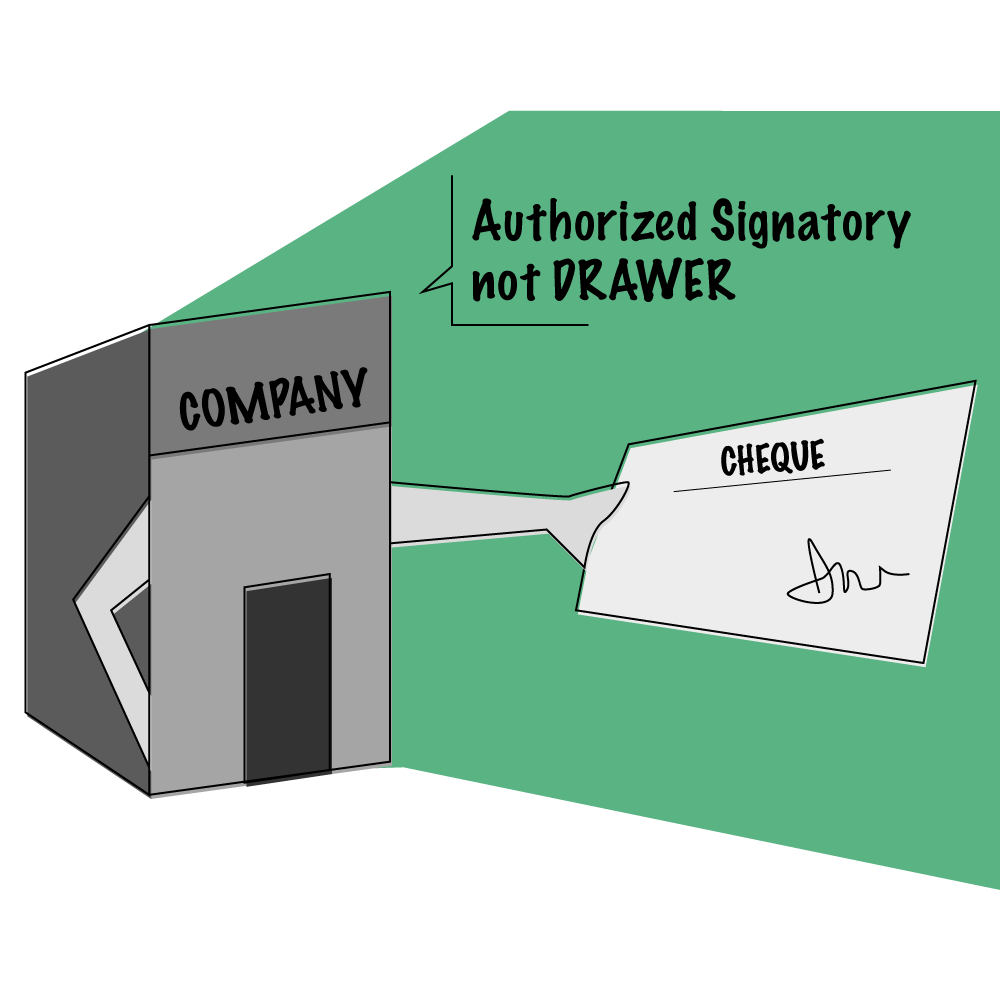

Authorized Signatory not ‘Drawer’

IN THE HIGH COURT OF JUDICATURE AT BOMBAY

Criminal Appellate Jurisdiction

Criminal Application No.886 of 2022

Lyka Labs Limited & Anr ………Applicants

Vs

The State of Maharashtra & Anr …… Respondents

with

Writ petition No.201 of 2022, Writ petition No.1250 of 2022, Criminal application No.240 of 2021, Writ petition No.4128 of 2021, Writ petition No.2075 of 2022, Writ petition No.3443 of 2022, Criminal application No.967 of 2022, Criminal application No.1205 of 2022, Criminal application No.1208 of 2022, Criminal application No.1207 of 2022, Writ petition No.2644 of 2022 and Writ petition no.4455 of 2022, Writ petition No.4576 of 2022

Latest

While passing a consolidated judgment on a batch of cases with common issues, the Bombay High Court decided on important questions of law. A look at the highlights of the case:

Issue of law

- Whether the signatory of the cheque, authorized by the Company, is the “drawer” and whether such signatory could be directed to pay interim compensation in terms of section 143A of the Negotiable Instruments Act, 1881 (“NI Act”) leaving aside the company?

