out the objects of this Act;

- conduct investor education and awareness programmes;

- enter into any memorandum or arrangement with the prior approval of the Central Government, with any agency of a foreign country, for the purpose of performing its functions under this Act.

9. Amendment in audit of accounts of the Council

(Section 18) The accounts of the Council shall be prepared in the prescribed manner and audited by a firm of Chartered accountants to be appointed annually by the Council from the panel of auditors maintained by the Comptroller and Auditor -General of India. Provided that a firm shall not be eligible to undertake such audit if any of its partner(s) is or has been member of the Council during the last 4 years.

- In the event the accounts of the Council do not represent a true and fair view of its finances, then the Council may itself cause for a special audit to be conducted.

10. Register of Members to include details of professional misconduct

(Section 19) The Register of Members shall include details of any actionable information or complaint, or penalty imposed against a member.

11. Registration of Firms and Register of Firms

(Insertion of new Section 20A to 20D in Section 20) Every Firms shall be registered with the Institute on an application made to the Council by any partner or owner in the prescribed manner. The Council shall maintain a register of firms. The Council has the power to remove the name of a Firm from the register of firms. The section provides mechanism for a firm aggrieved by such removal to apply to the Council for review.

12. Disciplinary Directorate, Board of Discipline, Disciplinary Committee

(Section 21, Section 21A to 21D)

- The Council shall establish a Disciplinary Directorate consisting of a Director (Discipline) and at least 2 Joint Directors (Discipline) not below the rank of Deputy Secretary of the Institute and such other employees.

- They shall make investigation either suo motu or on receipt of information or complaint.

- The Director (Discipline) shall decide within 30 days decide on whether such information or complaint is actionable or non-actionable.

- Recommendations of the Director (Discipline) on non- actionable complaints or information shall be submitted to the Board of Discipline for conducting further investigation.

- If in the course of investigation into a case which is found to be actionable, the Director (Discipline) shall give opportunity to the member to submit written statement within 21 days (extendable by another 21 days). Upon receipt of such written statement, a copy shall be sent to the complainant / informant to submit his rejoinder within 21 days. Based on such documents, the Director (Discipline) shall submit a preliminary investigation report within 30 days, if prima facie is made out against the Member / Firm. If a case of professional misconduct under First schedule or Second schedule is made out, then the Director (Discipline) shall submit a preliminary examination report to the Disciplinary committee. If no case is made out against the Member / Firm, the same may be closed. However, if a case is made out, then the Disciplinary committee shall undertake further investigation in the matter.

- The status of actionable information and complaints pending before the Disciplinary Directorate, Boards of Discipline and Disciplinary Committees and the orders passed by the Boards of Discipline and the Disciplinary Committees shall be made available in the public domain by the Disciplinary Directorate in such manner as may be prescribed.

- Complaint once made cannot be withdrawn under any circumstances.

- The Council shall constitute one or more Boards of discipline comprising a presiding officer (not being a member of the Institute with experience in law, professional and disciplinary matters), one member to be nominated by the Central government and one member to be nominated by the Council along with a person not below the rank of deputy secretary of the Institute.

- The investigation shall be completed within a period of 90 days.

- If found guilty of professional misconduct, the Board may reprimand the member, impose penalty / fine up to Rs. 2 lakhs and or remove the members’ name from the register of members for a period of 6 months. Where a member is found to be repeatedly guilty of professional misconduct, the penalties may go up to Rs. 25 lakhs, such member may be prohibited for undertaking professional activities for a period of 1 year and the name removed from the register of members for a period of of time as may be though fit.

- The provisions for Disciplinary Committee are similar as that of Disciplinary Directorate suffice that the Committee shall conclude its investigation within 180 days from date of receipt of preliminary examination report from the Director (Discipline).

If found guilty of professional misconduct by the Disciplinary Committee, the Board may reprimand the member, impose penalty / fine up to Rs. 10 lakhs and or remove the members’ name from the register of members permanently or for such period of time as thought fit. Where a member is found to be repeatedly guilty of professional misconduct, the penalties may go up to Rs. 50 lakhs, such member may be prohibited for undertaking professional activities for a period of 2 years and the name removed from the register of members for a period of time as may be though fit. - In order to make the transition to this Act smooth and effective, all complaints or any inquiry pending before the Board of Discipline or the Disciplinary Committee or any reference or appeal filed before the Appellate Authority or before a High Court prior to the commencement of the Chartered Accountants, the Cost and Works Accountants and the Company Secretaries (Amendment) Act, 2022, shall continue to be governed by the provisions of this Act, as if this Act had not been amended by the Chartered Accountants, the Cost and Works Accountants and the Company Secretaries (Amendment) Act, 2022.

The way ahead

In light of the increasing frequency of several scams, frauds and growing debt in Corporates, the issue of “self-regulation” by respective CA, CWA & CS institutes was re-visited. The government was of the view that the institutes were going soft / shielding their members from severe action.

Consequently, the Central government set up the National Financial Reporting Authority (NFRA) under the Companies Act 2013. The body is empowered to investigate matters of professional misconduct by Chartered Accountant individuals or Firms. On similar lines that CA, CWA & CS amendment Act 2002 seeks to strengthen disciplinary mechanism, impose stringent penalties thereby increasing accountability in each of these professions. By providing more external representation on the Board of Discipline and Disciplinary committees, the Act ensures an objective and fair examination / investigation of the cases. Further by defining a timeline for completion of the enquiry, the Act ensures speedy redressal of grievances.