Crypto Under PMLA

On 7th March 2023, the Finance ministry issued a notification amending the Rules to Prevention of Money Laundering Act 2002. (“PMLA”)

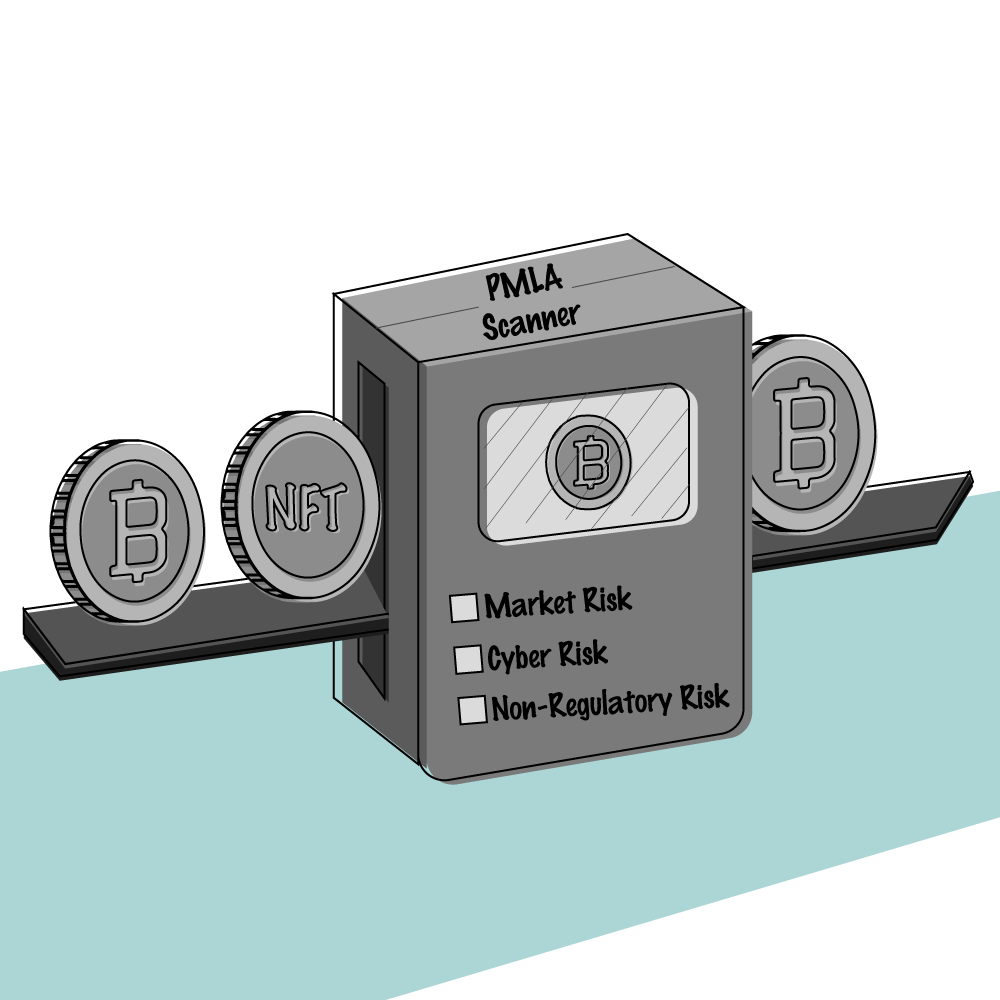

While several amendments to the Rules have been notified, an important amendment is to bring cryptocurrency related transactions within the ambit of the PMLA.

A look at the key points:

- By virtue of the Notification, provisions of Prevention of Money Laundering Act 2022 (PMLA) are made applicable to the following activities carried out by either natural or legal person in the course of any business activity:(i) Exchange between virtual digital assets and fiat currencies;

(ii) Exchange between one or more forms of virtual digital assets;

(iii) Transfer of virtual digital assets;

(iv) Safekeeping or administration of virtual digital assets or instruments enabling control over virtual digital assets; and

(v) Participation in and provision of financial services related to an issuer’s offer and sale of a virtual digital asset. - The Notification has stated that the definition of “virtual digital asset” shall be the one under the Income Tax Act 1961. As per Section 47(A) of the Income Tax Act 1961, virtual digital assets mean any data, code, number, or token generated using cryptography methods.

Virtual digital assets include virtual currencies, non-fungible tokens (NFTs), bitcoins, stablecoins etc. Block chain assets also come under the purview of virtual digital assets. Simply put, anything in digital form that creates value will be considered as (virtual) digital asset. - Crypto exchanges (like stock exchanges) and virtual intermediaries (like to financial intermediaries) will have to undertake KYC compliance of their clients. Entities dealing with virtual digital assets (like banks and financial institutions) will be considered as ‘reporting entity’ under the PMLA.

The need to bring crypto under PMLA

Lack of regulatory / compliance / reporting framework

There is no specific law governing cryptocurrencies in India. Crypto transactions remain unregulated. In 2018, the Reserve Bank of India (RBI) issued a circular banning banks and financial institutions from dealing or facilitating all cryptocurrency / transactions. The RBI justified that cryptocurrency is volatile and risky and would destabilize the Indian economy.

However, this RBI ban was set aside by the Supreme Court in 2020 on the grounds that RBI did not provide any proof of damage to the Banks, financial institutions and economy in general.

In the Budget of 2022, the finance minister imposed tax of 30% on all gains from crypto transactions and TDS of 1%. Despite that, there is no regulatory framework in place. Lack of regulatory / reporting or legal mechanism makes it that much more challenging to ensure accountability and protection of interests of crypto traders.

Risk nature

Cryptocurrencies suffer inherent risks – market risks, cyber risks and non-regulatory risk.

Market risks can increase or decrease the value of cryptocurrency in no time. This could render the crypto holder either prosperous or a pauper. Like gambling, it’s a high risk – high return stake. Volatility is constant in cryptocurrency.

Being virtual and digital in nature, these transactions and their trading platforms are highly susceptible to cyber- crimes – hacking, online fraud, and cheating. Though there is some online traceability of these transactions, it is not completely traceable. This is a boon and bane especially when cyber-crime is committed and it is not possible to trace the perpetrator.

The latest amendment is seen as a step towards regulating the largely unregulated crypto ecosystem. By virtue of the notification stated supra, investigating agencies are empowered to investigate any suspicious activity of crypto transactions to check whether they are proceeds of crime being passed off as legitimate asset. Provisions relating to imprisonment and penalty shall be levied on wrongfully gained crypto currency in the same manner as they would be levied on physical money. The crypto industry has welcomed the latest initiative by the government.

At this juncture, it is relevant to point out that due to the fiasco caused by the recent collapse of the Silicon Valley Bank (SVB), more than $ 70 billion (as reported by CNBC) was wiped off the crypto market in a matter of two days when the bitcoin dropped below $ 20,000. This necessitates the tightening of the regulation of crypto market nationally as well as globally.