Alternative statutory remedy under SARFAESI Act

In the Supreme Court of India

Civil appellate jurisdiction

Civil appeal nos. 7402 of 2022

(@ SLP (civil) no. 14695 of 2020)

K. Sreedhar ……………. Appellant(s)

Vs

M/s Raus Constructions Pvt. Ltd. & ors. ………………. Respondent(s)

with Civil appeal nos. 7404 of 2022 (@ SLP (Civil) no. 13508 of 2020)

In January 2023, a Division Bench of the Hon’ble Supreme Court passed an important judgement relating to alternative statutory remedy and agricultural lands exemption under the SARFAESI Act. A look at the highlights of the judgment:

Facts

- In 2012, M/s Raus Construction Private Limited (“RCPL”) availed credit facilities / financial assistance from Indian Bank (“Bank”). Due to default in repayment, the account was classified as Non-performing Asset (“NPA”).

- The Bank initiated recovery proceedings under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (“SARFAESI Act”). The Bank issued demand notice for repayment to concerned parties. When no payment was made, they issued notice / possession notice for 12 properties of RCPL. The possession notice was published in newspapers.

- Of the 12 secured properties of RCPL mortgaged to the Bank, property in item No.8 was put to auction through e-auction on 28.03.2016. RCPL filed a writ petition in the High Court praying for stay on all proceedings including e-auction under the SARFAESI Act till the disposal of case filed before the Debt recovery Tribunal, Hyderabad (DRT-I). The said writ petition was dismissed by the High Court, Telangana.

- A fresh e-auction notice was issued for property in item No. 8 which was conducted on 17.02.2017. Mr. K Sreedhar was declared the successful bidder / auction purchaser. He deposited 25% of the amount of sale consideration on 18.02.2017. The sale in favour of K Sreedhar was confirmed on 08.03.2017. On deposit of the entire /full sale consideration, the sale certificate was issued in favour of K Sreedhar on 23.03.2017.

- RCPL filed a case before the DRT-I, Hyderabad. The case filed by them before the DRT-I related to the fact that the property in item No. 8 was agricultural land and therefore could not be auctioned under the SARFAESI Act.

On 16.05.2019, the DRT-I, Hyderabad dismissed the case filed by RCPL on the ground that RCPL did not present any evidence that the land was agricultural land and there was any agricultural activity going on in the land mortgaged to the Bank. On the contrary the Bank, presented evidence showing no agricultural activities being carried on. Therefore, the property in item No. 8 was not agricultural land and hence not exempted under the SARFAESI Act. - Aggrieved by the order of the DRT-I, RCPL filed a writ petition under Article 226/227 of the Constitution before the High Court praying for the order passed by the DRT-I to be set aside. The High Court set aside the order passed by the DRT-I including e-auction notice, possession notice, sale of property in item No. 8 to K Sreedhar. The High Court set aside the DRT-I order on grounds of non- compliance of Rule 9(4) of the Security Interest (Enforcement) Rules, 2002 relating to deposit of sale amount within the time stipulated therein. Further, the property in item No. 8 was agricultural land and hence could not be auctioned.

- Aggrieved by the order of the High Court, the Bank and K Sreedhar have appealed before the Hon’ble Supreme Court.

Contention / submission

RCPL (Debtor / borrower)

Counsel for RCPL submitted that the order of the High Court setting aside the order of the DRT-I was justified on the ground(s) that:

- There was breach of Rules 8(1), (2), 9(4) of the Security Interest (Enforcement) Rules, 2002 and Section 13(4) of the SARFAESI Act as there was delay in depositing the sale consideration amount by K Sreedhar within the time period stipulated the Rules.

- The property in item No. 8 of the 12 secured properties mortgaged to the Bank was indeed an agricultural land. The revenue records of the said property shows it as agricultural land. Hence the said property was exempted from SARFAESI Act and consequently, the auction of the said property was set aside.

Indian Bank and K Sreedhar (Secured creditor and auction purchaser)

Counsel for parties submitted that the High Court erred in setting aside the order passed by the DRT-I on the ground(s) that:

