The Great Indian Self Reliance

Atma Nirbhar – a mammoth effort by the government to counter the unseen enemy that brought the country to near standstill and the economy on it knees. The outbreak of the Covid 19 pandemic led to India being locked down for almost two months and crippled the economy.

As soon as the government announced the lockdown, it also pro-actively set to work in ring fencing the Covid impact on the economy.

Several key measures were announced soon after the imposition of a never seen before lockdown. An insight into the key measures.

- Pradhan Mantri Garib Kalyan Yojana (PMGKY): Announced on 26th March 2020, this is a 1.7 lakh crore relief package to be announced as the first measure. The government announced that free food grains and cash to women, poor senior citizens, differently abled and farmers. This is being continuously monitored by Central and State governments. It is through this scheme that amounts ranging from Rs. 500 to Rs. 2,000 would be credited to identified beneficiaries in a phased manner.

- Fiscal measures announced by the RBI: On 27th March 2020, the RBI Governor introduced a slew of measures to tackle the Covid impact on the country’s fiscal growth.

Perhaps the most important measure was allowing all Banks and lending institutions to grant a moratorium period on payment of instalment on term loans. Originally the RBI declared it for a period of 3 months (1st March 2020 up to 31st May 2020). On 22nd May 2020, the RBI Governor extended the moratorium period by further period of 3 months (up to 31st August 2020). This moratorium essentially gave a breather from paying the instalment on term loans (including home loans, personal loans, education loans, working capital loan, credit card dues etc). The RBI further clarified that interest on loans is not waived off. It will accrue on the outstanding amount. It further clarified that the rescheduled tenor of payments will not amount to default or adversely affect the credit history of the borrower. All other terms and conditions at the time of availing the loan will remain the same.

While the moratorium breather is a welcome move to individuals and corporates, the RBI has reduced cash reserve ratio of banks for a period of 1 year up to March 2021 to cushion reduced liquidity (into banks) due to the moratorium. Further it has infused liquidity into the system of approximately Rs. 1.37 Lakhs Crores.

- Special liquidity facility for Mutual Funds: On 27th April 2020, the RBI announced to infuse up to Rs. 50,000 crores into Mutual Funds especially in the wake of large-scale redemption / withdrawal from the debt segment.

- Atma Nirbhar package: on 12th May 2020, the Prime Minister announced Rs 20 Lakh Crore special relief package to tackle with the consequence of the Covid 19 on the economy. Introduced in 5 tranches by the Finance Minister, Atma Nirbhar package includes all the relief measures announced by the RBI as well. The package accounts for 10% of the GDP of the country.

TRANCHE I

Validity < 31.10.2020

OBJECTIVES

Businesses including Micro, Small and Medium Enterprises Sector (MSME)

- Upto 3 Lakh Cores collateral free automatic loans

- Upto 45 lakh units to resume business and safeguard jobs

- Upto 2 Lakhs MSMEs are likely to benefit

- Upto Rs. 50,000 Crores to be leveraged at daughter funds level.

- Become self reliant, encourage ‘Make in India’

HIGHLIGHTS

- Definition of MSME to be revised

- Emergency credit line to MSMEs from Banks & NBFCs upto 20% of entire outstanding credit as on 29.02.2020

- Borrowers upto Rs. 25 Crores outstanding and Rs. 100 Crore turnover eligible

- Loan to have 4 year tenor and moratorium of 12 months on principal repayment

- Cap on interest

- 100% credit guarantee cover to Banks & NBFCs on Principal & interest amount

- No guarantee fee, no fresh collateral.

- GoI to infuse up to Rs. 20, 000 Crores to support in the form of equity to stressed MSMEs

- Promoters of MSMEs will be given debt by the Banks which can in turn be infused as equity into the MSME unit

- GoI to provide Rs. 4,000 Crores support to Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) which provides funds for MSMEs

- Fund of Funds (FoFs) with corpus of Rs. 10,000 crores to be set up. There will be a mother fund and several daughter funds.

- MSMEs to get listed on stock exchanges

- Global tenders in government procurement disallowed upto Rs. 200 Crores

- e-market linkage for MSMEs to be promoted to act as a replacement for trade fairs and exhibitions.

