Computation for Rs.1 Crore Minimum Threshold Under IBC

NCLT Delhi Bench II

(IB)-797(ND)2021

CBRE SOUTH ASIA PRIVATE LIMITED …………… Applicant

Vs

M/s UNITED CONCEPTS AND SOLUTIONS PRIVATE LIMITED …. Corporate Debtor

On 19th January 2022, the NCLT Delhi bench held that principal amount and interest amount cannot be clubbed to reach the minimum threshold of Rs. 1 Crore under the IBC 2016, if the debt is an operational debt.

A look at the details of the order passed:

Facts:

- M/s CBRE South Asia Private limited (“CBRE”) is engaged in the business of providing real estate advisory services, facility management, project management consultancy services and related services.

- M/s United Concepts and Solutions Private Limited (“UCAS”) is a private company engaged in the business of construction, office buildings and house realty.

- UCAS hired the services of CBRE in helping find a suitable company or organization that would take one of UCAS property on lease. It was mutually agreed that UCAS would pay CBRE three months’ gross rent plus applicable taxes as service fee.

- Thereafter, CBRE found a company (M/s IDC Technologies) who agreed to take UCAS property on lease. A lease agreement was executed between the lessee (M/s IDC Technologies) and UCAS.

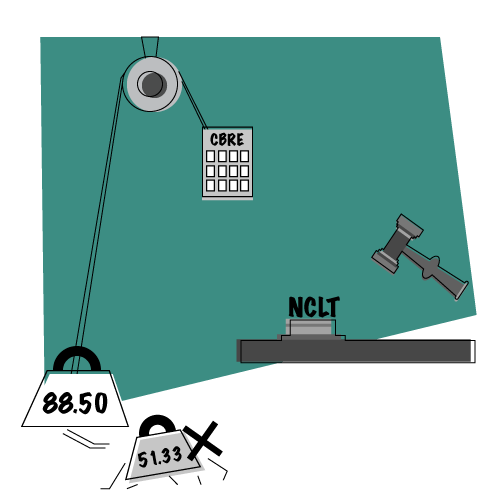

- CBRE raised an invoice on 23rd March 2019 for a sum of Rs. 88.50 lakhs as mutually agreed service fee. Further, the invoice stated that payment would have to be made within 7 days from the date of issue of invoice. Any payment received after due date would be subject to interest @ 2% per month.

- However, UCAS did not make payment to CBRE despite several reminders. On 31st March 2021 CBRE issued notices under u/s 138 Negotiable instruments Act. Despite that no payments were made.

- On 28th August 2021, CBRE issued demand notice u/s 9 of the IBC. As per the Code, UCAS had to reply within 10 days of receipt of the notice. However, UCAS replied after the stipulated period under IBC. Frivolous objections were raised by UCAS.

- On 3rd January 2022, in the course of the preliminary hearing, the NCLT Delhi Bench noticed that the CBRE had claimed a sum of approximately Rs. 1.39 crores as operational debt. Of this amount, Rs. 88.50 lakhs were the principal amount and Rs. 51.33 lakhs were the interest component.

Issue

In the course of deciding admissibility of the case, NCLT Delhi Bench raised a query that since the principal outstanding amount claimed by CBRE as operational creditor was less than Rs. 1 Crore, whether the principal and interest amounts can be clubbed together to reach the minimum threshold amount of Rs. 1 Crore as stipulated under section 4 of the IBC, 2016.

Judgment

In arriving at the decision, the NCLT Delhi Bench observed that:

- Application u/s 9 of the IBC can be filed only on occurrence of “default”.

a. “Default” means non-payment of whole or part of an amount of “debt” that was due and payable and has not been paid.

b. “Debt” means a liability or obligations in respect of a “claim” which is due from any person and includes financial debt and operational debt.

c. “Claim” is a right to payment irrespective of whether it is disputes, undisputed, legal or equitable; right to remedy for breach of contract if such breach gives rise to payment.

d. Since “claim” is common to both “operational” debt and “financial” debt, it is imperative to look into the definitions of operational and financial debt.

e. “Operational debt” means a claim in respect of the provision of goods or services including employment or a debt in respect of the [payment] of dues arising under any law for the time being in force and payable to the Central Government, any State Government or any local authority;”

f. “Financial debt” means a debt along with interest, if any, which is disbursed against the consideration for the time value of money and includes certain components.

g. It can be inferred that “interest” can be claimed as financial debt. However, there is no provision or scope to include “interest” in operational debt. The same was held in M/s. Wanbury Ltd. Vs. M/s. Panacea Biotech Ltd in CP No. 8/2016 dated 18.04.2017 by the NCLT Chandigarh Bench.

Based on the above, the NCLT Delhi Bench held that since the principal amount of operational debt claimed by CBRE is less than Rs. 1 Crore and the application is filed in the year 2021, the application is not maintainable under Section 4 of IBC, 2016 and is accordingly, dismissed.