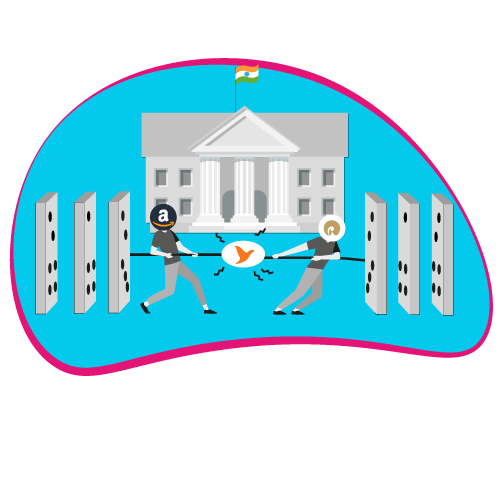

Amazon Inc V. Future Group: An Economic Battle gone all Nuclear

The recent tussle between Amazon Inc. and Future Group has gone all nuclear. Both the parties are currently aggressively defending their sides to safeguard their business entities and to survive the rough weather that has been self-created. In brief, the legal battle between Amazon and Future Group started as a result of Amazon raising an objection to a proposed deal that was recently signed between Future Group and Reliance Industries in which the Future Group signed an agreement to sell its assets to the latter.

The financial position of Future Group was getting worse as its liabilities were substantially high and huge pressure was being created by its lenders asking Future Group to manage its debts. Covid-19 made the condition even more detrimental due to long-lockdowns and capital-crunch. Therefore, in order to protect the company from collapsing and falling into insolvency, the company decided to sell its retail, wholesale, logistics, and warehousing business to Reliance Industries for an approximate figure of Rs 24,713 crore. 1

With the deal being signed, Amazon which is a business partner of Future Group objected to the deal between Reliance Industries and Future Group on multiple grounds and termed this agreement to be void and unlawful. Amazon asserts that it has the locus standi to object to the agreement because it has purchased 49% of the Future group’s unlisted firms in 2019 as per the deal between Future Group and Amazon Inc. (hereinafter 2019 deal) and that deal provides a clause which states that Future Group cannot sell it retail assets to anyone who falls in the ‘restricted persons’ list.

The Trumpet of Legal War

Amazon claims that Reliance Industries is also one of the entries in the ‘restricted person list’ and hence the current deal to sell assets to Reliance is barred.2 Amazon also claims that it holds shares in Future Retails Limited (FRL- retail unit of Future Group) indirectly because Amazon acquired 49% of shares in Future Coupon Pvt Ltd (FPCL) which in turn acquires 9.83 % shares

in FRL, hence Amazon claims to have 49% of 9.83% which is approximately 5% of the FRL shares . Moreover Amazon claims that the 2019 deal gives Amazon the right of first refusal to acquire more shares in the same entity. To substantiate, Amazon stated that it has the ‘call option’ according to which it has the option to acquire all or part of Future Retail’s shareholding in the company in the next 3 to 10 years of the agreement that is signed in 2019. Moreover, Amazon also asserted that Future Group was bound to inform Amazon about any such deal before entering into a sale agreement that deals with the third parties.

Therefore, Amazon stresses that the current deal signed between Future Group and Reliance Industries is a violation of a non-compete clause and a right of first refusal pact. On contrary, Future Group denies any such claim raised by Amazon by stating that it has not violated any clause as it has not made an agreement to sell stakes of the company but has only agreed to sell its assets, therefore contentions raised by Amazon are entirely misconceived.

Not satisfied with the defensive stance taken by Future Group, Amazon has resorted to Singapore International Arbitration Centre (SIAC) for an emergency arbitration demanding an interim injunction on the current agreement taking place between Reliance and Future Group. Under SIAC, emergency arbitrator provisions as provided in Rule 30 of the Singapore International Arbitration Centre Rules, 2016 deal with situations where a party needs emergency interim relief before a tribunal that is constituted.3 Rule 30 is quoted below as verbatim:-

Rule 30: Interim and Emergency Relief

30.1 The Tribunal may, at the request of a party, issue an order or an Award granting an injunction or any other interim relief it deems appropriate. The Tribunal may order the party requesting interim relief to provide appropriate security in connection with the relief sought.

