Bank Liable for Burglary and Theft from Locker

National Consumer Disputes Redressal Commission, New Delhi

First appeal No. 382 of 2020

State Bank of India

Bokaro Steel City branch

Jharkhand …………….. Appellants

Vs

Gopal Prasad Mahanty & another

Jharkhand …………….. Respondent

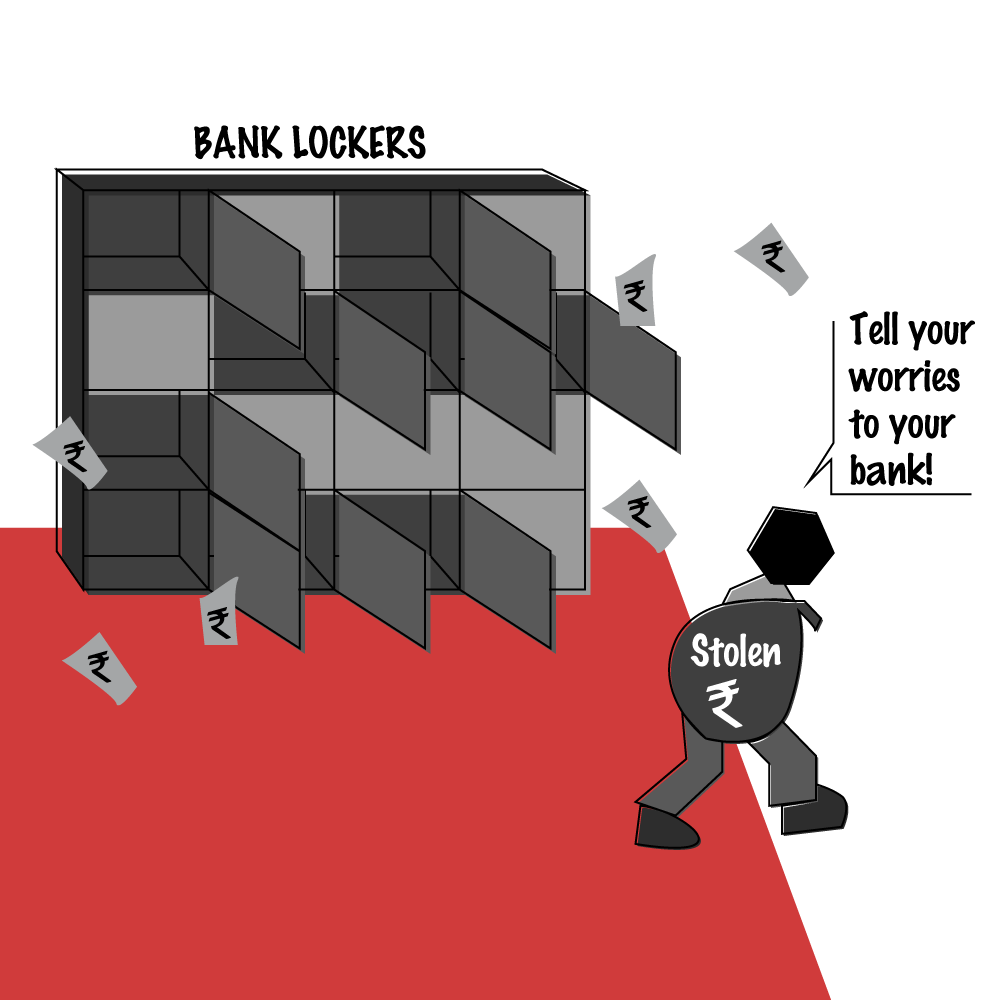

In August 2022, the Supreme Court upheld an order passed by the National consumer dispute redressal commission holding the Bank liable (to its customers) for burglary, break in or theft from locker of its customers. A look at the highlights of the case.

Facts of the case

- Gopal Prasad Mohanty (‘Gopal’) and his daughter Rupali Mohanty (‘Rupali) had savings account and several high value fixed deposits for almost 4 decades with State Bank of India (‘Bank’), Bokaro Steel City branch, Jharkhand.

- A theft took place on the midnight of 25th December 2017 in the bank. Thieves had stolen and taken away jewellery, postal deposit lockers and other valuables of customers from safety deposit lockers of the bank.

- Gopal had come to know of this through news media and rushed to the bank. He came to know that his safety deposit locker was one among those that were burgled.

- Gopal alleged that the Bank did not follow the RBI guidelines for safety and security and hence alleged there was deficiency in service provided by the Bank. He filed a complaint against the Bank in the State consumer dispute redressal commission (‘SCDRC’) seeking compensation of Rs. 34.20 lakhs along with interest @ 15% p.a.

Contention(s) of parties and observations by the Commission(s)

SCDRC

- Before the SCDRC the Bank submitted that it had duly followed the RBI guidelines and had installed fire detection alarm system, security alarm system, CCTV cameras and digital video recorders (DRVs) both inside and outside the bank branch premises. However, the same were neutralized by the thieves and some equipment were stolen as well. The SCDRC took note of the fact that Gopal suffered substantial loss. Therefore, to compensate for the mental trauma and agony suffered by Gopal and his family the State commission ordered a lumpsum compensation of Rs. 30 lakhs to be paid within a stipulated time failing which interest @ 6% p.a shall be additionally paid by the bank. The SCDRC passed the said order on 31.01.2020.

Aggrieved by the SCDRC order dated 31st January 2020, both parties filed cross appeals before the National Consumer dispute redressal commission (NCDRC) – Gopal filed an appeal for enhancing the compensation while the Bank filed an appeal for setting aside the SCDRD order.

NCDRC

- Before the NCDRC the counsel for the Bank submitted that there were enough safety precautions / measures taken by the Bank. Further, most of the stolen goods were recovered from the thieves. Hence the compensation be set aside. However, Gopal submitted that there was very little recovery of items from the stolen goods. Most of it was distorted and melted and converted into gold biscuits. As a result, Gopal could recover very less amount of his valuables.

- The NCDRC observed that the very purpose for which a customer avails bank locker facility is to rest assured that their assets are safe and properly being taken care of. When the bank fails to do so, it amounts to deficiency in service and the aggrieved customer must be suitably compensated. On these grounds, the NCDRC passed an order dated 7th April 2022 upholding the order passed by the SCDRC and dismissing all appeals.Aggrieved by the NCDRC order, the Bank filed a Special Leave petition before the Hon’ble Supreme Court of India. The Apex court also concurred with the observations of the NCDRC upheld the order passed by it. The SC held the bank liable based on facts and circumstances in the present case. Thus, the question of law on whether a bank could be held liable to compensate for customers in the event of burglary or theft was kept open.