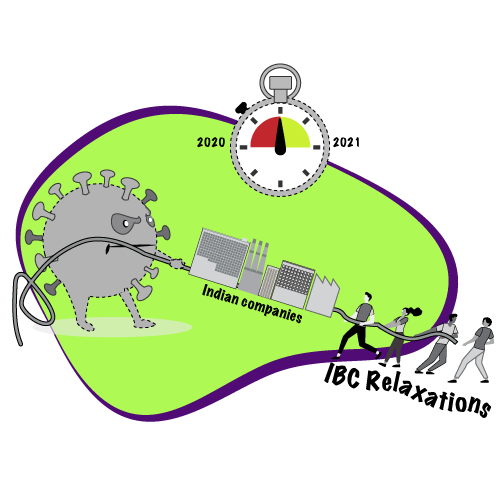

Insolvency and Bankruptcy (Amendment) Ordinance, 2020 And its Implications

On 25th March, 2020, the entire country went into a lockdown as directed by the Central Government in order to contain the spread of the novel coronavirus (Covid-19). As a precautionary measure, the courts, the Hon’ble National Company Law Tribunal included, closed its doors to any fresh filings and accordingly, hearings were curtailed from 16th March, 2020 onwards.

The much-awaited Insolvency and Bankruptcy (Amendment) Ordinance, 2020 (hereinafter “Ordinance”) was announced on 5th June, 2020 and effective immediately. As per the said Ordinance, the immediate measures announced were the suspension of Sections 7, 9 and 10 respectively. The said measure was announced to prevent corporate persons from facing distress in these unprecedented times. The Covid-19 crisis has had a huge impact on businesses, financial markets and economy; and uncertainty in the business has caused alarming effects.

Addition of Section 10A:

Along-with the suspension of Sections 7, 9 and 10 respectively, a new provision, Section 10A was introduced. The salient features of the said provision are as follows:

- No corporate insolvency process to be initiated for any default arising on or after 25th March, 2020 for a period of 6 (six) months;

- The 6 (six) month time-limit has come with a enabling feature to extend such limit to a maximum of 1 (one) year, as may be notified subsequently;

- Additionally, for default arising during this period, no application can be filed even at a subsequent date.

- This provision shall not be applicable to any defaults that have arisen prior to 25th March, 2020.

Impact of Suspension of Provisions:

While the Ordinance shall provide some respite to creditors who have been caught in the Covid crises, the Ordinance does not to redress any grievances of the MSME’s. It is reliably learnt that the Government is likely to promulgate enabling provisions to secure the interests of MSME’s.

The moratorium as announced by the Reserve Bank of India for a period of six months, had already provided some relief to the corporate debtors from the financial creditors such as banks and financial institutions. That along with the current suspensions and further, by completely exempting filing any applications for any default that arose during the said period and not providing for any distinctions in the nature of the default, may cause gross misuse of the law by fraudulent and willful defaulters.

The Ordinance does however, clarify that those applications filed prior to this period, shall continue as it is without any changes, but fails to throw light on such creditors who may have issued demand notices before the change in the threshold limit. Section 5(11) of the IBC, 2016 defines “initiation date” “as the date on which a financial creditor, corporate applicant or operational creditor, as the case may be, makes an application to the Adjudicating Authority for initiating corporate insolvency resolution process;” The aforementioned provision provides inter-alia, that the initiation date with respect to Operational Creditors shall be on such date when the Application under Section 9 is filed before the NCLT which is subsequent to the issuance of the Demand Notice under Section 8. Therefore, if such Demand Notice is issued prior to the lock-down, only those Applications which satisfy the newly amended minimum threshold limit can be filed.

Section 10 of the Code, allows Corporate Applicants to voluntarily enter into the Corporate Insolvency Process, as a means of exit and to enable restructuring of the debt they carry. However, with the recent suspension of S.10 through the Ordinance, such businesses who may have faced direct impact of the pandemic, amongst other reasons shall not have a resourceful and viable option to exit through the previously active provisions of the Code. While this may also provide such affected businesses time to reflect and internally restructure debt due to the suspension of Sections 7 and 9, instead of approaching the NCLT under Section 10.

Section 66(3):

The Ordinance has also affected the amendment of Section 66 of the Code. The relevant extract of the clause (3) is added for reference herein-below:

In Section 66, after sub-section (2) following sub-section shall be inserted:

“(3) Notwithstanding anything contained in this section, no application shall be filed by a resolution professional under sub-section (2) in respect of such default against which initiation of corporate insolvency resolution process is suspended for Section 10 A.”

The aforesaid provision provides respite from wrongful trading provisions as provided under Section 66. As per the provision that has been newly inserted, the resolution professionals shall not be entitle to initiate wrongful trading applications against directors of companies wherein the corporate insolvency process is suspended.

Conclusion:

According to the proviso of the newly inserted Section 10A, it debars any action at any point of time. However, in our view, if the default continues, we can always invoke the provisions of Sections 7, 9 and 10 once the suspended provisions are reinstated. While we await further clarifications with respect to the present Ordinance, it is only advisable for the stakeholders involved to wait and watch as to what changes will occur in the times to come. Whether it comes with prolonged litigations, recourse to commercial courts or subject to arbitrations in the event where the minimum threshold limits are not met, or hopeful negotiations and settlements of debt; it is all a matter of time.