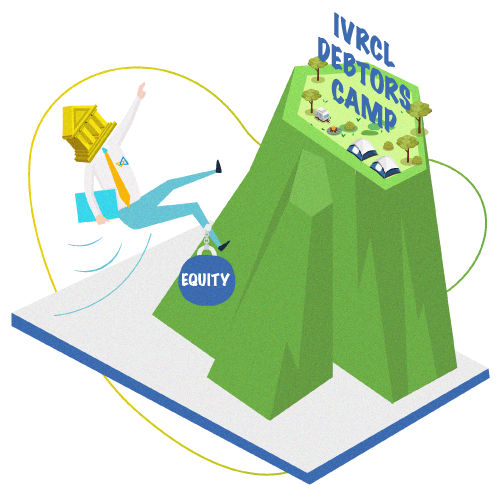

NCLT: Conversion of Loan to (In)equity?!

It is a judgment with an explosive impact on the Banking system in India. In February 2019, the Hyderabad branch of National Company Law Tribunal (NCLT), in the Canara Bank Vs IVRCL Limited, passed a judgment stating that loans converted into equity before the process of insolvency and bankruptcy began CANNOT be considered as debt at the time of settling dues of financial creditors. In the same case, the single member bench of the NCLT ruled that uninvoked bank guarantees will very much be considered as debt of the corporate debtor. An insight into the same:

Case Highlights

- Canara Bank sanctioned IVRCL Limited (a company engaged in contracts, infrastructure works and projects) open cash credit facilities and bank guarantee to the tune of Rs. 1,211 crores.

- The company which had several subsidiaries, associate and JV companies got restructured. Thereafter its total debt exposure stood at Rs. 1,264 crores. Its total debt exposure consisted of working capital term loans, funded interest term loans, rupee term loans, open cash credit facility and bank guarantee.

- Part of the funded interest term loan to the tune of Rs. 61.02 crores were converted into equity

as part of the corporate debt restructuring process (CDR). - The Joint lenders forum (JLF), a consortium of banks and NBFC’s that lent to IVRCL, as part of the strategic restructuring scheme (SDR) sought to effect change in management by acquiring 51% of shares in IVRCL. As a result Rs. 26.56 crores got further converted from debt to equity. Thus the total figure debt that stood converted to equity stood at Rs. 87.55 crores.

- However, both the CDR and SDR schemes could not be implemented within the stipulated period of 18 months. As a result, the joint lender forum (JLF) exited. All concessions granted were withdrawn, EXCEPT the conversion of loan into equity.

- Thereafter, Canara Bank represented to the resolution professional (RP) about including as financial claim(s) two components – (i) uninvoked bank guarantee and (ii) debt that got converted into equity.

Now, the requirement of Banks and other financial institutions on including uninvoked Bank guarantee and converted debt as financial claim has opened a pandoras box for discussion and debate. Both parties have reinforced their respective submissions:

Stance of Bank(s)

It has been strongly contended by Banks and NBFC’s that conversion of loan / debt into equity is an instrument, part of the strategic debt restructuring. (SDR). This is a method for revival of debt and does not amount to the Bank taking over the corporate debtor. Under the SDR mechanism, it is mandatory for banks to acquire 51% upon revival of the corporate debtor and take over the corporate debtor. When the SDR scheme either fails or is not completed within the stipulated time, then the revival of the corporate debtor does not happen. Then the Banks will revert to be a lender. They would no longer continue as shareholder(s) of the corporate debtor. Acquisition by lenders was only for the purpose of revival of corporate debtor as a special initiative. Though the debt / loan is converted into equity, the term “equity” is used only for nomenclature. It cannot be strictly treated as an equity investment. It should be considered only as converted debt. The Bank also submitted that conversion of debt to equity does not attract compliance/ reporting under AS-23. Hence the banks cannot be shareholders.

The Bank further contended that uninvoked bank guarantee or contingent liability and debt converted equity shall fall under the definition of financial debt u/s 5(8) of the IBC, 2016.

The judgment passed in two previous cases were relied upon – Andhra Bank vs. F.M Hammerle Textile Ltd 1 and the Supreme Court ruling in Chitra Sharma vs Union of India 2

Submission by the Resolution Professional (RP) on behalf of the Corporate debtor

It was the RP’s contention that for any amount to qualify as ‘debt’ under IBC or Indian Contract Act. 1872, the amount must be due from the relevant person. Since the bank guarantee has not been invoked, an uninvoked bank guarantee cannot be considered as amount due and hence cannot be considered as debt. The RP was of the view that if uninvoked BGs are considered, it would only increase the overall liability of the corporate debtor and thus jeopardize the implementation of a resolution plan which could provide effective value to all creditors including financial creditors.

The RP submitted that once debt is converted as equity, it no longer remains a debt either in the books of the lending bank or the corporate debtor. Such lender is reflected as share holder of the corporate debtor. The debt amount will stand reduced to the extent of conversion into equity. Once debt is converted to equity, it is irreversible. Thereafter such converted amount cannot be considered as a claim. The RP states that debt is a liability or obligations in respect of a claim which is due from any person and includes financial debt and operational debt. It was argued that debt converted into equity shares cannot be reversed merely on account of non implementation or failure of CDR and SDR schemes. The bank cannot become a lender first, then a shareholder (consequent to conversion) and thereafter revert to be a lender.

The Judgment

After hearing both sides of arguments, the single member bench of the NCLAT ruled that:

- Notwithstanding the requirement of non reporting under AS-23, the Bank was unable to prove any express regulation / guideline issued by the RBI that amount converted from debt to equity will revert to the category of debt if the CDR / SDR fails.

- “Claim” means a right to payment and a right to remedy a breach of contract under any law for the time being in force whether such right is reduced to a judgment. Section 3(11) of the IBC, 2016 defines a debt to be a liability or obligation in respect of a claim which is due from any person and includes a financial debt and operational debt. A combined reading of both definitions will lead to the conclusion that uninvoked bank guarantee not being considered a debt at all will not find merit as in case the uninvoked bank guarantee is not admitted or included as a claim, it will seriously jeopardize the interest of the Banks. Relying on the Andhra bank case, it was decided that corporate debtor owes counter indemnity obligation to the lender, such claim would have to come under the purview of financial creditor

Sum and Substance

The NCLT accepted the RP’s stand that debt, once converted into equity cannot be considered debt and hence included in the claims. However, going by the meaning of the term “claim” (section 3(11) of the Code) NCLT has categorically concluded that uninvoked bank guarantees will be treated as debt and hence considered as claims of the financial creditors.

With the NCLT ruling on debt converted to equity, lending institutions such as Banks may have to show substantial loss as such amounts will not be considered as financial claims. The ball is now in NCLAT.

References