Conflicting Views by Tribunals

In the National Company Law tribunal, Kochi Bench, Kerala

IBA/35/KOB/2020

M/s Al Sadiq Sweets……… Applicant / Operational Creditor

Vs

M/s Krisenter Impex Private Limited ……Respondent / Corporate Debtor

In February 2021, the Kochi Bench of NCLT Kerala passed an order for admitting an application filed by the operational creditor under the IBC. In the course of the hearing, the Kochi Bench made observations relating to admitting cases where default was less than INR 1 crore as per the Notification dated 24th March 2020.

The stand taken by the Kochi Bench is in contrast to the stand taken on the same issue by the Delhi Bench and Chennai Benches of the NCLT. A look at the facts and findings in the case.

Facts

- M/s Al Sadiq Sweets (“AS”/“Operational Creditor” / “applicant”)is a company registered with the Ministry of Economy & Commerce in Qatar.The company is engaged in the business of restaurants, confectionaries, and trading in nuts.

- In view of the Ramadan festival approaching, Al Sadiq was expecting increased sales of cashew nuts during the month. Hence it placed an order for Cashew nuts with M/s Krisenter Impex Private Limited (“KIPL”/“Operational debtor”/“Respondent”). The said company was a private company incorporated in Kochi, Kerala under the Companies Act 1956, and engaged in the business of supplying cashew nuts.

- AS entered into an agreement with KIPL through WhatsApp for supply of different grades of cashew kernels. A proforma invoice dated 25th November 2019 was raised for an amount of USD 1,44,500. KIPL assured AS that the consignment would reach Qatar within a period of 30 days from the date of advance payment of 70% as per the proforma invoice.

- KIPL confirmed it shall despatch consignment by the first week of January 2020. On 1st January 2020, AS made advance payment of USD 1,00,000. KIPL acknowledged receipt of payment on 3rd January 2020.

- However, the consignment did not reach Qatar within the 30day period. Despite repeated requests / reminders through phone, WhatsApp, the consignment was not delivered despite the huge advance payment.

Submission of Al Sadiq

- On 30th April 2020 AS requested KIPL to return the advance amount. Though KIPL agreed to do so, the amount was not repaid / refunded. The amount of INR 74.87 lakhs remained outstanding till the filing of the application.

- AS served a demand notice to KIPL on 1st August 2020 u/s 8 of the IBC through WhatsApp, email and speed post. KIPL neither made the payment nor raised dispute regarding the existence of debt within 10 days from date of receipt of demand notice.

- Hence AS sought to initiate insolvency proceedings u/s 9 of the IBC.

Contention ofKrisenter Impex Private Limited

KIPL has challenged maintainability of this applicationon the following grounds:

- Application is not maintainable as it does not meet the pecuniary limit for filing application under Section 4 of the IBC.

- The application is not maintainable under Section 10A of Insolvency and Bankruptcy Code, 2016.

- Applicant is not an operational creditor, and the Applicationis liable to be dismissed.

- Pre-existing dispute between the Applicant and Respondent.

Of the above, points (i) &(ii) are the most crucial objectionsraised by KIPL.The Central Government by Notification No. S.0.1205(E) dated 24.03.2020 increased the threshold limit for initiation of CIRP from INR 1 Lakh to INR 1 Crore. KIPL contended that the AS application could not be admitted as it did not meet the minimum amount of default of INR 1 Crore for filing an application under Section 9 of the Code.

KIPL stated that while the increased threshold limit was notified on 24th March 2020, AS filed the applicationon 16th September 2020 which is after the notification. KIPL stated that the total claim of AS was USD 1 Lakh (equivalent to INR 74.87 lakhs). Since this amount is less than INR 1 Crore, the application will not be maintainable.They further stated that initiation of date does not mean the date of default, which is the date when actually the application is filed before this Tribunal.

Counsel for KIPL further stated that the notification is prospective in nature and not retrospective.Hence, no application is maintainable after 24.03.2020 under Part-II of the Code if the minimum amount of default is less than One Crore.Reference was made to the judgment in Pankaj Aggarwal Vs UOI (WPC 3685 of 2020).

Findings by the NCLT Bench, Kochi

The Bench made the following observations:

- Section 4 of the IBC grants delegatory powers to the central government to increase the threshold of the minimum default amount to an amount not exceeding INR 1 Crore. This powerwill not deny the right which had already accrued to an Operational Creditor at the time of default of the debt.

