Nullification of Retrospective Tax Laws

On 5th August 2021, the finance minister introduced the Tax Amendment Bill 2021 in the Parliament. The most significant amendment in the Bill is to nullify / invalidate the retrospective taxability of transactions.

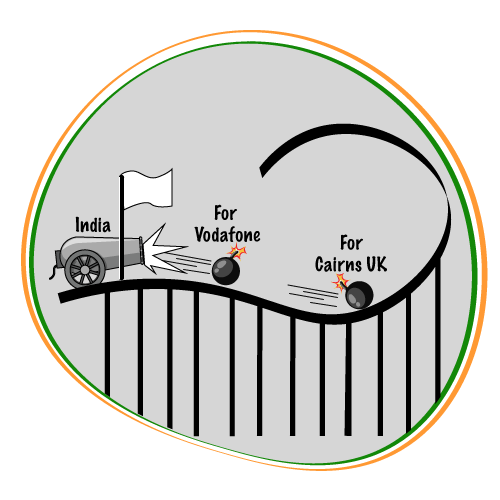

The government has stated that no further orders shall be passed on retrospective basis. Further it has expressly clarified that even previous orders passed on retrospective basis shall be nullified. Such retrospective orders passed in the past shall be invalidated. An insight into events that prompted this amendment.

Background

In May 2007, Vodafone International Holdings (“Vodafone”), the Dutch company acquired 100% shares in CGP investment Holding Ltd (“CGP”), which invested in Hutchinson Essar Limited (“HEL”), an Indian company engaged in mobile telephony business with assets in India. Through such acquisition of CGP investment Holding Ltd, Vodafone acquired 67% holding of HEL. In September 2007, the IT department issued a show cause notice as to why TDS was not deducted on the said transaction as it involved indirect transfer of assets in India. A demand of Rs. 7,990 crores was raised on Vodafone for failure to deduct tax at source before making a payment to HEL for transfer of shares resulting in indirect transfer of assets.

Vodafone challenged this demand notice in the Bombay High Court. The court upheld the demand notice issued by the IT department. Thereafter Vodafone challenged the Bombay HC judgment in the Supreme Court. In 2012, the Apex court ruled in favour of the Vodafone group stating that there was no need to pay taxes for the said transaction.

Amendment to circumvent the SC judgment

In the Union budget of 2012-13, the then finance minister introduced the retrospective taxation law. An amendment to the Finance Act gave the IT department the power to impose retrospective capital gains tax for transactions of transfer of shares in foreign entities located in India. World over countries such as US, UK, Netherlands and others have used the “retrospective tax” laws to plug loopholes in law that were being used by many corporates to their advantage.

While the Supreme Court ruled that Vodafone need not pay the money, the amendment in Budget 2012-13 was obviously to circumvent the SC judgement. Hence retrospectively, Vodafone had to pay taxes to the tune of almost 22,000 crores after factoring in interest and penalties.

In 2014, Vodafone initiated arbitration in the permanent Court of Arbitration in the Hague, Netherlands. Vodafone submitted that the retrospective tax laws were in violation of the bilateral treaty between India and the Netherlands. The intention of the previous government was to the enable recovery of money from Vodafone. However, this retrospective tax laws also unintentionally brought into its net several other companies/ corporates.

Cairn UK is another such (in) famous case. Cairn UK Holdings Limited (“Cairn UK”), a UK based company had a wholly owned subsidiary – Cairn Jersey (“CJ”). CJ owned subsidiaries in India. In 2006, Cairn UK transferred all its business and shareholding in CJ to Cairn India Holdings Limited (“Cairn India”). In 2014, the IT department was of the view that the transfer of shareholding in CJ to Cairn India had the effect of transferring business in India and hence Cairn UK was liable to pay capital gain tax. Like in the Vodafone case, retrospective tax amendment laws were imposed on Cairn UK as well.

Related developments

In September 2020, the Permanent Court of arbitration ruled that the Indian government’s demand of Rs.22,000 (approximately $ 3.7 billion) to be paid by Vodafone is in breach of “fair and equitable treatment” and violates the bilateral treaty. Further, it directed India to pay $5.4 million as compensation. In December 2020, India filed an appeal in the Singapore High Court challenging the international arbitration tribunal verdict in favour of Vodafone in the retrospective tax imposition case. The hearing is likely to come up in September 2021. The most important ground of contention is that the “right to tax” is a sovereign right of India and cannot be governed by bilateral treaties / agreements with other nations.

Cairn UK initiated proceedings in Indian courts and also in the Hague, Netherlands claiming India violated the India-UK bilateral treaty. In December 2020, the Permanent court of arbitration ruled in favour of Cairn UK. Stating that the retrospective imposition of tax is in violation of the treaty, Cairn UK was awarded $ 1.7 billion in damages and compensation to be paid by India. In January 2021, Cairn UK went a step ahead and stated that it will move to freeze all India’s assets including bank accounts located outside India, if it fails to make the payment. Cairn UK executives are now in talks with the government to resolve the issue. The government has assured that it will do all it can to amicably resolve the issue.

The latest

In light of the above cases, the August 2021 amendment of altogether doing away with retrospective tax laws becomes crucial. The 2012 tax amendment was widely criticized both within and outside the country. It was seen as a major bottle neck to inflow of foreign investments in India. Further, the circumventing of the Apex Court judgment by a tax amendment indicated a sense of superiority of the Executive over the Judiciary. The twin loss (in Vodafone and Cairns cases) will cost India a staggering Rs. 30,000 crores (approximately) in damages / penalties / legal costs to be paid to the other parties.

Keeping the above in mind, the present Indian government has nullified the 2012 Tax amendment by introducing the Tax Amendment Bill 2021 which abolishes the retrospective tax laws. No further orders shall be passed on retrospective basis. The orders already passed on retrospective basis would be nullified / invalidated.

Impact analysis

The move has been widely welcomed and praised by the Indian and foreign investor community alike. Particularly in the aftermath of the Covid19 pandemic when the government has to bring the economy back on track, this amendment will ensure more foreign investment without unduly taxing and burdening them.

This will also ease the burden of the cash strapped government from incurring thousands of crores in paying compensation / damages in the two international cases they recently lost. Whether it is a face- saving tactic or rectifying an anomaly in (tax) laws, the economy is set to gain big.

For full text of the Tax Laws Amendment Bill 2021:

http://164.100.47.4/BillsTexts/LSBillTexts/Asintroduced/120_2021_LS_E.pdf