Analysis of U.S. Corporate Transparency Act

With the start of this year 2021, the United States assured itself of gearing up against the incessant rise of frequent activities of economic crimes like money laundering, terrorism financing, etc., and promised to reduce the same.1

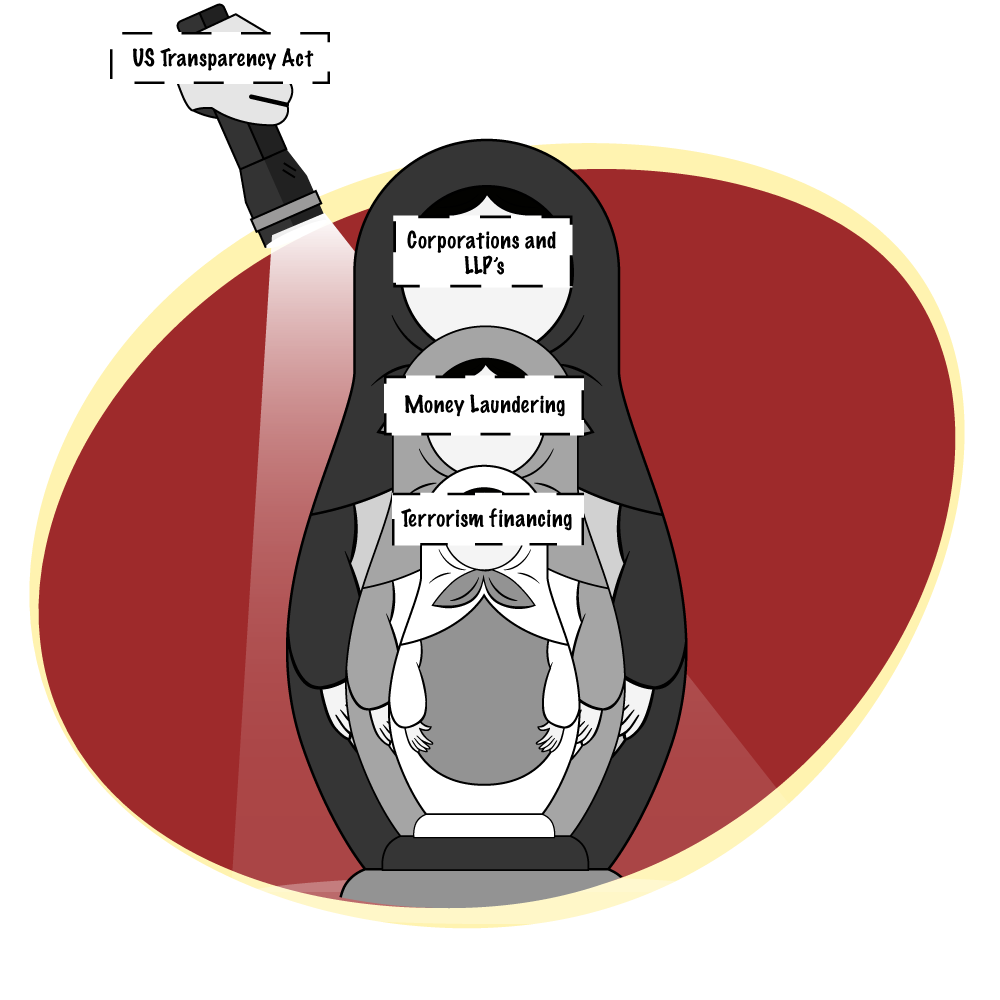

One such move was to give effect to the Corporate Transparency Act, 2021 as it got passed and enacted as part of the National Defense Authorization Act. According to the U.S. Congress, more than 2,000,000 corporations and limited liability companies are formed in the U.S. States every year and most of these States do not obligate the entities to provide information about the beneficial owners which results in malign actors concealing their ownership of entities to facilitate illicit activities including economic crimes that causes a threat to national security interests of the U.S. and its allies. It is a practice followed by money launderers and other offenders involved in commercial activities to intentionally conduct transactions through these corporate structures so that they could evade scrutiny and may layer such structures, much like Russian nesting ‘‘and Matryoshka’’ dolls, across various secretive jurisdictions such that each time an investigator obtains ownership records for a domestic or foreign entity, the newly identified entity is yet another corporate entity, necessitating a repeat of the same process.

Therefore, through this Act, it has been mandated that the entities including corporations, LLC would be made liable to disclose information about beneficial ownership so as to protect vital national security interest, to protect interstate and foreign commerce, to better enable critical national security, intelligence, and law enforcement efforts and to bring the U.S. in compliance with international anti-money laundering and countering the financing of terrorism standards. A duty has been cast upon the Secretary of Treasury to maintain the information provided by reporting company in a secure, non-public database with the highest security level and to take all steps, regular auditing to ensure that the information collected of the beneficial ownership is accessed by government authorities only for the purposes which are authorized. 2

Who is a beneficial owner according to the legislation?