- Payments from Central Govt & CPSEs to MSMEs to be released within 45 days.

Provident Fund Support (EPF)

- Rs. 2500 crore EPF Support for 3.67 lakh business establishments and approximately Rs. 72.2 Lakhs employees

- Rs. 6,750 Crores liquidity support to businesses and employees by reducing the EPF contribution

- Under the PMGKP scheme, payment of 12% Employer and 12% Employee contribution made by government into EPF accounts of eligible establishments will extend to June, July & August 2020 as well.

- Except CPEs and PSUs, all other establishments to contribute reduced EPF rate of 10% (instead of 12%) for the next 3 months.

- This scheme will be applicable to those who are not eligible for 24% EPF support under the PMGKP scheme.

NBFCs / Housing Finance Companies (HFCs) / Micro Finance Institutions (MFIs)

- Rs. 30,000 Crores special liquidity scheme to augment liquidity / funds

- Rs. 45,000 Crores Partial Credit guarantee scheme (PCGS) 2.0 for NBFCs

- Augment liquidity

- Investment will be made in both primary and secondary market transactions in investment grade debt paper of NBFCs/HFCs/MFIs

- Securities fully guaranteed by Government of India.

- Existing PCGS to be extended to cover borrowings such as issuance of Bonds etc

- First 20% loss to be born by the GoI as the Guarantor.

Power Distribution Companies (DISCOMS)

- Rs. 90,000 Crores Liquidity injection to DISCOMS

- Power Finance Corporation Ltd. (PFC) and Rural Electrification Corporation (REC) to infuse liquidity to DISCOMS against receivables.

- Loans to be given against State guarantees for exclusive purpose of discharging liabilities of DISCOMS to Power Generating Companies (Gencos)

- Central Power Generator companies shall give a rebate to DISCOMS to be passed on to the final consumer industries

Contractors

- Ease cash flow and extend timelines

- All central agencies – Railways, Road, Transport & Highways, CPWD to provide extension of upto 6 months to contractors to complete pending works / contracts including construction works, Goods & service contracts.

- For partially completed contracts, government shall partially release Bank guarantees.

Real Estate

- Extension of timelines under RERA

- Encourage Developers for timely project completion and home buyers for acquiring their homes.

- Treat Covid 19 as “Force Majeure” event under RERA

- Suo motu extension of completion timelines by 6 months + 3 months for projects registered and expiring on or after 25th March 2020

- Issue fresh Project registration certificates with extended timelines.

Direct tax measures

- Rs. 50,000 crores liquidity through TDS/TCS rate reduction

- Enable more funds at the disposal of taxpayers

- TDS for non salaried specified payments made to residents reduced by 25% of the existing rate

- TCS for specified receipts shall be reduced by 25% of the existing rates.

- Payment for contract, professional fee, interest, rent, dividend, commission, brokerage etc eligible for this reduced TDS.

- Reduction applicable from 13th May 2020 up to 31st March 2021

Charitable Trusts & Non corporate business & profession

- All refunds to proprietorships, Partnerships, LLPs, Co-operative to be issued immediately.

Due date of IT Return for FY 19-20

- Tax audit extended to 31st October 2020

- Filing IT returns extended to 30th November 2020

Date of assessment getting barred

- Those getting barred on 31st March 2020 extended to 30th September 2020

- Those getting barred on 30th September 2020 extended to 31st December 2020

Vivad se Vishwas scheme

- Extended to 31st December 2020

TRANCHE II

Validity < n/a

OBJECTIVES

Poor including migrants & farmers

- Direct support to farmers and rural economy

HIGHLIGHTS

- 3-month Loan moratorium to be availed by 3 crore farmers with agricultural loans

- Prompt re-payment incentive in crop loans and interest subvention extended upto 31st May 2020

- 25 lakh new Kisan Credit cards sanctioned with a loan limit of Rs. 25,000 crores.

Liquidity support to Farmers

- Loans to the tune of Rs. 86,600 crores sanctioned between March – April 2020

- Refinancing support of Rs. 29,500 crores provided by NABARD to co-operative and regional rural banks in March 2020

Support to migrants & urban poor

- State Disaster Response Fund (SDRFs) providing shelter and food to migrants and urban poor since the start of the lockdown.

