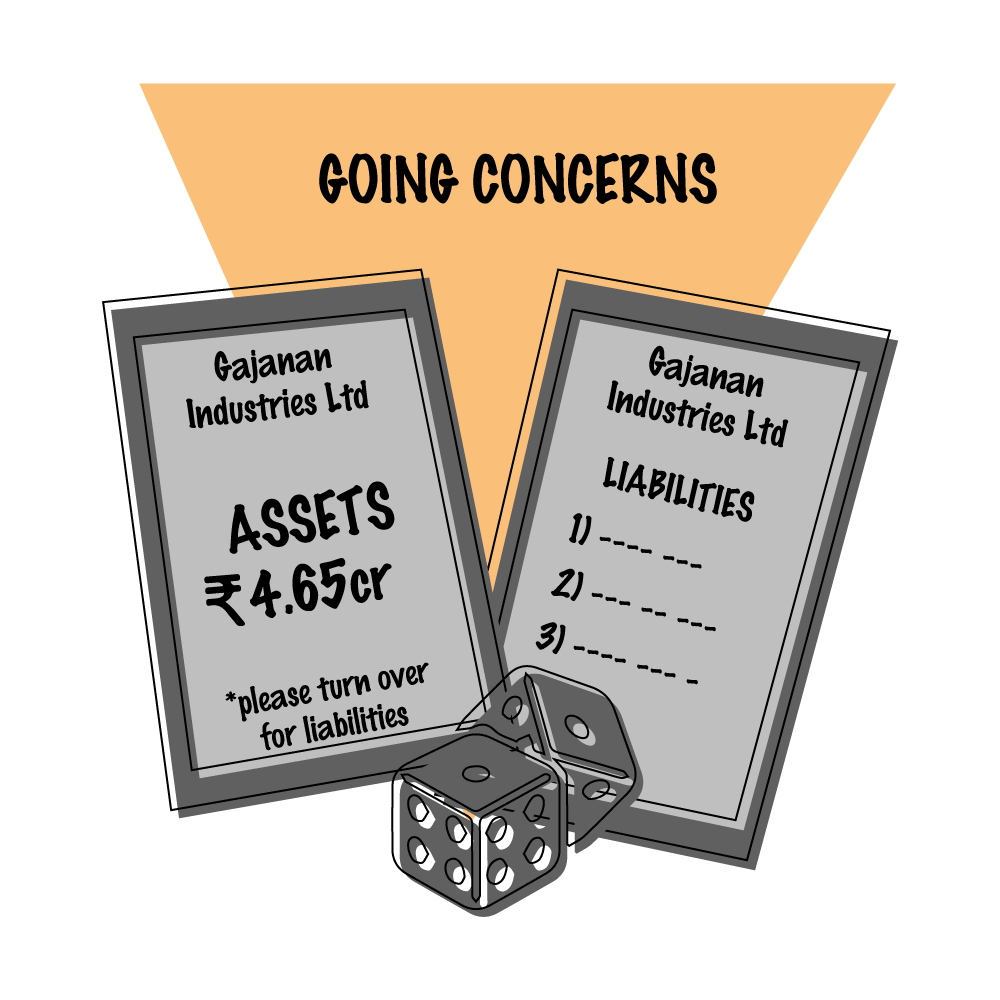

IBC: Going Concern = Assets + Liabilities

National Company Law Tribunal, Mumbai bench

- I.A. 1253/2021 in C.P.(IB)-2521(MB)/2018

HARSH VINIMAY PRIVATE LIMITED ……… Financial Creditor

V/s

GAJANAN INDUSTRIES LIMITED …………. Corporate Debtor

On 6th May 2022, a two-member bench of the NCLT, Mumbai held that in an insolvency proceeding, when an entity (corporate debtor) is sold as a ‘going concern’, it shall include both assets and liabilities (and not just assets without liabilities).

Highlights of the case / judgment:

Facts

- Insolvency proceedings were initiated against Gajanan Industries Limited (“Corporate Debtor”). In November 2019, liquidation orders were passed, and a Chartered Accountant was appointed as Liquidator.

