GST Council Recommendations are Persuasive: SC

The Judgment

In May 2022, the Hon’ble Supreme Court delivered a landmark judgment stating that the recommendations of the GST Council are recommendatory in nature and do not have binding power on the Union and states. This has opened up a pandoras box of views from various professionals.

This ruling was delivered amongst other issues in the case of Union of India vs Mohit Mineral Pvt. Ltd (Civil Appeal No. 1390 of 2022). In the said case, the validity of the Goods and Services Tax (Compensation to States Act), 2017 and the Goods and Services Tax Compensation Cess Rules, 2017 were challenged. One of the main issues that was challenged – the validity of paying cess in order to compensate states for loss suffered due to GST for a period of 5 years.

About Goods & Service Tax (GST)

- GST is a uniform tax that levied on all goods and services produced in the country and on all goods and services imported from abroad. It is a comprehensive indirect tax on manufacture, sale and consumption of goods and services throughout India. It came into effect on 8th July 2017.

- GST subsumed number of laws – VAT, Service Tax, CST, Excise, Customs, CENVAT, Entertainment tax, Luxury tax and related taxes.

- GST is destination-based tax where the tax is not applied at the point of production but at the point of supply or consumption.

- There are 4 types of GST:

(i) The Central Goods and Services Tax (CGST) (levied by Central Government on all intra state transactions)

(ii) The State Goods and Services Tax (SGST) (levied by State Governments on all intra state transactions)

(iii) The Union Territory Goods and Services Tax (UTGST) (levied by Government of UTs on all intra UT transactions)

(iv) Integrated Goods & Service Tax (IGST) (levied by Central and shared proportionately with respective State government(s) on all inter-state transactions) - GST Council is a constitutional body established as per Article 279A (4) of the Constitution (One Hundred and First Amendment) Act 2016. The Council has been constituted to make recommendations to the Union and States from time to time on important issues relating to GST – goods and services that may subjected to or exempted from paying GST, the rate(s) of GST, threshold of GST rates etc.The composition of the GST council consists of two members from the Central government (the Finance minister shall be the Chairperson and a Minister of State in charge for revenue) and the remaining from each State and Union Territory of India.

The issue

- Mohit Mineral Pvt. Ltd. (MMPL) a Private company was engaged in the importing coal. The goods are transported from a place outside India to customs station in India. MMPL pays customs duty which includes ocean freight. Prior to enforcement of GST, ocean freight was exempt from Service tax. This exemption was withdrawn in January 2017 which levied service tax by reverse charge mechanism.

- With GST coming into effect, a notification was issued under the IGST Act 2017 read with CGST Act 2017 that levied an integrated tax @5% on supply of specified services including transportation of goods in a vessel from a place outside India up to customs station in India. The levy of such tax was made on the importer vide the notification. The said notification was issued under the advice of the GST Council.

- MMPL contended that levy of customs duty on ocean freight (under the Customs Act 1975) as well as IGST on ocean freight (under IGST Act 2017) amounted to double taxation as ocean freight is included in the value of goods for the purpose of customs duty which the importer is liable to pay. Therefore, MMPL filed a writ petition alleging double taxation and hence the notification issued under the IGST Act 2017 (as advised by GST Council) was ultra vires / unconstitutional.

- A division bench of the Gujarat HC held that the said notifications are unconstitutional as they exceed their powers provided in the IGST and CGST Act.

- The Union of India preferred an appeal in the Supreme Court aggrieved by the order of the Gujarat HC.

- The Supreme Court upheld the order passed by the Gujarat HC. In doing so, the made important observations on the role of the GST Council.

SC on GST Council

- Article 246A and Article 279A hold the key to understanding the role of GST council.

- Article 246A introduced as part of the amendment Act is the most important provision relating to concurrent levy and implementation of GST. While Article 246 delas with demarcation of subjects where union and state governments have power to legislate, Article 246A was inserted to confer concurrent or simultaneous taxing powers on central and state governments. However, the Article does not talk about the applicability of such concurring laws made. The Article also does not mention the mechanism in the event of inconsistency or difference in laws made by the union and state governments. It is here that the role of GST council becomes crucial.The recommendations of the GST Council are not based on a unanimous decision but on a three-fourth majority of the members present and voting, where the Union’s vote counts as one-third, while the States’ votes have a weightage of two-thirds of the total votes cast. There is unequal voting structure. Despite that Article 246A treats the Centre and States as equal units by conferring a simultaneous power of enacting law on GST.

