Resilience is an inherent human quality

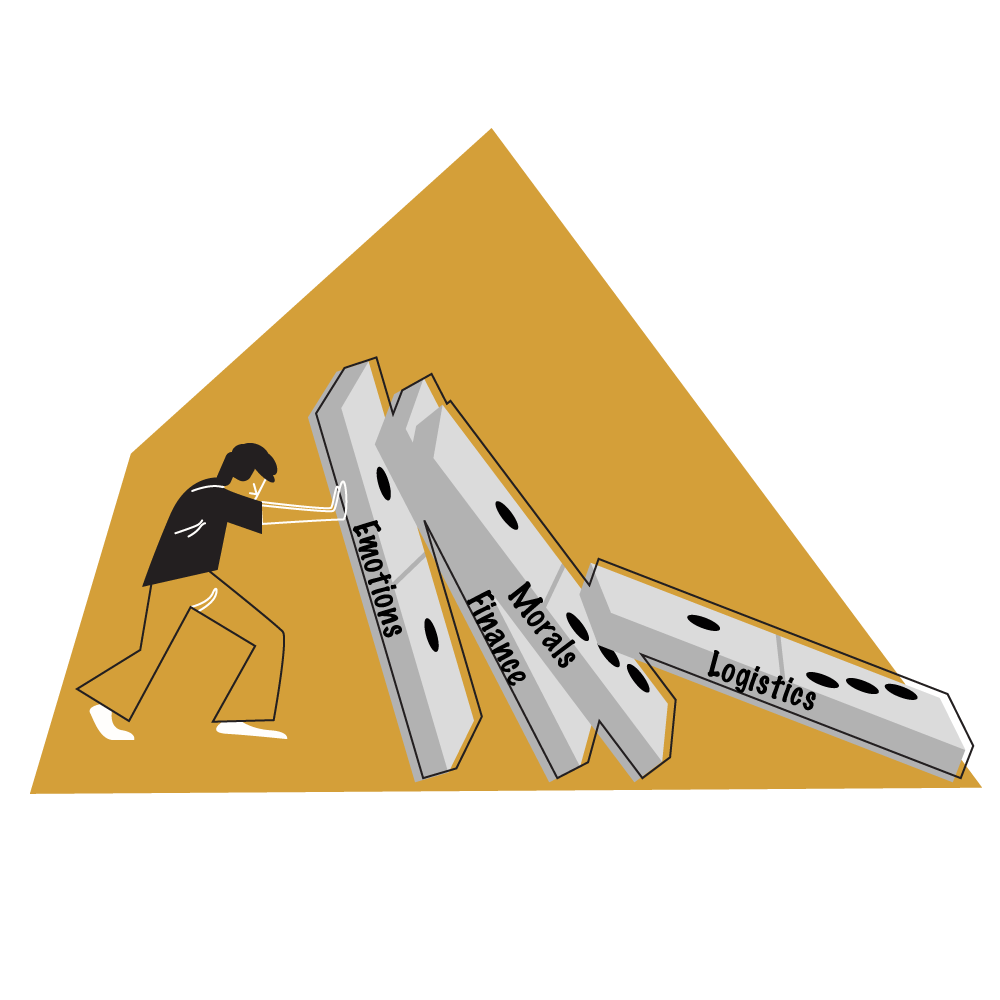

The Covid19 pandemic affected one and all irrespective of their race, religion, economics and education. Everyone fought their own battles due to the onset of Covid. Whether it was losing lives or livelihoods, no one was spared. Yet, humankind displayed resilience. The lives of children turned upside down. From going to school and playing outside, young ones took to the new normal of online school and technology driven activities almost overnight.

Healthcare workers were exemplary in their resilience. From treating patients to encountering resistance to vaccinations and even threat to their lives, they rendered services rising beyond their call of duty. Law enforcement personnel put their lives and their families at risk by reining and managing people during lockdowns and shutdowns. People chasing livelihoods swiftly coped by working from home, working for home, schooling children online and doing practically everything from home. For the semiskilled / unskilled / the migrant labour force for whom working from home was not an option, they did all they could to survive.