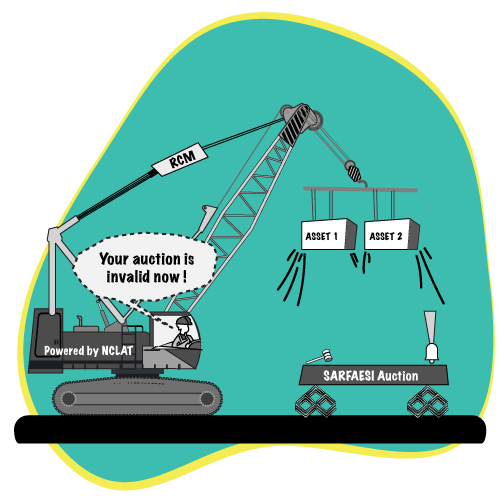

IBC Prevails Over SARFAESI

National Company Law Appellate Tribunal, Principal bench, New Delhi

Company Appeal (AT) (Insolvency) No. 736 of 2020

Indian Overseas Bank … Appellant/Financial Creditor

Vs

M/S RCM Infrastructure Ltd. …. Respondent No. 1 &

Koneru Subbiah Chowdry … Respondent No. 2

On 26th March 2021, the New Delhi bench of the National Company Law Appellate Tribunal (NCLAT) upheld NCLT (Hyderabad Bench – I) order which set aside a sale of the secured assets of the Corporate debtor under SARFAESI Act when the moratorium period under IBC was in existence. A look at the highlights of the case:

Facts

- Ravi Crane and Movers Ltd (“RCM Ltd” / Corporate Debtor) availed credit facilities Indian Overseas Bank (“IOB”/Financial Creditor). However, RCM failed to repay the dues to IOB and hence was classified as non-performing asset (NPA) in June 2016 as per RBI guidelines.

- IOB issued a demand notice under SARFAESI Act, 2002 to RCM in January 2018 to repay the dues. Despite the notice, RCM failed to repay the dues. Consequently, IOB took possession of two assets that were provided as security by RCM while availing the loan.

- Thereafter IOB issued e-auction notice twice to auction the assets. In the second attempt, IOB was successful in getting a bid for a total amount of Rs. 32.92 crores for both secured assets in November 2018. The auction / bid was accepted by IOB and the bidders deposited 25% of the total bid amount in December 2018. The balance 75% of the total bid amount was to be deposited within 15 days thereafter.

- In the meanwhile, RCM filed an application under the Insolvency bankruptcy Code (IBC). The Adjudicating authority accepted the application on 3rd January 2019. The corporate insolvency resolution process (CIRP) commenced, and moratorium was imposed. An insolvency resolution professional was appointed. IOB filed its claim of approximately Rs 79 crores in the third week of January 2019.

- In March 2019, the bidders paid the balance amount of 75% of the total bid amount to IOB after declaration of moratorium by NCLT. Thereafter IOB filed a revised claim of Rs. 46 crores from RCM under IBC.

- RCM filed an application to the Adjudicating authority to set aside the amount realised from sale of its security by IOB.

- The Adjudicating authority set aside the sale by IOB. Aggrieved by the order, IOB has approached the NCLAT.

Issues:

- Whether after imposition of moratorium any transaction done with respect to the assets of the Corporate Debtor/Corporate Applicant deemed to be valid or not?

- Whether provisions of IBC prevail over other laws?

Arguments:

IOB (Financial Creditor)

- Counsel for IOB argued that the auction bid, and sale confirmation were undertaken in December 2018 much before the commencement of the CIRP / moratorium under the IBC in January 2019.

- Once a property was sold in public auction in favour of a purchaser, the sale becomes absolute and the title vests in the purchaser. Such a purchaser derives title on confirmation of sale in his favour and a sale certificate is issued. Thereafter no further deed is required. Sale is complete.

- Since 25% of the sale consideration was received, the balance consideration and issue of sale certificate was only in continuation of sale confirmed, the same cannot be hit by the moratorium under IBC as the sale was undertaken prior to initiation of insolvency proceedings under the IBC.

- RCM had remedy under SARFAESI Act 2002 to challenge such auction sale by IOB. However, it did not avail the remedy. Instead, RCM filed an insolvency petition under IBC.

RCM (Corporate Debtor)

- The sale was not complete. Though 25% of the total bid amount was received prior to commencement of moratorium under IBC, the remaining 75% was realized after the imposition of moratorium.

- IOB initially filed a claim as a creditor for approximately 78 crores. Thereafter it filed a revised claim for a lesser amount of Rs. 46 crores. This violates the order of moratorium. The IBC is a complete code in itself. It has over riding effect on all other laws including the SARFAESI Act.

NCLAT Analysis

- The NCLAT was of the view that merely receiving 25% of the sale proceeds does not conclude the sale. The remaining 75% was received by IOB after imposition of moratorium. Only when the full amount is paid prior to imposition of moratorium, it will be considered as a sale. This was held in the B. Anand Kumar Vs Govt. of India and Others” reported in (2007)5 SCC 745

- Since only a part sale was effected, the property continued to remain in the name of RCM. Hence, RCM continued to own the property(s) when moratorium was imposed.

- The NCLAT took note of the order passed by the Adjudicating authority which expressly stated that as per Section 14 of the IBC, consequent to imposition of moratorium, no suits can be instituted or continued either for enforcement of any judgment or transferring, encumbering or disposing off any asset or right or beneficial interest including under the SARFAESI Act 2002.IOB filed a claim for recovery from RCM under the IBC. It was well aware that in the moratorium period, no action could be initiated for recovery. Yet it received the remaining 75% of the total bid amount. This is in violation of the moratorium period. Hence the auction sale is set aside. The action of sale when the moratorium period is in force is deemed invalid.

- The NCLAT considered its own judgement passed in previous cases – Encore Asset Reconstruction Company Vs Charu Sandeep Desai (2019 SCC Online NCLAT 284) and Arcelor Mittal (India) Ltd Vs Satish Kumar Gupta (2019) 2 SCC 1.In the Encore Asset case, it was held that as per Section 238 of the IBC, the provisions of this Code will prevail over the provisions of SARFAESI, in the event of any inconsistency between IBC and SARFAESI.The imposition of moratorium u/s 14 of the IBC is to protect the interest of the corporate debtor by protecting the assets of the corporate debtor with the sole objective of maximizing the value of assets. Hence, any sale of assets during moratorium period is against the spirit of section 14 of the IBC.

Further, drawing from the judgement passed in the Arcelor Mittal case, it was held that the “primary focus of the IBC legislation is to ensure revival and continuance of the corporate debtor by protecting the corporate debtor from its own management and from and corporate death by liquidation. The IBC is intended to put the debtor back on its feet and not merely to recover dues by the creditors.

In light of the above, the NCLAT upheld the decision of the NCLT setting aside the sale of assets of RCM by IOB during the moratorium period as it is against the spirit of Section 14 of the IOB. Further it held that IBC would prevail over all other laws including SARFAESI Act 2002.

For the text of the Judgement, refer:

https://nclat.nic.in/Useradmin/upload/1376642871605dc1412413e.pdf