30.2 A party that wishes to seek emergency interim relief prior to the constitution of the Tribunal may apply for such relief pursuant to the procedures set forth in Schedule 1.

30.3 A request for interim relief made by a party to a judicial authority prior to the constitution of the Tribunal, or in exceptional circumstances thereafter, is not incompatible with these Rules.

In the present dispute, the SIAC in its emergency arbitration has passed an award in favour of Amazon by granting an interim injunction against the agreement between Reliance and Future Group. Also, in the emergency relief granted by SIAC, it has also injuncted Future group from filing or pursuing any application before any Body or Agency in India.

Reliance Industries and Future Group both have argued that the interim order passed by SIAC is not binding in the present case as the provision of the emergency arbitrator is not compatible with Indian Laws and further Future Group states that order of emergency arbitrator is required to be tested on grounds of Indian Law as it lacks jurisdiction. Moreover, Reliance has intended to speed up the agreement of purchasing Future Group’s asset without any delay.

In order to prevent the deal from taking place, Amazon had also written a letter to different agencies in India like Securities and Exchange Board of India (SEBI), Competition Commission of India (CCI), and stock exchanges, to make them aware about the interim order passed by the SIAC regarding temporarily injuncting the Future Group and Reliance proposed deal, as the deal has to be approved by these regulators as well. Till now, CCI has responded and has approved the proposed deal to take place and thus it and has dismissed the request of Amazon to consider the SIAC order.

Nonetheless, Reliance Industries and Future Group irked by the continuous interference of Amazon in obstructing the deal has approached the Delhi High Court seeking an ad-interim injunction against Amazon for sending letters to various regulatory authorities. The Future Group has argued that emergency arbitration is illegal as it is a foreign concept alien to Indian law, and in such cases, Section 17 of the Indian Arbitration Law is to apply to get any injunctive relief, if any, therefore approaching emergency arbitrator for the award is illegal and thus, the award is not valid and binding in the present case.

In its arguments advanced, Future Group has submitted that Amazon is not a party to its agreement with its own shareholder and Amazon is also not its shareholder as it is just the shareholder of Future Coupon Private limited but not of Future Retail Limited, therefore, it cannot deny the latter’s right to enter into an agreement with Reliance. As a result, the Future Group and Reliance had pleaded that the Court should ignore the award passed by the emergency arbitrator as same is not valid as per Indian Laws and is void, non este and outside the jurisdiction, therefore, it is not required to be challenged or set aside. Thus, they have prayed before the court to restrict Amazon from interfering in the proposed deal taking place.

Amazon in its reply has contended that arbitration agreement is decided mutually and in the 2019 agreement between Amazon and Future Group, SIAC was the appropriate forum decided mutually. Therefore, when parties have agreed to SIAC rules, it means that they accept the rules in their entirety. So, these SIAC rules contemplate the provision of an emergency arbitrator which is within the scope and can be exercised. Thus, the argument made by the petitioners regarding jurisdiction of SIAC is fundamentally flawed and to claim that award passed by the Emergency arbitrator is null and void, is contrary to the Acts and Rules and the scheme of SIAC. Hence, Amazon argues that award by emergency arbitrator is lawful and correct and the sanctity of the same has to be maintained.

What is at stake?

At present, Delhi High Court has concluded the hearing of the matter and it has reserved the judgement. The current matter has brought the question of India’s adaptability to International arbitration Jurisdiction into the limelight. The judgment that will be given in the present case will certainly be an important precedent for future matters based on international arbitration awards and its applicability in India as it will have a precedential value.

For now, the approval from CCI to take forward the proposed deal ahead will mount additional pressure on Amazon. There is no doubt that the current fierce battle amongst the key players is majorly dealing with acquiring dominance in India’s estimated $1 trillion consumer retail market. All the parties have a higher stake in the deal. Moreover, Future Group has claimed that if the proposed deal fails, the company would have to go for liquidation, therefore, bringing the jobs of thousands at risk.

On the other side, Amazon has warned that the stance taken by India in the current matter would surely be material in making investment decisions in India for the global market and key market players. So, the current situation has become a matter of concern if seen from different aspects. As for now, the future course of the proposed deal is dependent on the decision of the Delhi High Court, and the next line of action is unpredicted but it is sure that no side will leave any table unturned in order to win this battle.

References