No cheque dishonour cases can be filed or continued against corporate debtors under Negotiable instruments Act during moratorium period under the IBC

In the Supreme Court of India

Civil/Criminal Appellate Jurisdiction & Original Jurisdiction

CIVIL APPEAL NO.10355 OF 2018

MOHANRAJ & ORS. … APPELLANTS

Vs

M/s. SHAH BROTHERS ISPAT PVT. LTD. …RESPONDENT

and related cases

On 1st March 2021, a three Judge bench comprising Rohinton F Nariman, Navin Sinha and KM Joseph ruled that cheque dishonour cases cannot be instituted or continued against companies which are under insolvency proceedings under the Insolvency and Bankruptcy Code (IBC).

In a 120-page judgement, the bench was unambiguous in stating that criminal proceedings for cheque dishonour u/s 138 of the Negotiable instruments Act 1881 (NI Act) are “quasi criminal” in nature. They further added that section 138 of NI Act is a “civil sheep” in a “Criminal wolf’s” clothing.

A look at the salient points of the case:

Facts

- M/s. Shah Brothers Ispat Pvt. Ltd (“SB Ispat), respondent supplied steel products to M/s Diamond Engineering Private Limited (DEPL) amounting to Rs. 24.20 crores in 2015 -2016. The appellant Mr. P. Mohanraj is the director of DEPL.

- DEPL issued 51cheques, all of which were dishonoured citing “insufficient funds” as reason. Consequently, on 31st March 2017, SB Ispat instituted demand notice u/s 138 r.w 141 of the NI Act, 1881 asking the company and its directors to make good the payment within 15 days. In April 2017, DEPL issued two further cheques which also got dishonoured due to “insufficient funds”. A second demand notice was issued by SB Ispat to DEPL.

- Since no payments were made by DEPL to SB Ispat, two criminal complaints were instituted by SB Ispat against DEPL in Additional Chief Metropolitan Magistrate (ACMM) Kurla, Mumbai on 17th May 2017 and 21st June 2017 respectively. Summons were issued to both parties on 12th February 2018.

- On 21st March 2017, SB Ispat simultaneously initiated proceedings against DEPL u/s 8 of the IBC. On 6th June 2017, an order was passed admitting the insolvency petition u/s 9 of the IBC. A moratorium was ordered u/s 14 of the IBC. As a result, there was a stay on proceedings of the two criminal cases filed in before ACMM Mumbai.

- On an appeal filed against stay in the NCLAT, it set aside the order stating that section 138 of the NI Act is a criminal provision and hence cannot be “proceeding” within section 14 of the IBC.

- Similar views were taken by High courts that Section 138/141 provisions of NI Act 1881 being criminal provisions would not be a “proceeding” within the meaning of section 14 of the IBC. Hence the cheque dishonour cases can be instituted simultaneously despite moratorium u/s 14 of the IBC being in place.

Issue

Whether institution or continuation of cheque bounce cases u/s 138/141 of the NI Act 1881 would be covered under moratorium period u/s 14 of the IBC?

Analysis

- The first part of section 14 (1) of the IBC states that: “Subject to provisions of sub-sections (2) and (3), on the insolvency commencement date, the Adjudicating Authority shall by order declare moratorium for prohibiting all of the following, namely— (a) the institution of suits or continuation of ending suits or proceedings against the corporate debtor including execution of any judgment, decree or order in any court of law, tribunal, arbitration panel or other authority;”

The phrase “institution of suits or continuation of pending suits” is to be read as one category. The phrase “or proceedings” make it clear that the proceedings are against the corporate debtor and it is a separate category.

The phrases “any judgment, decree or order” and “any court of law, tribunal, arbitration panel or other authority” make it clear that a section 138 proceeding being conducted before a Magistrate would certainly be a proceeding in a court of law in respect of a transaction which relates to a debt owed by the corporate debtor.” This throws light on the width of the expression “proceedings”. It is not a narrow phrase and is widely inclusive.