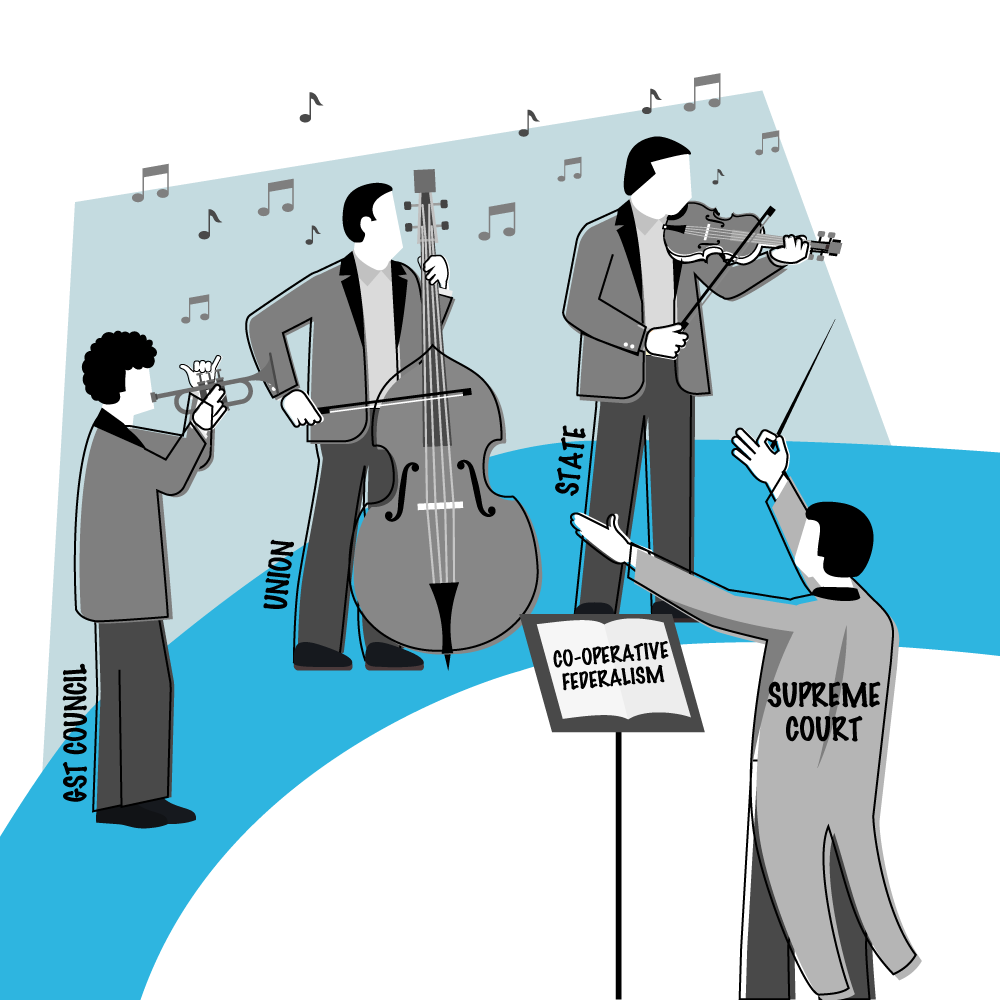

- Article 279A of the amendment Act deals with the constitution of the GST council, role and powers. The Article stated that the GST council is entrusted with the duty to make ‘recommendations’ on a wide range of areas ‘on any matter’ concerning or related to GST.The standing committee on Finance, Ministry of Finance, while introducing and explaining about GST, reiterated that the GST council would only play a ‘constructive and enabling role’ vis –a- vis the legislature (union and state governments) and it would not override their roles. Further, the deletion of Article 279 (B) and inclusion of Article 279(1) by the Constitution Amendment Act 2016 indicates that the Parliament intended for the recommendations of the GST council only to have persuasive value. The GST council was to follow principles of co-operative federalism. The council plays a recommendatory role vis-à-vis the legislature.

The impact

The judgment has drawn mixed response from the tax and legal professionals. While there is a section which feels that the by making the GST council only recommendatory, the power of state governments in regulating tax in their states may be adversely affected. However, there is a section that is of the view that the SC judgment has clearly defined the roles of the Centre, State governments and the GST council in effective decision making and implementation of the GST.