Mandatory Submission of Financial Creditors’ Details from Information Utility as Pre-condition to Filing Under IBC is Ultra Vires

IN THE HIGH COURT AT CALCUTTA, Constitutional Writ Jurisdiction, Appellate Side

W.P. No. 5595 (W) of 2020 with C.A.N. 3347 of 2020

UNIVALUE PROJECTS PVT. LTD.

Vs

THE UNION OF INDIA & ORS.

And

W.P. No. 5861 (W) of 2020 with C.A.N. 3937 OF 2020

CYGNUS INVESTMENTS AND FINANCE PVT. LTD. & ANR.

Vs

THE UNION OF INDIA & ORS.

Background

On 12th May 2020, the Principal bench of the National Company Law Tribunal (NCLT) in New Delhi passed an order relating to submission of financial information by creditors.

The order made it mandatory for all financial creditors to submit financial information from the Information Utility as a pre-condition to file an application under section 7 of the Insolvency and Bankruptcy Code 2016 (IBC). Further the order was made retrospective for all pending applications under 7 of the IBC filed before various benches of NCLT prior to final hearing of such applications.

The petitioners have filed this writ petition under Article 226 of the Constitution of India challenging the order passed on 12th May 2020.

Contention

The first petitioner, Univalue Projects Pvt. Ltd. was a financial creditor which had a pre-existing application of insolvency pending before the NCLT, Kolkata Bench. It was contended that the 12th May 2020 order would adversely affect their substantive rights granted to a financial creditor under IBC provisions and its parent legislation Companies Act, 2013.

The second petitioner, Cygnus Investments and Finance Pvt. Ltd. intended to file a new application under section 7 of the IBC to initiate corporate insolvency resolution process against a debtor, but could not do so as the 12th May 2020 order made it mandatory to submit financial information from Information utility as a pre-condition.

Since the issue was similar in both the cases, Hon’ble Justice Shekhar B Saraf framed common issues and passed a common judgment.

Issues

- What is the scope of the powers of the NCLT? Whether the exercise of such powers in passing the impugned order May 12, 2020 is de hors the IBC, 2016 and the rules and regulations framed thereunder?

- Whether the NCLT could enforce the impugned order retrospectively thereby adversely affecting the rights of the petitioners as financial creditor under the extant provisions of the IBC, 2016?

Arguments

The counsels for the petitioners argued that:

- The NCLT did not possess the statutory or regulatory authority to pass such order, let alone pass it with retrospective effect. They relied on judgments passed in cases such as Pradyut Kumar case1[1965], Hitendra Vishnu Kumar case2 (1994) and Pallawi Resources Ltd3 (2010) besides other decided cases of the Supreme Court and High Courts. The functioning of the NCLT and NCLAT is not bound by the Code of Civil Procedure,1908 (CPC). They are governed by the provisions of the Companies Act, 2013 and IBC 2016 and rules of natural justice.

- Section 424 of the Companies Act, 2013 confers no powers to either the NCLT/NCLAT to make any rules of such procedure that have the effect of altering the provisions of the CA, 2013 or the IBC, 2016 or the regulations that may be framed under the IBC, 2016.

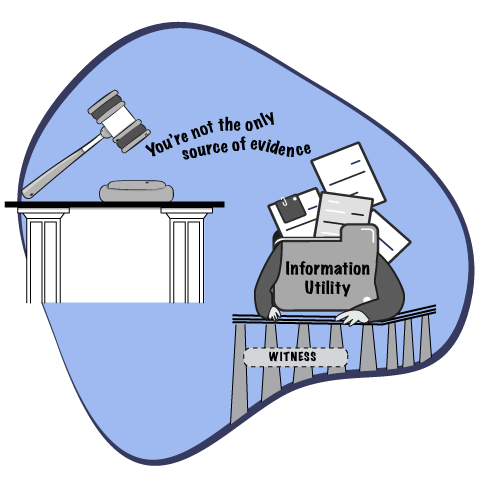

- Section 7 (3)(a) of the IBC contains that details of default recorded with information utility (IU) is one of the designated methods of furnishing / submitting proof of financial debt between a debtor and financial creditor. It is not the only forms of evidence that would be considered by the Adjudicating Authority (AA).

