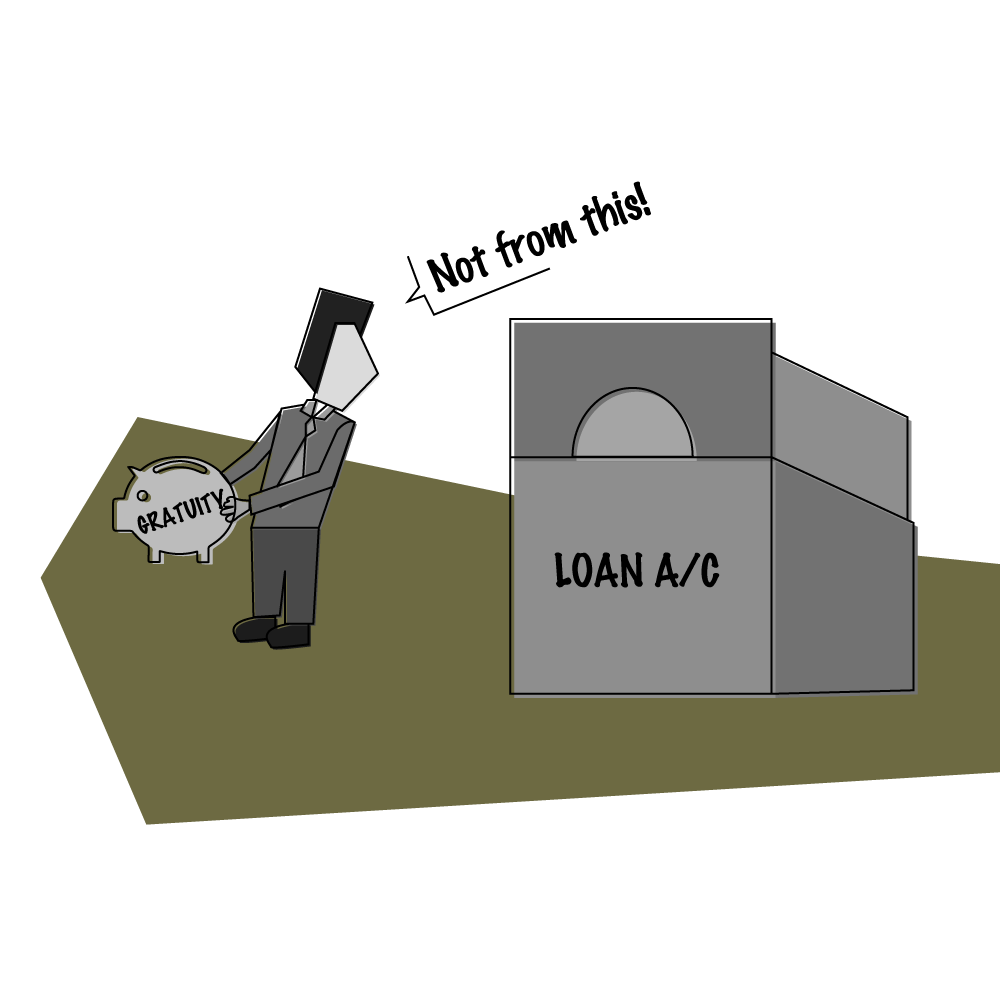

Gratuity of Bank Employees Cannot be Adjusted Towards their Loan Account

The High Court of Karnataka at Bengaluru

Writ Petition No. 11463 of 2020

M/s Canara Bank …………. Petitioner

and

Smt. M. Shantha Kumari ………Respondent

W/o Srimantha. D

Recently, a single Judge Bench of the Karnataka High Court held that the gratuity amount payable to an employee cannot be adjusted towards his loan account. A look at the highlights of the case.

Facts

- Srimantha. D joined Canara Bank as a peon in 1975. He was promoted as a clerk in 1987.

- During his service, Srimantha availed a housing loan which was being repaid from time to time.

- In 2005, disciplinary proceedings were initiated against Srimantha for gross misconduct. On enquiry, the charges of misconduct were proved and consequently punishment of compulsory retirement was imposed on Srimantha in 2006.

- Srimantha filed an appeal against the order. Simultenaously, he raised an industrial dispute before the CGIT, Labour Court. Srimantha expired thereafter and hence his legal heirs – wife Shantha Kumari and children were impleaded in the case. In 2017, they filed an application to Canara Bank for the release of his gratuity fund. That claim was rejected by the Bank.

- Hence Srimantha / Shantha Kumari approached the Controlling Authority (Labour Law) praying for release of his gratuity amount from the Bank. The Bank contended that there dues towards housing loan and staff welfare fund. These dues were adjusted from and out of the gratuity amount and hence no (gratuity) amount was due from the Bank to Srimantha. The Controlling Authority accepted that that adjusting the loan from gratuity is permissible and rejected the application of Srimantha. An appeal was filed before the appellate authority by Shantha Kumari (legal heir of Srimantha). The appellate authority set aside the order of the Controlling authority and directed the Bank to make payment of gratuity along with interest at 10% p.a from the date when it became due till the date of payment. Aggrieved by the order, Canara Bank challenged the order of the appellate authority by preferring a writ petition in the Karnataka High Court.

Contention(s)

The counsel for the Bank argued that the Bank is entitled to adjust the outstanding loan amount towards gratuity payable to the employee. Further, it was contended that interest on gratuity cannot be levied on the Bank. Hence the petition could be allowed.

The counsel for Shantha Kumari, (wife of Srimantha. D) submitted that the order of the appellate authority should be upheld.

Issue

Whether Loan account of an employee can be adjusted towards gratuity amounts?

Analysis /Judgment

- There is special treatment for payment of gratuity both under the Payment of Gratuity Act 1972 and Code of Civil Procedure 1908. Gratuity has been given special protection and treatment.

- Gratuity is paid to safeguard the financial security of a person at the time of retirement. Gratuity amount cannot be attached, or any garnishee order passed.

- In the present case, the Bank sought to adjust dues from Srimantha of staff welfare fund and home loan from his gratuity amount. The staff welfare fund comes within the domain of his service conditions. However, the home loan is completely different. It is a commercial transaction governed by way of (loan) agreement between the Bank and its debtor (Srimantha). Irrespective of whether the debtor is an employee or not, the terms of the loan would govern the said relationship.

- Home loan is governed by the agreement of loan. The Bank must act in terms of the said agreement and accordingly exercise its rights under the agreement with the debtor. The Bank could not have adjusted the home loan amount as against debtor’s gratuity which is protected u/s 7 of the Payment of Gratuity Act 1972. It is this factor that has been considered by the appellate authority while setting aside the controlling authority’s order.

- Regarding the contention on levying interest on delayed gratuity payment to the Bank, the HC noted that the employee made an application for payment of gratuity in 2017 almost 10 years after the 2006 order passed against him for compulsory retirement. The HC observed that the consequent to the compulsory retirement order, Srimantha filed an appeal against such order and simultaneously raised an industrial dispute before the Labour tribunal. If he chose to claim his gratuity at that stage, that would have amounted to him giving up his employment. The employee can be paid gratuity only after the person accepts retirement. In the present case, the employee could have claimed gratuity only after his super annuation / retirement. The HC further held that proviso to the payment of gratuity rules confers power on the authority to condone the delay including levying interest.

Based on the above, the Judge rejected / dismissed the writ petition and directed the Bank to comply with the order passed by the appellate authority for payment of entire gratuity amount along with interest @10% p.a from the date when it became due till the date of payment.

For full text of Order:

http://karnatakajudiciary.kar.nic.in:8080/repository/rep_judgmentcase.php