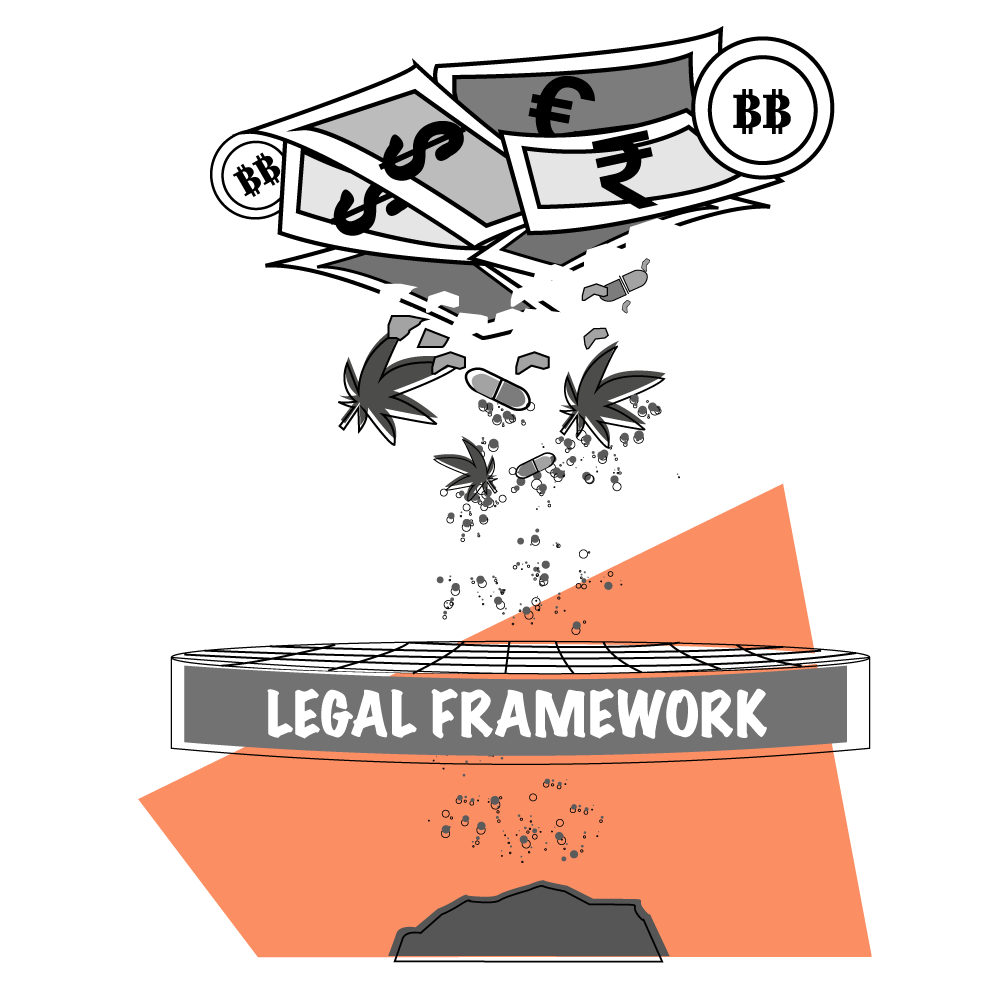

The Offence of Money Laundering & The Legal Framework Around the World

All over the world, the problem of money laundering has now become a matter of concern because of the rise in transnational organized crimes. The money that is laundered is used to conspire, prepare, attempt, and commit offences that directly threaten the sovereignty and security of the state. Annually, 2 to 5 percent of global GDP ($800 billion- $2 trillion) is the estimated amount of money that is laundered.1 Article 3.1 of the UN Convention against illicit traffic in narcotic drugs and psychotropic substances, 1988, has addressed the concern of Money Laundering by articulating that-

“the conversion or transfer of property, knowing that such property is derived from any offense(s), for the purpose of concealing or disguising the illicit origin of the property or of assisting any person who is involved in such offense(s) to evade the legal consequences of his actions”.

Similarly, the UN Convention against Transnational Organized Crime, 2000 has significantly dealt with the problem of money laundering and has recognized a need to have a strong front against the rising trends of such crimes. For example, Article 6 of the convention deals with the criminalization of the laundering of proceeds of crime. Under this Article, it is provided that the State Party should adopt legislative and other measures which are required to make this act of laundering of proceeds of a crime a criminal offence when committed intentionally. The Article also provides for certain acts that are ancillary to the subject matter of the offence which is also required to be criminalized.2 Further, Article 7 deals with measures to combat money laundering. With the aid of this Article, State Parties have been asked to take certain measures which shall act as an efficient framework to tackle the menace of money-laundering feasibility3 Similarly, the Political Declaration adopted by the Special Session of the United Nations General Assembly held from 8th to 10th June 19984 also calls upon the Member States to adopt national money-laundering legislation and programme.

Globally, different countries have taken measures in lieu of tackling the problem of money laundering. The need of having stringent provisions to battle against the menace has been recognized by the countries and in regard to the same, several countries have drafted strict laws that penalize the offence of money laundering and certain acts that are related to it.