- An E-auction of assets of Corporate Debtor was conducted in March 2021. One Mr. Gaurav Agarwal (“Applicant /” successful bidder”/ Gaurav”) submitted an earnest money deposit (EMD) for a sum of INR 50 Lakhs. His bid of Rs. 4.65 crores for taking over the corporate debtor as a going concern was successful. A letter of intent was issued by the Liquidator on 19th May 2019. On 31st May 2019, Gaurav paid the remaining amount along with interest. The Liquidator issued an acknowledgement letter dated 1st June 2021.

- When Gaurav approached the Liquidator to complete the remaining process / formalities, the Liquidator indicated that Gaurav had to take on the liability of the Corporate Debtor in accordance with Regulation 32A of Insolvency and Bankruptcy Board of India (Liquidation Process) Regulations, 2016.

- Gaurav contended that the takeover of liability(s) was not expressly mentioned in the E-auction process documents. Therefore, it is totally inappropriate on the part of the Liquidator to force Gaurav to take over the liabilities of the Corporate Debtor. Even the Regulation 32A of Insolvency and Bankruptcy Board of India (Liquidation Process) Regulations, 2016 requires the Liquidator to specifically identify and group the assets and liabilities. However, the Liquidator identified only the group of assets (and not liabilities).

- The Liquidator contended that the e-auction process was conducted in accordance with the provisions of the IBC read with Regulation 32A of Insolvency and Bankruptcy Board of India (Liquidation Process) Regulations, 2016. Once Gaurav made entire the payment, the Liquidator duly issued an acknowledgement. Thereafter, Gaurav repeatedly sent communication to the Liquidator including drafts of the Deeds of assignments of land and deed of transfer of entire assets of the Corporate debtor contemplating as a slump sale and not as a going concern sale of the corporate debtor. Even after that, he kept sending mails with frivolous demands / queries as to taking over only the assets (and not the liabilities) of the corporate debtor.

- Relying on the judgment passed by the Mumbai bench of the NCLT in Topworth Pipes & Tubes Pvt Ltd case (CP No. 1239/2018) (that granted various concessions / benefits to the Applicant in that case) Gaurav (applicant) filed an interlocutory application seeking directions for completion of liquidation process by allowing for the following claim”: “The Applicant shall not be responsible for any other claims/ liabilities/ obligations etc. payable by the Corporate Debtor as on this date to the Creditors or any other stakeholders including Government dues. All the liabilities of the Corporate Debtor as on the date stand extinguished, as far as the Applicant is concerned.”

- The Liquidator contended that Gaurav is not following the terms of e-auction and process document which is on record and taking possession factory premises without following the due process of law and is trying to mislead this tribunal.

Issue

Whether the sale of the Corporate Debtor as a going concern under the Code and the Regulations includes both assets and liabilities or assets alone without any liabilities?

Analysis / Judgment

- The two-member Bench placed reliance on one of their own previous judgments in the case M/s Visisth Services Limited Vs. S.V. Ramani in Company Appeal (At) (Insolvency) No. 896 of 2020 in January 2020.

In the said case, the members held that sale as a ‘Going Concern’ means sale of assets as well as liabilities and not assets sans liabilities. All assets and liabilities, which constitute an integral business of the Corporate Debtor Company would be transferred together and the consideration paid must be for the business of the Corporate Debtor.

They held that sale of a Company as a ‘Going Concern’ means sale of both assets and liabilities, if it is stated on ‘as is where is’ basis”.

A similar judgment was passed by the NCLT, Chennai bench in order dated in February 2022 in M.S. Viswanathan Vs. Pixtronic Global Technologies Pvt. (I.A./1215/CHE/2021 in CP/699/IB/2017)

2. The Bench observed that the bid documents also expressly contained that the liquidator does not take or assume any responsibility for any dues, statutory or otherwise, of the Company, including such dues, if any, which may affect transfer of the liquidation assets in the name of the Successful Bidder and such dues, if any, will have to be borne/paid by the Successful Bidder.

3. The Bench further observed that the liquidator in this case clearly put the Applicant on notice that sale of the Corporate Debtor as going concern as is where is’ basis. The applicant is duty bound to undertake due diligence with regard to the local taxes/maintenance fees /electricity expenses/water charges etc., outstanding as on date or yet to fall due in respect of the relevant asset and would be borne by the successful bidder.

On the basis of the above, the Bench dismissed the interim application filed by Gaurav and ruled that sale of a corporate debtor as a going concern will include both assets and liabilities.