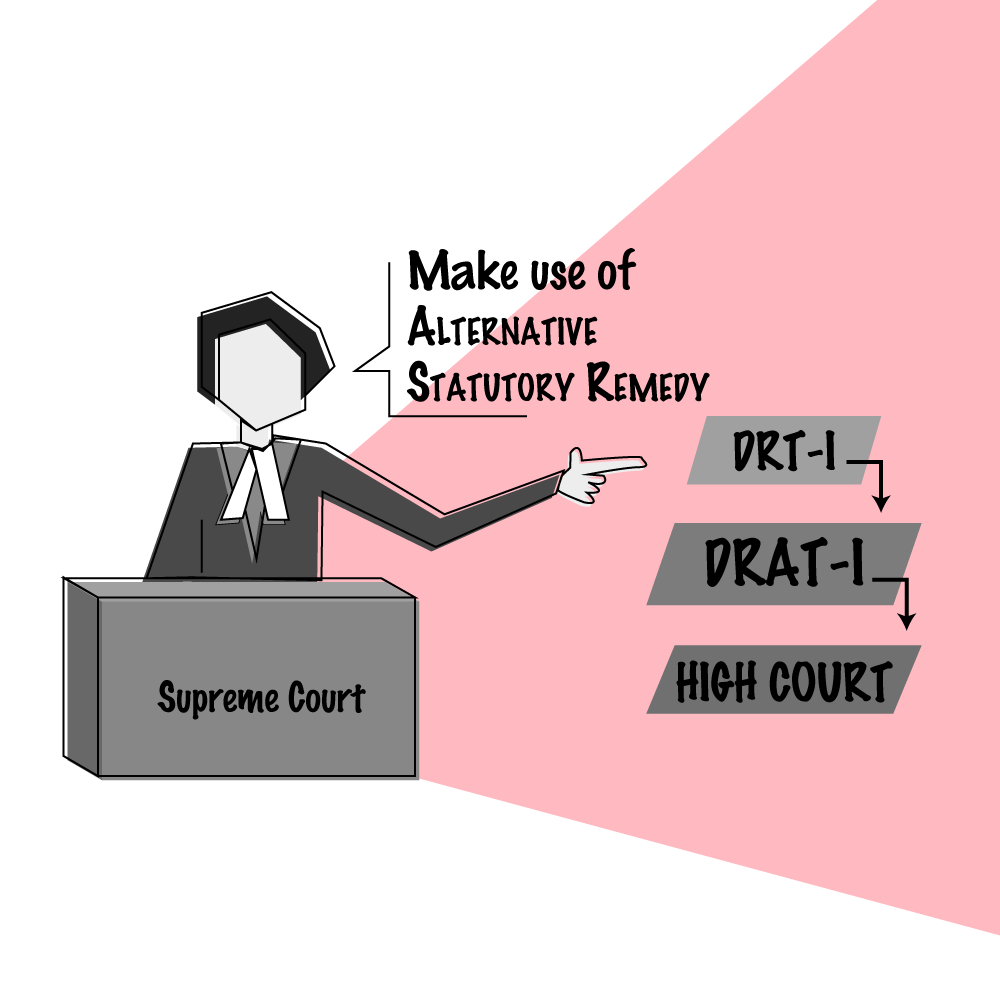

- In 2019, when the DRT-I dismissed the petition filed by RCPL, the company had the option of preferring an appeal before the Debts recovery appellate tribunal (“DRAT”). However, RCPL did not appeal before the DRAT. Instead it straightaway filed a writ petition before the High Court. This was done only to avoid the payment of pre-deposit amount before the DRAT. This ought not to have been entertained by the High Court when an alternate statutory remedy was available under the SARFAESI Act.

- The 2016 amendment of Rule 9(3) of the said Rules was not considered by the High Court. As per the amendment, 25% of the payment could be made on the same day or within the next day of auction. In this case, payment of 25% made by K Sreedhar on the next day of the auction. The remaining payment was also made within the stipulated time and hence K Sreedhar was issued the sale certificate after which it was registered, and the possession of property handed over to him.

- The scheduled properties were not actually used for agricultural purposes. RCPL did not submit any evidence of undertaking agricultural activities on the said properties. On the other hand, the Bank filed photographs to show no agricultural activities were taking place. therefore, they could not be considered as agricultural properties and hence not exempted under the SARFAESI Act. Judgments passed in cases – (i) ITC Limited vs. Blue Coast Hotels Limited and Others reported in (2018) 15 SCC 99 (Para 36) and (ii) Indian Bank and Another vs. K. Pappireddiyar and Another reported in (2018) 18 SCC 252 (Paras 7 & 8) were considered.

Analysis / Judgment

Based on the submissions made, the Division Bench of the Hon’ble Apex Court was of the view that:

- RCPL (borrower) had an alternative statutory remedy by way of an appeal before the DRAT. Instead, it chose to straightaway file a writ petition under Article 226/227 of the Constitution. The High Court ought not to have entertained the writ petition straight away under Article 226/227 of the Constitution when an alternative statutory remedy was available before the DRAT as that amounted to allowing RCPL (borrower) to circumvent the provision involving the pre-deposit of 25% of the debt amount.

- The possession notice required under Rules 8(1) & (2) of the said Rules was duly published in newspapers and served on concerned parties. The payment of amounts by the auction purchaser K Sreedhar as required under Rule 9(4) of the said Rules was done within the time stipulated under the provisions and amendments. Therefore, there was no breach of said Rules. The High Court did not take this into consideration.

- The High Court considered that the scheduled properties were agricultural lands based on revenue records, pattadar books and hence exempted them from the SARFAESI Act. The High Court did not consider the fact that merely because in the revenue records the secured properties are shown as agricultural land, it is not sufficient to attract exemption under the SARFAESI Act. Section 31(i) of the SARFAESI Act states that for the purpose of attracting Section 31(i) of the SARFAESI Act, the properties in question ought to be actually used as agricultural lands at the time when the security interest was created. In this case, RCPL did not provide any evidence to show agricultural activity on the said property. On the other hand, the Bank provided by photographic evidence that no agricultural activity was carried out on the property. Further, the High Court seemed to have shifted the burden of proof on the Bank (secured creditor) when the burden of proof (to show the lands as agricultural lands) was actually on RCPL (borrower)

Accordingly, the Hon’ble Supreme Court set aside the order of the High Court and restored the order passed by the DRT-I.

For full text of Order

https://main.sci.gov.in/judgments/ 26112_2020_4_1502_40734_Judgement_05-Jan-2023