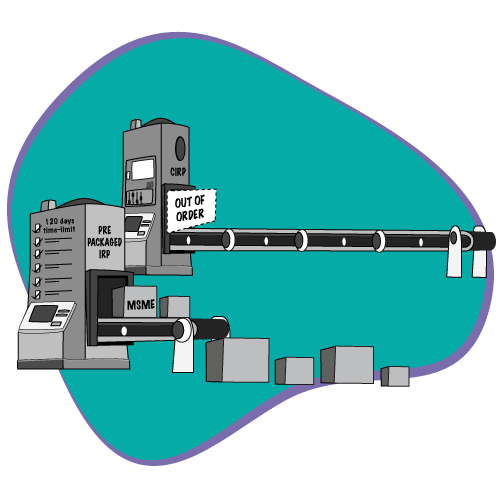

Insolvency in MSME: A (pre) Package Deal

In April 2021, the Central government promulgated the IBC Amendment Ordinance 2021. This is in continuation of its previous measures such as increasing the threshold of the default limit to INR 1 Crore and suspending the initiation of insolvency against companies during the Covid19 pandemic.

The Ordinance amended the Insolvency Code to allow / enable the central government to notify pre-packaged insolvency resolution process for micro, small and medium enterprises (MSMEs).

A pre package is a form of structuring / re-structuring in which the management negotiates and arrives at a settlement with the creditors in a time bound manner. While this not only saves time and money but it also enables the management to continue to run the affairs of the business without handing it over to a resolution / interim resolution professional and indulging in lengthy IBC process. For the NCLT, this would mean easing the burden of cases as the companies come with agreed pre-packaged solutions. Such pre- packages are being offered to companies and LLP’s.

Chapter IIIA has been included in the IBC which expressly details the procedure / process for initiation of insolvency resolution process for MSMEs. An insight into the process, procedure and information required under Chapter IIIA.

CHAPTER III-A: PRE-PACKAGED INSOLVENCY RESOLUTION PROCESS (PPIRP) (Sections 54A to 54P)

Section 54A – Eligibility of Corporate debtors for pre-packaged insolvency resolution process

- Corporate debtor should be classified as MSME under Section 7 (1) of the MSME Act 2006;

- In case of corporate debtors who make default as stated in Section 4 (default in repayment of minimum amount of Rs. 10 Lakhs) can make application for initiating the PPIRP subject to fulfilling conditions under Section 54A (a) to (g) such as: it has not undergone PPIRP or CIRP process in the preceding 3 years; it is not currently undergoing CIRP; no liquidation order has been passed u/s33 and it is eligible to submit resolution plan u/s 29A; the requisite number of financial creditors have appointed the RP for the PPIRP process and at least 66% of voting share of the CoC have voted in favour; the promoters / directors have given declarations the promoters / directors have given declarations in prescribed From P6 in accordance with Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021that the PPIRP shall be duly completed and have got approval by special resolution from shareholders.

- The Corporate debtor shall obtain approval from its financial creditors (not being its related parties) representing not less than 66% in value of the financial debt due to its creditors for filing application under PPIRP. The consent to be obtained in prescribed Form P4 in accordance with Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021

- Prior to seeking approval, the Corporate debtors shall provide financials creditors with information as required under 54A (4) (a) to (d) such as giving declarations of complying with the process and timelines for PPIRP, passing special resolution in members meeting approving the initiating of PPIRP and information relevant to base plan.

Section 54B – Duties of resolution Professional (RP) before initiation PPIRP

The duties of the RP shall commence from the date of obtaining approval from 66% financial creditors section 54A(2)(e):

- Prepare a report in the prescribed Form P8 confirming whether the Corporate debtor meets requirements of Section 54A and the resolution plans conform the requirements u/s 54A(4)(c)

- File such reports and documents as may be required by the Insolvency Board and undertake such other duties as may be specified by the Insolvency Board in accordance with Section 17 of Chapter III of Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021

The duties of the RP will cease if the application is not initiated within 90 days from the date of default as required u/s 54A (4) (c) or such application is rejected or admitted (along with payment of fee and costs) by the Insolvency Board.