- The notification dated 24th March 2020 increases the minimum amount of default from INR 1 lakh to INR 1 Crore. The Notification was issued by the Central government in order to protect the MSME’s who were impacted due to the Covid pandemic from further being adversely impacted due to litigation.

- In the absence of a clear indication to the contrary in the notification, the substantive rights of individuals to an action are to be decided by law that existed when the action was initiated.

- The Notification dated 24th March 2020 is only ‘prospective in nature’ and not ‘retrospective’ in nature as the said notification does not expressly contain the applicability as ‘retrospective’ one.

- However, the intention of the Notification is not to save the corporate debtors from defaults which took place before the Covid pandemic and resultant financial crisis.Thus, if the intention were to provide for a blanket protection to Corporate Debtors from being dragged to the NCLT irrespective of when or what extent a default has taken place, it would necessarily require a legislative amendment, and that a mere issuance of the notification would not suffice.

- With respect to this case, the Tribunal noted that on 3rd January 2020, KIPL acknowledged receipt of payment and was supposed to have initiated despatch of the consignment. This is the day when cause of action arose. Since this happened prior to the date of notification (24th March 2020), the application will very much be maintainable.

- Section 10 A of the IBC expressly makes it clear that no insolvency proceedings can be instituted against any entity for defaults arising on or after 25th March 2020 upto a maximum period of 25th March 20201. Section 10A suspended institution of insolvency action for a whole period of 1 year. This implies that insolvency proceedings can be initiated for default occurring prior to 24th March 2020.

- Unlike in the Pankaj Aggarwal case supra,in Madhusudan Tantia V. Amit Choraria – Company appeal (AT) Insolvency No. 557 of 2020, the NCLT Kolkata took a divergent view. The tribunal heard arguments on 13th March 2020 for admission of the case. Thereafter due to onset of the Covid pandemic and nationwide lockdown, the government introduced the notification dated 24th March 2020 increasing the minimum default limit from Rs 1 Lakh to Rs. 1 Crore. When the matter was listed again, the NCLT admitted the application. This order was challenged in NCLAT. The appellate tribunal held that the legislative intent was to make it prospective and not retrospective. Application of the notification to pending cases would result in widespread implications and therefore could not be applied to pending applications awaiting admission before the NCLT.

In light of the above, the NCLT Bench, Kochi ruled that the application of Al Sadiq Sweets be admitted as the default amount (though lesser than the amount of INR 1 Crore contained in the Notification) arose prior to the date of Notification dated 24th March 2020.

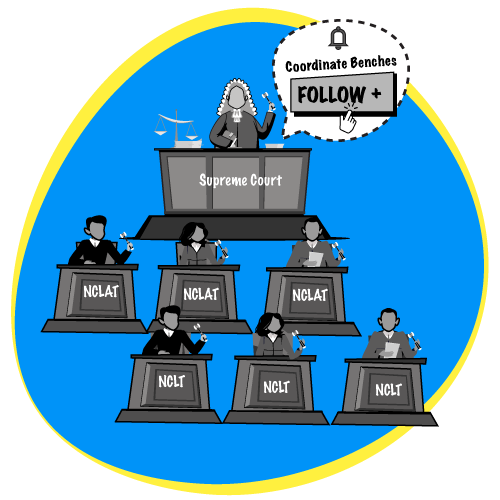

One issue – conflicting views by Tribunals

The Kochi Bench of the NCLT took a view which is contrary to the views taken by the NCLT, New Delhi,in the decision reported in Rakesh Kumar Mediratta Vs. Asian Hotels (North) Ltd case and Chennai NCLT Benches (in the decision reported in the cases M/s Mahaveer Wires Sales Corporation Vs M/s Arempee Compressors Private Limited and JK Food Products Vs Hocaps Facility Management Pvt Ltd, while interpreting the applicability of MCA Circular dated 24th March, 2020.

Emphasis is placed on decision passed by the Hon’ble Supreme Court in RaashmiMetaliks Limited v. Kolkata Metropolitan Development Authority(2013 10 SS 95).The apex court held that if any judgment is passed by a Coordinate Bench in the past, the same should be followed by other Coordinate Benches as well. If any Bench is of the view that judgment passed by a Coordinate Benchin the past needs to be revisited, then such Bench shall refer the case to larger Bench instead of passing judgment inconsistent with the judgement already passed.

In viewment of SC, it is believed that conflicting views being taken by various Benches of NCLT will stand solved in due course of time.

Full text of the Judgment:

https://nclt.gov.in/sites/default/files/January2021/final-orders-pdf/IBA-35-KOB-2020_0.pdf