Applicability of Section 138 NI Act 1881 for part payment made after cheque is drawn and before being encashed

Applicability of Section 138 NI Act 1881 for part payment made after cheque is drawn and before being encashed

In the Supreme Court of India (Criminal Appellate jurisdiction)

Criminal appeal No. 1497 of 2022

Dashrathbhai Trikambhai Patel …Appellant

Vs

Hitesh Mahendrabhai Patel & Anr. …Respondents

On 11th October 2022, a Division Bench of the Supreme Court dealt with the issue of whether the offence under Section 138 of the Act would deem to be committed if the cheque that is dishonoured does not represent the enforceable debt at the time of encashment. A look at the highlights of the case:

Facts

- Dashrathbhai (“Dashrath”) and Hitesh Mahendrabhai (“Hitesh”) are related. On 16th January 2012 Hitesh borrowed a sum of Rs. 20 lakhs from Dashrath. To discharge the liability, Hitesh issued a cheque dated 17th March 2014 for the said sum.

- When Dashrath presented the cheque in the bank, it was dishonoured due to lack of sufficient funds. Dashrath issued a notice to Hitesh asking for pay the legally enforceable sum of Rs. 20 lakhs. However, Hitesh did not pay the amount.

- On 12th May 2014, Dashrath filed a criminal complaint against Hitesh us/ 138 of the Negotiable instruments Act 1881 in the Trial court. (“NI Act”).

- On 30th August 2016, the Trial acquitted Hitesh of the offence u/s 138 of the NI Act on the ground that Hitesh paid a part payment of Rs. 4,09,315 to Dashrath thereby partly discharging his liability in respect of the debt of Rs. 20 lakhs. The sum of Rs. 4,09,315 was paid in tranches between 18th April 2012 and 30th December 2013.

- Dashrath filed an appeal against the Trial court order before the High court of Gujarat. On 12th January 2022, the Gujarat HC dismissed the appeal filed by Dashrath and upheld the order passed by the Trial court on the ground that part of the debt owed by Hitech to Dashrath was discharged and hence demand notice u/s 138 of the NI Act was not valid. Aggrieved, Dashrath filed an appeal before the Supreme Court.

Contention(s)

Dashrath (Appellant)

The payment of Rs. 4,09,315 was made by Hitesh before issuance of cheque as security (17th March 2014). Hitesh did not make any payment due since the demand notice was served on him in April 2014. Hence offence u/s 138 of the NI Act is attracted.

Hitesh (Respondent)

Since part payment of Rs. 4,09,315 was made to Dashrath, he cannot initiate action u/s 138 of the NI Act if the cheque contained the entire principal amount (of Rs. 20 lakhs in this case) without deducting or endorsing part payment has been dishonoured. Offence under Section 138 was not committed since the amount that was payable to Dashrath, as on the date the cheque was presented for encashment, was less than the amount that was represented in the cheque.

Issue

Whether the offence under Section 138 of the Act would deem to be committed if the cheque that is dishonoured does not represent the enforceable debt at the time of encashment.

Analysis / Observation by the SC

The Apex court considered several precedents –(i) Indus Airways Private Limited v. Magnum Aviation Private Limited [(2014) 12 SCC 539], (ii) Sunil Todi v. State of Gujarat [Criminal Appeal No. 1446 of 2021], (iii) Sampelly Satyanarayana Rao v. Indian Renewable Energy Development Agency Limited [(2016) 10 SCC 458] (iv) NEPC Micon Ltd. v. Magna Leasing Ltd. [AIR 1995 SC 1952].

Based on the precedents, the SC observed the following:

- For a cheque dishonour to be considered an offence u/s 138 of the NI Act, the cheque that is dishonoured must represent a legally enforceable debt on the date of maturity or presentation.

- If the drawer of the cheque (i.e, one who issues the cheque) pays whole or part of the amount between the period when the cheque is drawn and when it is encashed on maturity, then the legally enforceable debt would not be the amount represented on the cheque. In this case the cheque was issued for a sum of Rs. 20 lakhs. However, a part payment of Rs. 4,09,315 was made before the encashing of the cheque on maturity. Hence the legally enforceable debt amount would not Rs. 20 lakhs (as contained in the cheque). It would be the total amount reduced by the part payment made.

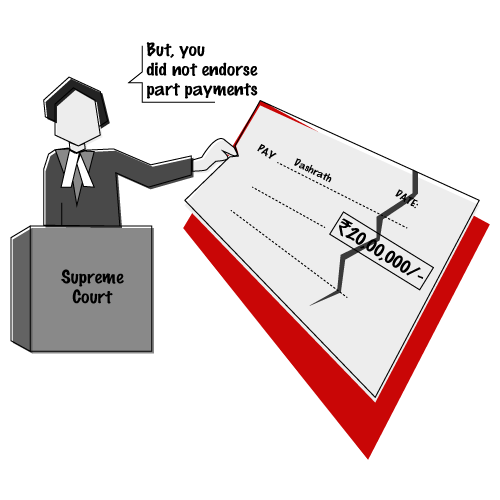

- When part or whole of the amount contained in the cheque is paid by the drawer of the cheque, it must be endorsed on the cheque in the manner prescribed u/s 56 of the NI Act. Such a cheque (with an endorsement made on it for part payment) may be used to negotiate the balance amount, if any. If the cheque that is endorsed is dishonoured, on encashment upon maturity, then offence u/s 138 of the NI Act will be attracted.

Based on the above observations / analysis, the Supreme Court held in this case that:

Hitesh made part payments (of Rs. 4,09,315) after incurring the debt of Rs. 20 lakhs and before the cheque was encashed upon maturity. Hence the sum of Rs. 20 lakhs contained on the cheque would not be considered ‘legally enforceable debt’ on the date of maturity. Therefore, Hitesh cannot be deemed to have committed an offence u/s 138 of the NI Act when it was dishonoured due to insufficient funds. This is because the demand notice u/s 138 of the NI Act of the ‘said money’ is interpreted by courts to mean the cheque amount – Suman Sethi Vs Ajay K Churiwal [(2000) 2 SCC 38] and conditions u/s 138 must be fulfilled. Since in this case Hitesh made part payment and the same was not endorsed on the cheque encashed upon maturity, provisions of sections 138 and 56 of the NI Act were not complied with. Hence it was considered that Hitesh did not commit an offence us 138. Consequently, there was not necessity to decide on the form of notice. Therefore, the appeal against the order of the High Court was dismissed by the Supreme Court.