Section 54C – Application for PPIRP

Application for initiating PPIRP shall is such prescribed Form, particulars and fee along with documents / declarations. The Adjudicating Authority shall within 14 days of receipt of application, shall either accept the application or reject it.

The Application shall be accompanied by:

Declaration, Special resolution, Approval of financial creditors for initiation of PPIRP, Name and written consent of the RP proposed to be appointed prescribed Form P5 in accordance with Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021, Report of the RP under Sec 54B(1)(a), Declaration of existence of any transactions which are in the scope of avoidance of transactions which are fraudulent or wrongful under Chapter III or VI prescribed Form P7 in accordance with Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021 , Information relating to Books of account and any other information.

If the Adjudicating authority is rejecting the application, then the Corporate debtor shall be given 7 days’ notice to rectify the defect in the application.

Section 54D – Time-limit for completion of PPIRP

- The PPIR process shall be completed within 120 days from the PPIRP commencement date.

- The RP shall submit the resolution plan as approved by the CoC within 90 days from the PPIRP commencement date.

- If no resolution plan is approved by the COC within 90 days as stated above, then the RP shall after the expiry of the said period, file an application for termination of the PPIRP in the prescribed manner.

Section 54E – Declaration of moratorium & Public announcement during PPIRP

On the PPIRP commencement date, the Adjudicating Authority shall:

- Declare moratorium as required u/s 14(3) of the IBC

- Appoint a resolution professional (RP) subject to being satisfied of his credibility / credentials / track record

- RP to make a public announcement of initiation of the PPIRP in the prescribed Form P9 in accordance with Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021.

The order of moratorium shall have effect from the date of such order till the date on which the PPIRP comes to an end.

Section 54F – Duties & Powers of RP during PPIRP

The RP shall conduct the resolution process during the PPIRP as per his duties & powers assigned.

Duties:

- Confirm the list of claims submitted by the Corporate Debtor in the specified manner;

- Inform creditors regarding their claims in the specified manner;

- Maintain an updated list of claims

- Monitor management of the affairs of the Corporate debtor;

- Inform the CoC of breach of obligations, if any, by directors or partners of the Corporate debtor under this Chapter, Rules & Regulations;

- Constitute the CoC meeting and attend all meetings;

- Prepare information memorandum to be submitted under section 54G and relevant information in the prescribed forms and manner;

- File applications for avoidance of transactions under Chapter III or fraudulent or wrongful trading under Chapter VI;

- Such other duties as may be specified.

Powers:

- Access all books of accounts, records and information available with the Corporate debtor; electronic records / financial information of the corporate debtor from the Information Utility (IU); available with Government authorities, statutory auditors, accountants and such other persons as may be specified;

- Attend meetings of members, Board of Directors, CoC of the Corporate Debtor;

- appoint accountants, legal or other professionals in such manner as may be specified;

- collect all information relating to the assets, finances and operations of the corporate debtor for determining the financial position of the corporate debtor and the existence of any transactions that may be within the scope of provisions relating to avoidance of transactions under Chapter III or fraudulent or wrongful trading under Chapter VI.

Note: Information includes (i) business operations, financial and operational payments for the previous 2 years from the date of PPIRP commencement date; list of assets and liabilities as on the initiation date; and such other matters as may be specified;

Section 54G – List of claims and preliminary information memorandum

The Corporate debtor shall within 2 days of the PPIRP commencement date, submit the following to the RP:

- A list of claims of the respective creditors, their security interests and guarantees, if any if any in prescribed From P10 in accordance with Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021;

- A preliminary information memorandum containing information relevant for formulating a resolution plan.

Where any person’s claim has been omitted and such person has incurred damage on account of omission of such material omission, then every promoter / director / partner of the Corporate debtor responsible for authorization and or submission of such information memorandum shall be liable to pay compensation to such person as who has suffered damage or loss. Such person is entitled to move the Courts as well to get compensation.

However, such promoter / director / partner of the Corporate debtor shall not be liable if such submission was made without his knowledge or consent.