- Whether a deposit of a minimum sum of 20% of the fine or compensation is necessary under Section 148 of NI Act in an appeal filed by persons other than “drawer” against the conviction and sentence under section 138 of the NI Act?

Simplifying key provisions of the NI Act

- Section 7 of the NI Act states that the maker of a cheque or bill of exchange is called the “drawer”. “Drawer” is a person who draws an instrument in writing.

- Section 138 of the NI Act states that where any cheque made by a person (drawer) on a bank account maintained by him is returned by the Bank on ground of insufficiency of funds in the said bank account, such person shall be deemed to have committed an offence and shall, liable to be punished with imprisonment for or fine or both. The cheque must have been returned on specific grounds and subject to certain conditions.

- Section 141 of the NI Act states that if the person committing an offence under Section 138 is a company, every person who, at the time of committing the offence was in charge of and responsible for the conduct of the business of the company, as well as the company, shall be deemed to be guilty of the offence and shall be liable punished accordingly.

- Section 143A of the NI Act states that the court trying a section 138 offence may order the drawer of the cheque to pay interim compensation to the complainant either in a summary trial pleading not guilty or other cases where charges are framed provided such interim compensation does not exceed 20% of the amount of the cheque subject to certain conditions.

- Section 148 of the NI Act states that the appellate court has power to order payment pending appeal against conviction a sum of minimum of 20% of the fine or compensation awarded by the trial court.

Analysis

- A plain reading of section 138 of the NI Act states that “where a cheque drawn by a person on an account maintained by him”. To attract liability under section 138, it is a precondition that a cheque must be drawn on an account maintained by the drawer. The person contemplated in the section can be an individual or legal entity. The principal liability is imposed on the drawer. Section 141 states that for any offence under section 138 of the NI Act the company and all its officers are vicariously liable.

- As per section 143A of the NI Act, the trial court is empowered to order the drawer to pay interim compensation to the complainant pending appeal. The section clearly states that the liability to pay interim compensation is on the “drawer” / issuer of the cheque. All others are excluded. Drawer alone would be liable u/s 143A. The section clearly spells out the intention of the parliament by resorting to the golden rule of interpretation- that a statute must be read plainly to arrive at its meaning. Principal offender under Section 138 in case cheque issued by the company is the drawer (company). Drawer alone would have been the offender thereunder if the Act did not contain section 141. By virtue of Section 141 of the Act that penal liability under Section 138 is cast on other persons connected with the company. Therefore, there is no need to interpret the word ‘drawer’ to include authorized signatory.

- Sections 143A and 148 were enacted in the year 2018. This was much after the enactment of the Insolvency and Bankruptcy Code, 2016 (IBC). Therefore, at the time of bringing section 143A into force, the legislature was aware that drawer companies could not be made to pay interim compensation in light of the moratorium imposed by section 14 of IBC on companies undergoing a insolvency resolution process.

- To interpret ‘Drawer’ to include ‘authorised signatory’ would amount to violation of the fundamental principle of interpretation which prohibits cutting out inter-related portions of the same statute, tearing them from their context and construing them as stripped of their relation to each other or to the whole.

- Since it has been settled that ‘drawer’ does not include ‘authorized signatory’ for a company, section 148 needs to be interpreted to mean that such power to direct compensation is conferred on the Appellate Court only in an appeal filed by the drawer against the conviction under section 138 of the Act.

Judgment

Based on the above, the Court held that:

- The signatory of the cheque, authorized by the “Company”, is not the drawer in terms of section 143A of the NI Act and cannot be directed to pay interim compensation under section 143A.

- In an appeal under section 148 of NI Act filed by persons other than “drawer” against the conviction under section 138 of the NI Act, a deposit of a minimum sum of 20% of the fine or compensation is not necessary.

For full text of Order