- More than 7,200 Self-help groups (SHGs) have been formed to produce masks and hand sanitizers generating employment and livelihood to migrants

- Disbursal of revolving fund to SHGs made online.

- Drive to enroll returning migrants

- Labour Codes and legislations to contain provisions to universalize minimum wages to all workers as against current 30% of workers.

- Definition of inter- state migrant workers to be modified and made broader

- Welfare benefits to be made applicable to them as well.

- Extension of ESIC benefits to all districts and establishments employing 10 mor more persons as against those in notified areas only. For establishments less than 10 employees the ESIC coverage is voluntary. In hazardous industries ESIC coverage is mandatory even if employees is less than 10

Rs. 3,500 Crores spent on food grains and shelter for migrants

- 8 crore migrants to benefit.

- Central government to bear entire cost; State governments to ensure implementation.

- Intra State portability on Fair price shops (FPSs) to enable migrants access their ration. Portability to be 100% complete by March 2021

- Affordable housing rental complexes (AHRCs) for migrants

Relief of Rs. 1,500 crores to Mudra Shishu loanees

- 3-month loan moratorium

- Interest subvention of 2% for prompt payees for 12 months

Rs. 5,000 Crores liquidity to 50 lakhs street vendors

- Government to launch special scheme to enable easy credit access to street vendors

- Initial working capital of upto Rs. 10,000

Rs. 70,000 crores to boost housing sector and middle-income group

- Credit linked subsidy scheme for middle income group (CLSS) to be extended upto 31st March 2021

- Create jobs

Rs. 6,000 crores employment opportunities using AMPA funds

- Compensatory Afforestation Management & Planning Authority (CAMPA) set up under Compensatory Afforestation Fund Act, 2016 to create employment for tribals / adivasis in urban, semi urban and rural areas.

TRANCHE III

Validity < n/a

OBJECTIVES

Animal husbandry

- Rs. 5,000 Crores additional liquidity to benefit 2 crores farmers

- Rs. 15,000 crores animal husbandry infrastructure fund to be set up

HIGHLIGHTS

- A new scheme to provide interest subvention @2% per annum to dairy cooperatives for FY 20-21.

- Additional 2% p.a interest subvention on prompt payment/interest servicing.

Micro Food Enterprises (MFEs)

- Launch of scheme to enable 2 lakhs MFEs upgrade technology and procure FSSAI standards, build brands and marketing

Fishermen

- Rs. 20,000 crores relief through schemes for fishermen

- Pradhan Mantri Matsya Sampada Yojana (PMMSY) to augment Rs. 20,000 crores for marine, inland fisheries, aqua culture, fishing harbours, cold chains and markets

- Provision of boat insurance and support during ban period (when fishing is banned)

- Employment to 55 lakh persons

- Double exports to Rs. 1 lakh crores

Amendments to Essential Commodities Act, 1955

- Amendment necessitated to enable better price realisation for farmers by attracting investments and making agriculture sector competitive

- Agricultural reforms to ensure more freedom to farmers in taking their produce directly to retailers and not necessarily through APMCs

TRANCHE IV

Validity < n/a

OBJECTIVES

Policy reforms to fast track investments

HIGHLIGHTS

- Fast track Investment Clearance through Empowered Group of Secretaries (EGoS).

- 3376 industrial parks/estates/SEZs in 5 lakh hectares mapped on Industrial Information System (IIS)

Coal Mining

- Introduction of commercial mining in coal sector

- Rs. 50,000 crores infrastructure fund

- Rs. 5,000 crores relief to Coal India Limited (CIL)

- Self reliance in coal production

- Private sector participation in coal sector through a fixed revenue sharing mechanism

- Entry norms to be liberalized

- No eligibility conditions, only upfront payment

- Coal gasification / liquification to be incentivized

- Environmental friendly impact

- Concessions given to CIL consumers

Defence Production

- “Make in India” defence production

- Indigenization of imported spares

- Reduce defence import bill

- FDI limit in defence manufacturing under automatic route increased to 74% (from 49%)

Air Space Management

- Only 60% air space to be made freely available

- Civilian flying to become more efficient

- Rs. 1,000 crores saving expected

- More world class airports to be put in place.