Section 54H – Management of affairs of Corporate debtor

The management of the affairs of the Corporate Debtor shall continue to vest in the Board of Directors / Partners of the Corporate debtors, subject to: They endeavouring to protecting/ preserving the value of the property and managing operations as a going concern; Promoters/ members / personnel and partners of the Corporate debtor shall discharge their statutory, contractual obligations subject to the provisions of this Chapter.

Section 54I – Committee of Creditors

- The RP shall within 7 days from PPIRP commencement date constitute a committee of creditors based on the list of claims confirmed under Sec 54F (2)(a). The composition of CoC shall be altered on the basis of the updated list of claims and any such alteration in composition will not affect validity of past decisions.

- The First meeting of CoC shall be held within 7 days from date of constitution of the CoC.

- Provisions of Section 21 (except sub section (1)) will apply to Resolution professional or Corporate debtor.

Section 54J – Vesting management of corporate debtor with resolution professional

- The RP can make an application before the Adjudicating Authority for vesting the management of the corporate debtor, if not less than 66% of the voting shares of the CoC vote for the same during the PPIRP.

- On receipt of such application, if the Adjudicating Authority is satisfied that during the PPIRP process the affair were conducted in fraudulent manner or there is gross mismanagement, then the Adjudicating authority may vest the management of the corporate debtor with the RP.

Provisions of Section 14(2) & (2A), Sections 17 to 20, Section 25(1)(A) to (c) & (k) shall apply mutatis mutandis to the corporate debtor from the date of order under sub section (2) until the PPIRP comes to an end.

Section 54K – Consideration and approval of resolution plan

- The Corporate debtor shall submit a base resolution plan to the RP within 2 days of the PPIRP commencement date. The RP shall present the same to the CoC.

- The CoC may provide an opportunity to the Corporate debtor prior to giving approval to such plan or invitation of prospective resolution applicants.

- The base resolution plan / resolution plan submitted shall conform with requirements u/s 30(1),(2) under this Chapter. Provisions of section 30 (5)(1) (2) shall apply mutatis mutandis.

- The CoC may approve the base resolution plan as long as it does not impair the claims of the operational creditors by the Corporate debtor.

- Where the CoC does not approve the base resolution plan or such plan impairs the claims of the operational creditors, the CoC shall invite prospective resolution applicants to submit the resolution plans to compete with the base resolution plan. Such invitation shall be in the prescribed From P11 in accordance with Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021.

- The resolution applicants submitting the resolution plan shall have due regard to the complexity and scale of operations of business of the corporate debtor.

- The RP shall provide to the resolution applicants, information such as the basis of evaluation of the plans by the CoC and relevant information referred to in section 29 under this Chapter.

- The RP shall submit those plans which conform to the requirements u/s 30(2).

- The CoC will evaluate such resolution plans so submitted and select one amongst them.

- If the resolution plan submitted by the resolution applicant is significantly better than the base resolution plan, then the same may be approved subject to meeting criteria laid down by the CoC.

- The resolution plan submitted to the Adjudicating Authority must be approved by the CoC. It must be accompanied in prescribed Form P12 in accordance with Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021

- If the CoC does not approve the resolution plan, then the RP shall apply for the termination of the PPIRP process in the specified manner in Form P13 in accordance with Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021

- The approval of the resolution plan shall be done by not less than 66% of those having voting shares by CoC after considering its feasibility, viability and manner / order of distribution amongst creditors as contained in Sec 53(1).

- If the resolution plan submitted contains any impairment of claims owed by the corporate debtor, then the CoC may require dilution of promoters’ shareholding or voting or control rights in the corporate debtor. If there is no impairment as stated above, the CoC will accord approval and record reasons for doing so, prior to such approval.

- The RP shall submit the resolution plan as approved by the CoC to the Adjudicating Authority.

Note: Claims shall be considered to be impaired where the resolution plan does not provide for the full payment of the confirmed claims as per the updated list.

Section 54L – Approval of resolution plan

(1), (2) If the Adjudicating authority is satisfied that the resolution plan submitted (as approved by CoC) meet the requirements of Section 30(2), it shall by order approve the plan within 30 days after satisfying itself of its effective implementation. Else it shall reject the resolution plan and pass an order u/s 54N within 30 days.