UK

In the United Kingdom, the Proceeds of Crime Act, 2002 as amended by the Serious Crimes Act, 2015, provides for the legislative scheme that deals with the recovery of criminal assets and further provides for criminal confiscation and recovery of proceeds of crime either in a criminal manner like conviction or by a civil mechanism like civil recovery, cash seizure and taxation powers. The idea of this Act is to promote asset recovery schemes whereby criminals are stopped to use assets that are derived from the proceeds of crime. The law also aims to disrupt and deter criminality. Moreover, the Act also emphasizes and provides numerous investigative powers including search and seizure powers, power to apply for production orders, disclosure orders, etc.5

Till now, a large number of criminal assets have already been seized through different recovery methods under this Act. Further, several freezing orders have also been passed so as to restrain the usage of the same. Part 7 of the said act in detail deals with the offence of Money Laundering and what all aspects constitute the same offence. Further, the Part also provides some of the exceptions that are available. In addition to this Act, there is the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 20176 which ensures a strong framework for the UK’s anti-money laundering regime. The Regulations further implement different suggestions and recommendations of the Financial Action Task Force and the EU’s Fourth Money Laundering Directive7 that deals with preventing the misuse of the financial system to keep fraud and terror financing at bay.8

USA

The USA is one of the first countries where money laundering was recognized as a penal offence. In the USA, money laundering has been criminalized in the year 1986 through Money Laundering Control Act, 1986 where money laundering was made punishable under 18 United States Code, Section 1956 and Section 19579 The intent was to make the hiding and reinvestment of illegal profit made from a criminal enterprise into a new federal offence. These provisions prohibit an individual from engaging in a financial transaction with proceeds that were generated as a result of an offence as specifically mentioned. This offence is considered a serious offence in the USA and its violation can result in a sentence of up to 10 to 20 years of prison term.10

Additionally, the Bank Secrecy Act is another U.S. legislation that is enacted with the objective of preventing criminals from using financial institutions to hide or launder money by providing law that deals with strict compliance obligations. This law mandates financial institutions to assist U.S. government agencies to detect and prevent the proceeds of crime and any act related to money laundering. It directs the financial institutions to keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 and to further report any apprehensive activity which may signal money laundering.

India

In India, the Prevention of Money Laundering Act, 2002 is the law of land to deal with the prevention of money laundering and to provide for confiscation of property which is derived from the offence of money laundering or was involved in the same. Under the Act, money laundering has been defined and made punishable under Section 3 wherein it has been stated that-

Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the 1 [proceeds of crime including its concealment, possession, acquisition or use and projecting or claiming] it as untainted property shall be guilty of offence of money-laundering.

For the removal of doubts, it is hereby clarified that,—

(i) a person shall be guilty of offence of money-laundering if such person is found to have directly or indirectly attempted to indulge or knowingly assisted or knowingly is a party or is actually involved in one or more of the following processes or activities connected with proceeds of crime, namely:—

(a) concealment; or

(b) possession; or

(c) acquisition; or

(d) use; or

(e) projecting as untainted property; or

(f) claiming as untainted property,

in any manner whatsoever;

The punishment of money laundering is provided under Section 4 of the Act wherein the offence is made punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years (and ten years in certain cases) and shall also be liable to fine. The Act also provides for attachment of property involved in money-laundering and further also deals with the power of summons, searches, seizures, arrests etc. Moreover, a specialized law enforcement agency that is Directorate of Enforcement has also been mandated to be an agency responsible for enforcing the provisions of this law.

Although, globally the domestic framework has been carved out to mitigate and eliminate the problem of money laundering crime, nevertheless, the measures at present seem to be less effective practically. Such laws are failing to create a deterrent effect on criminals. Moreover, technology is adding another issue of concern as it is escalating the rate of crime by opening new gates to criminal activities. It is required that global actions through stricter conventions should be introduced wherein the States are bound to come up with an exhaustive framework that is effective and has a deterrent effect so as to reduce the crime occurrence and reoccurrence rate.

References

| ↑1 | https://www.unodc.org/unodc/en/money-laundering/overview.html. |

| ↑2, ↑3 | https://www.unodc.org/documents/middleeastandnorthafrica/organised-crime/UNITED_NATIONS_CONVENTION_AGAINST_TRANSNATIONAL_ORGANIZED_CRIME_AND_THE_PROTOCOLS_THERETO.pdf. |

| ↑4 | https://www.unodc.org/documents/commissions/CND/Political_Declaration/Political_Declaration_1998/1998-Political-Declaration_A-RES-S-20-2.pdf. |

| ↑5 | https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/317904/Fact_Sheet_-_Overview_of_POCA__2_.pdf. |

| ↑6 | https://www.legislation.gov.uk/uksi/2017/692/pdfs/uksi_20170692_en.pdf. |

| ↑7 | https://www.ifa.org.uk/technical-resources/aml/uk-law-and-guidance. |

| ↑8 | https://www.tcs.com/blogs/6th-anti-money-laundering-directive. |

| ↑9 | https://www.law.cornell.edu/uscode/text/18/1956. |

| ↑10 | https://www.pagepate.com/experience/criminal-defense/federal-crimes/federal-money-laundering/. |