- Regulation 8 (2) of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 (CIRP Regulations 2016) expressly contains other (2) also lists other relevant documents, specially four (4) categories of documents, in addition to the records of default available with an IU, that may be submitted by a financial creditor to prove the financial claims of such a creditor.

A conjoint reading of Section 7(3)(a) of the IBC, 2016 along with Regulation 8 of the CIRP, 2016 makes it clear that NCLT can consider either of the options: a record of default recorded with the IU or such documents that have been specified by the IBBI vide its regulations. - Section 215 read with section 240 of the IBC, 2016 creates the IBBI (Information Utilities) Regulations 2017 which makes it expressly clear that submission of financial information by creditor from IU should be done only by those creditors having “secured interest”, meaning secured creditors. This means it is not mandatory for unsecured creditors to do so.

The counsel for petitioner submitted that a combined reading of all sections makes it clear that it was beyond the authority of the NCLT to have passed the 12th May 2020 order.

The counsels for the respondents’ argued that:

- The NCLT was well within its rights in passing the 12th May 2020 as it is based on the provisions of section 215(2) of the IBC where in it is mandatory for financial creditors to submit information on default from the IU.

- Section 424 of the Companies Act, 2013 indeed vests powers on the NCLT / NCLAT powers to make and regulate their own rules and procedures. Reliance was placed on Izhar Ahmed Khan case4 (1962).

- There is no distinction between secured and unsecured financial creditors section 215(2) of the IBC. Be it submission of financial information or information relating to assets in relation to which any security interest has been created, a financial creditor has to mandatorily file such information with the IU, irrespective of whether such creditor is a secured or an unsecured creditor.

- The role of IU which became operational on and from 25th September 2017 is not a mere formality. Rather, it is both the duty and services of the IU to authenticate and verify the financial information submitted by a financial creditor, which “core service” rendered by such IU defined in Section 214(e) of the IBC, 2016.

- Provisions of Section 7 imply that submission of default information from Information Utility (IU) is mandatory.

- In the Shyam Sundar case5 (Supra), Gurbachan Singh6 case (Supra) and New India Assurance Ltd case7 (Supra) highlights the retrospective nature of an amendment. Hence the 12th May 2020 order being retrospective in nature is not outside the scope of law.

Order

After hearing arguments of both sides and relying on several decided Supreme Court cases, Hon’ble Justice Shekhar B Saraf ruled:

- The NCLT and NCLAT have been conferred with powers to lay down their own procedures. However, such powers are subject to principles of natural justice. Further such powers are also subject to provisions of its parent legislation – the Companies Act, 2013 and IBC 2016. NCLT rules will primarily be governed by its superior or parent legislation and only then its own rules. While quoting the Lokhandwala Kataria Construction Private Limited case8 (2018), Justice Saraf sated that the inherent powers of the NCLT under Rule 11 of the NCLT Rules, 2016 do not permit the NCLT to pass the impugned order.

- Section 7(3)(a) of the IBC, 2016 contains three different categories of documents which are available to a financial creditor to submit proof of default by a corporate debtor. They are (a) record of the default recorded with the information utility; (b) such other record; (c) evidence of default as may be specified. The disjunctive nature of these imply that either one of the three set of documents may be submitted by the financial creditor to the adjudicating authority. Further, in the Swiss Ribbons case9, it was held that apart from the information from the information utility, there were at least 8 other classes of documents that could be considered as evidence for “financial debt”. So, any one of the documents /set of documents could be submitted.

- The Hon’ble Justice also observed that a harmonious reading of section 215 of the IBC, 2016 with section 7 of the IBC, 2016 along with the Rules and Regulation did not intend to make it mandatory for financial creditors to submit financial information to the IU. While IU Regulations, 2017 are pertinent, he observed that that other sources of evidence are present apart from the record maintained by the IU. It may therefore be inferred that Section 215 of the IBC, 2016 is not mandatory in nature. It was not mandatory for all class of creditors.

- The Shyam Sundar case (Supra), Gurbachan Singh case (Supra) and New India Assurance Ltd case (Supra) highlights the retrospective nature of an amendment to an Act of Parliament. However, there is no “amendment” to an Act of Parliament in the 12th May 2020 NCLT order for it have retrospective effect. Therefore, the issue of retrospectivity stands quashed.As a result, the 12th May 2020 order was struck down for being ultra vires the IBC and Companies Act, 2013.

For the text of the Judgement, refer:

References