(3) If the resolution plan does not result in change in management or control of the corporate debtor to a person who was not a promoter / in management /control of the Corporate debtor, the Adjudicating authority shall pass an order rejecting such resolution plan, terminate the PPRIP process and pass order for liquidating the Corporate debtor including that costs will be borne by the Corporate debtor.

Section 54M – Appeal against order u/s 54L

Any appeal from an order approving the resolution plan 54L (1) shall be on the grounds laid down in Section 61 (3).

Note: U/s 61 appeal against order could be on grounds of may be filed on grounds of material irregularity or fraud committed in relation to such a liquidation order.

Section 54N – Termination of pre-packaged insolvency resolution process

- Where the RP files an application with the Adjudicating authority u/s 54K(12) proviso or 54D(3)(b) the Adjudicating Authority shall within 30 days from the date of application, terminate the PPIRP and provide for continuation of avoidance of transactions under Chapter III, or Sec 66 or 67A.

- Where the RP files an application after commencement of PPIRP but before submission of a resolution plan, atleast 66% voting shares of the CoC voted to terminate the PPIRP process, the Adjudicating Authority shall pass an order.

- In the above cases, the Corporate debtor shall bear the costs.

If a liquidation order is passed u/s 33(i),(ii),(iii) and (1)(b), the PPIRP costs shall be include in part of the liquidation costs for the purpose of liquidation of the Corporate debtor

Section 54O – Initiation of corporate insolvency Resolution process

(1) The committee of creditors, may, at any time after the PPIRP commencement date but before the approval of resolution plan may resolve to initiate a corporate insolvency resolution process in respect of the Corporate debtor, if such corporate debtor is eligible for corporate insolvency resolution process under Chapter II. This has to be voted by at least 66% of the voting shares of the CoC.

(2) Once the above stated happens, the Adjudicating authority shall pass an order within 30 days to the effect that the PPIRP process is being terminated and corporate insolvency process is being initiated, the RP is being appointed as interim resolution professional, the PPIRP costs shall be included in the corporate insolvency resolution process.

(3) Where the RP fails to submit the written consent, the Adjudicating authority may appoint another interim resolution professional by referring to the Board as provided u/s16 of the Code.

(4) (i) The order passed by the Adjudicating Authority shall be deemed to be an admission of application u/s 7 of the Code.

(ii) The CIRP shall commence from the date of such order. Proceedings initiated for avoidance of transactions under Chapter III, Sections 66 & 67A, if any shall continue under the CIRP. Relevant time period for computing such transactions under PPIRP shall also be included in the CIRP.

(iii) For the purpose of sections 43,46& 50 “insolvency commencement date” shall mean the PPIRP commencement date.

Section 54P – Application of provisions of Chapters II, III, VI, and VII to this Chapter

- Provisions of Sections 24 to 28, 29A, 32A, 34 to 51 shall apply mutatis mutandis to the PPIRP subject to the following:

Reference to:

- “members of the suspended Board of Directors or the partners” shall be construed as “members of the Board of Directors or the partners;

- “resolution professional” in Section 28 (1) & (4) shall be construed as “Corporate debtor”.

2. Without prejudice to the provisions of this Chapter and unless the context otherwise requires, where the provisions of Chapters II, III, VI and VII are applied to the proceedings under this Chapter, references to —

(a) “insolvency commencement date” shall be

construed as references to “pre-packaged insolvency commencement date”;

(b) “resolution professional” or “interim resolution professional”, as the case may be, shall be construed as references to the resolution

(c) “corporate insolvency resolution process”

shall be construed as references to “pre-packaged insolvency resolution process”; and

(c) “insolvency resolution process period” shall be construed as references to “pre-packaged insolvency resolution process period.”

The intention behind promulgating the IBC Ordinance allowing the pre package insolvency resolution process especially for MSMEs is viewed s a win -win situation for the corporate debtor and the regulator. However, with the second wave of Covid19 hitting India like a Tsunami, only time will tell how effective the pre-packaged solution will be.