2. The Bench observed that the intention of enacting section 138 of the NI Act 1881 is “what is otherwise a civil liability is now also deemed to be an offence. In such cases, there is imprisonment coupled with the fine that may extend to twice the amount of cheque payable as compensation to the aggrieved party. This is a hybrid provision to enforce payment of a bounced cheque even if it is otherwise enforceable in civil law. It is a quasi-criminal proceeding.

By keeping such quasi-criminal provisions (Sec 138, NI Act) out of the ambit of the moratorium (Sec 14, IBC), it would result in the assets of the corporate debtor eroding when twice the compensation amount is to be paid. This would directly adversely affect the insolvency proceeding in the same manner as the institution, continuation, or execution of a decree in such suit in a civil court for the amount of debt or other liability. This is in stark contrast to the intention of imposing a moratorium: to protect the assets of the insolvent company and ensure it is running as a going concern.

Consequently, it is impossible to differentiate between the impact of a civil suit and a quasi- criminal proceeding so far as the corporate debtor is concerned.

3. Section 138 of the NI Act 1881 expressly states that no court can take cognizance of an offence u/s 138 unless a written complaint is received by the holder of the cheque – the victim. Further section 142 of the NI Act states that such complaint must be made within 1 month of the date on which “cause of action” arises. Now, the concept of “cause of action” is not recognized under criminal jurisprudence. It is alien to CrPc.

The Bench categorically stated that section 138 of the NI Act 1881 is a “civil sheep” in a “Criminal wolf’s clothing” as it is the interest of the victim that is sought to be protected. The interest of the State subsumed by the victim making complaint to the court.

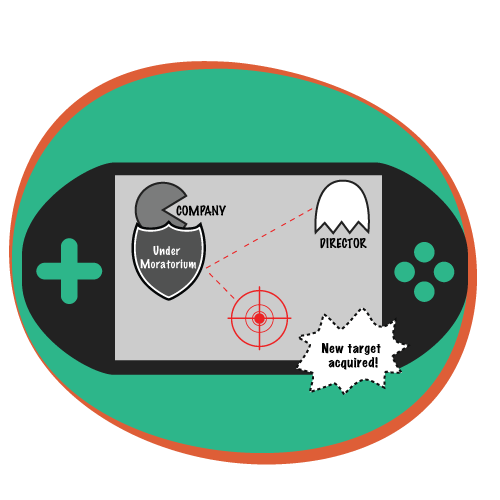

The Bench further noted that since the corporate debtor would be covered by the moratorium provision contained in Section 14 of the IBC, by which continuation of Section 138/141 proceedings against the corporate debtor and initiation of Section 138/141 proceedings against the said debtor during the corporate insolvency resolution process are interdicted, it would be impossible u/s 14 of the IBC to institute or continue any proceeding including section 138 NI Act during the moratorium period against the Corporate debtor – the Company. However, such proceedings can be initiated against the natural persons (such as individual directors of the company) mentioned u/s 141(1) & (2) of the NI Act who would continue to be statutorily liable under Chapter XVII of the NI Act.

The Bench made the above observation in disagreement of the ruling on thie issue by Bombay HC in Tayal Cotton Pvt. Ltd. v. State of Maharashtra, 2018 SCC Online Bom 2069 (2019) 1 Mah LJ 312 and Calcutta HC in M/s MBL Infrastructure Ltd. v. Manik Chand Somani, CRR 3456/2018.

The benefit of moratorium from cheque bounce cases is only for the corporate debtor (Company). It does not extend to directors / signatories of such companies as criminal cases would continue against “natural persons”.

Judgment

Based on the above, the operative part of the judgment is as follows:

- Cheque bounce case u/s 138/141 of the NI Act are quasi criminal proceedings and come within the ambit of moratorium under section 14 of the IBC.

- Cheque dishonour cases under section 138 of the NI Act cannot be filed or continued against companies under moratorium u/s 14 (1) (a) of the IBC

- Moratorium u/s 14 of the IBC is applicable only to the corporate debtor – the company. Cheque bounce case proceedings can continue against natural persons such as director of the corporate debtor company.

For the text of the Judgement, refer:

https://main.sci.gov.in/supremecourt/2018/34430/34430_2018_33_1501_26551_Judgement_01-Mar-2021.pdf