Under layman’s term, a beneficial owner is a person who enjoys the benefits of ownership though the title of the property in some form is in the name of the other person. Moreover, the term beneficial owner is also used in the sense of defining those individuals who can either directly or indirectly enjoy the power to vote or influence any decisions in a company. Under the Corporate Transparency Act, beneficial owner consists of an entity or an individual who directly or indirectly, through any arrangement, contract, relationship, understanding, or in any other form exercises substantial control over the entity or, owns or control at least 25 (twenty-five) percent of the ownership interests of the entity is a beneficial owner. At the same time, some exceptions have been carved out to this definition whereby firstly, minors are kept out of its purview, secondly, an individual will not be termed as beneficial owner when he is acting as a nominee, intermediary, custodian, or agent on behalf of another individual, thirdly, when such an individual act solely as an employee of the company or an entity and whose control over or economic benefits from such entity is derived only because of the employment status of person will not be a beneficial owner, and lastly, all those individuals whose interest in the entity is just due to a right to inheritance will not fall under the ambit of this term.3

Which companies have to mandatory report about the beneficial ownership?

As per the Act, reporting company means a corporation, limited liability company, or any other entity of similar nature which was created as a result of filing the documents with the secretary of the State or a similar officer under the laws governed by the State or when the entity is formed under the law of another country but is registered to do business in the United States after the filing of documents as per the Law of State. This obligation of reporting has been extended to most of the companies but a space has been given for exceptions. Some of the major exceptions are

- an issuer of a class of securities registered under Securities Exchange Act, 1934 or by nature is required to file supplementary and periodic information under the Act. Even brokers or dealers covered under the Act enjoy immunity.

- an entity which is established under US laws or under any laws of a State and such entity exercises governmental authority on behalf of the US

- banks, insurance company, and federal credit union or state credit union.

- a bank holding company or a savings and loan holding company.

- a money transmitting business or an exchange or clearing agency

- an entity that is an investment company or an investment adviser and is registered with the Securities and Exchange Commission.

- Entity that is an insurance producer that is authorized by a State and subject to supervision by the insurance commissioner or agency of State and has an operating presence at a physical office within the USA.

- a registered entity under Commodity Exchange Act

- an entity that is a futures commission merchant, introducing broker, swap dealer, major swap participant, commodity pool operator, or commodity trading advisor, or a retail foreign exchange dealer registered with the Commodity Futures Trading Commission.

- a public accounting firm or a public utility that provides telecommunication serves, electrical power, etc.

- any entity that, operates exclusively to provide financial assistance to, or hold governance rights over, is a US Person as well, and is a beneficial owner or controlled exclusively by 1 or more US persons that are US citizens or lawfully admitted for permanent resident and at the same time derives at least a majority of its funding or revenue from 1 or more US persons that US citizens or permanent residents.

- any entity that employs more than 20 employees on a full-time basis in the US, filed tax returns more than $5,000,000 in gross receipts or sales in aggregate in the previous year and has an operating presence at a physical office within the US

- entities which are in existence for 1 year but has not engaged in active business and has not been owned, directly or indirectly, by a foreign person. Moreover, in such cases, there should not be a change in ownership in the last 12 months and there should not be holding of any kind of assets, including an ownership interest in the corporation.

So excluding this wide pool of exceptions, other companies and entities are bound to disclose information regarding the beneficial ownership if any.

Safeguards and other aspects in dealing with reporting information

Although the information has to be provided by the reporting company, the U.S. Congress has made this fundamental by directing that while providing information for the reporting of beneficial ownership, the Secretary shall to the greatest extent has to seek to minimize burdens on reporting companies and at the same time provide clarity to the reporting companies in the identification of their beneficial owners.4 It has been made clear that any information collected from the reporting company shall be maintained at least for 5 years.

Another important aspect provided in the Act is the provision of Prohibition of Disclosure which states that the information reported will be confidential in nature and cannot be disclosed by any person except as per the disclosure provision which provides a strict scope according to which such information can only be shared. Some of the important disclosing situations include request made by Federal agency engaged in national security, intelligence or other law enforcement agencies or if the competent court has authorized any agency of State to seek such information. Failure to protect the information and disclosing it without following the proper protocol can lead to civil as well as criminal penalties.

Penalties for non-compliance

Under the Act, those persons who either provide false or fraudulent information on beneficial ownership or willfully fail to report complete or updated beneficial ownership may have to face criminal as well as civil penalties. Such persons have to face a civil penalty of a maximum of $500 every day till the violation is not remedied and shall also be liable for imprisonment up to 2 years. Similarly, in those case where the person who has received the disclosed information unauthorized and knowingly discloses or knowingly use the beneficial ownership information shall be liable to a fine of up to $500 per day and imprisonment to the maximum period of 5 years.

Conclusion

This Act can set a precedent for other countries to ensure stringent compliance with the anti-money laundering framework in order to reduce the rising and panicking situation of organized crimes as it is an international risk where every state is under security threat even if only one state is facing such problem. It is an urgent need that such laws should be brought into force however, it is necessary to understand that the ease of business is also to be maintained and unnecessary hurdles and restrictions cannot be created for foreign companies as it will lead to national treatment and unfavorable treatment to foreign entities.5

Thus, risk should be properly analyzed and laws should be created to mitigate the same keeping in mind that it should not cause trouble to unrelated persons. Also, the laws have to be elaborative and should not provide any position of ambiguity. This measure of U.S. is a positive step towards the international fight against economic crimes and terror financing and therefore, this Act if brought in proper compliance can result in accumulating important data which may, as a result, provide a steady decrease in money-laundering, and other financing crimes in the U.S. and other jurisdictions as well through a rippling effect.

References