- India to be a world class hub for aircraft maintenance, repair and overhaul (MRO)

- Maintenance cost of aircraft to come down

Boosting private participation in Space activities

- Private sector also to participate in India’s space endeavors

- Provide level playing field and policies to private companies in satellite launches and space-based activities.

- Private sector to be allowed to use ISRO facilities to improve their capacities.

- Liberal geo-spatial data policy for providing remote-sensing data to tech-entrepreneurs.

Atomic energy related reforms

- Establish Private -Public participation (PPP) for production of atomic energy

- Include start ups in research facilities and tech entrepreneurship.

TRANCHE V

Validity < n/a

OBJECTIVES

Government reforms & Enablers

HIGHLIGHTS

- Sustained measures to improve India’s position in World Bank’s doing business Report to 63 in 2019. (from 142 in 2014)

Ease of doing business

- Next phase of Ease of Doing Business Reforms relating to easy registration of property, fast disposal of commercial disputes and simpler tax regime for making India one of the easiest places to do business.

Corporate Law reform measures

- First phase decriminalization of offences; compoundable offences made in house adjudication; penalty mechanism

- De-clogging Criminal courts and NCLT.

- Incorporation of companies made simpler

- Data bank of independent directors launched

- Pro-active relaxations in compliance during Covid19 time announced

- Streamlining of IBC cases. Minimum threshold to initiate insolvency proceedings raised to Rs. 1 crore (from Rs. 1 lakh, which largely insulates MSMEs).

- Special insolvency resolution framework for MSMEs under Section 240A of the Code to be notified soon.

- Suspension of fresh initiation of insolvency proceedings up to one year depending upon the pandemic situation.

- Empowering Central Government to exclude COVID 19 related debt from the definition of “default” under the Code for the purpose of triggering insolvency proceedings.

Further key reforms to include –

- Direct listing of securities by Indian public companies in permissible foreign jurisdiction(s).

- Private companies which list Nonconvertible debentures (NCDs) on stock exchanges not to be regarded as listed companies

- Producer companies (Part IX) to be re-included in Companies Act, 2013

- Power to create additional / specialized benches for NCLAT

- Lower default penalties for Small companies, OPCs, Producer companies and Startups.

Education

- Introducing technology driven systems that enable online education to children especially to those with no internet access.

Public Sector policy

- New coherent policy for private sector and public sector enterprises to co- exist harmoniously.

- List of strategic sectors requiring PSEs to be notified.

- Number of PSEs in public sector will be minimized to 1 to 4. The rest will be merged or privatized.

The Atma Nirbhar stimulus package announced in light of the Covid 19 pandemic has evoked mixed response. While measures to uplift the MSME sector, agriculture, farmers and migrants / poor have been positively viewed, certain other provisions such as revising the threshold of default amounts under the IBC and amendments to EC Act deregulating essential commodities have been critically viewed as it could provide contra effective.

Experts are of the view that government has relied heavily on the liquidity infusion into Banks and financial institutions. Several initiatives are in the nature of credit guarantees. So, while the government per se is not incurring cost on all the policies initiated, the need is for the funds to go to the public. This could prove a challenge.

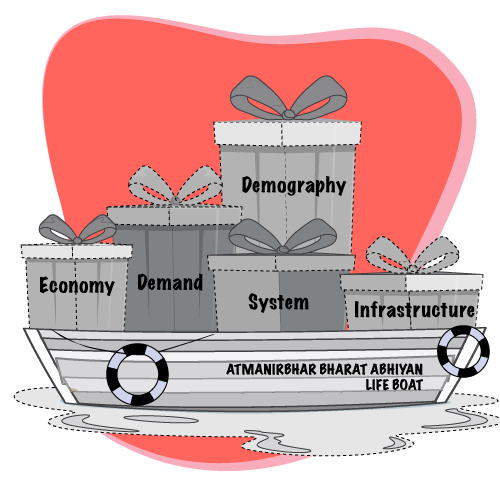

The Prime Minister’s 5-pronged objective of this stimulus package – Economy, Infrastructure, Systems, Vibrant demography and Demand. Only time and effective implementation will spell the success of this package. Till then, stay safe and self-reliant.