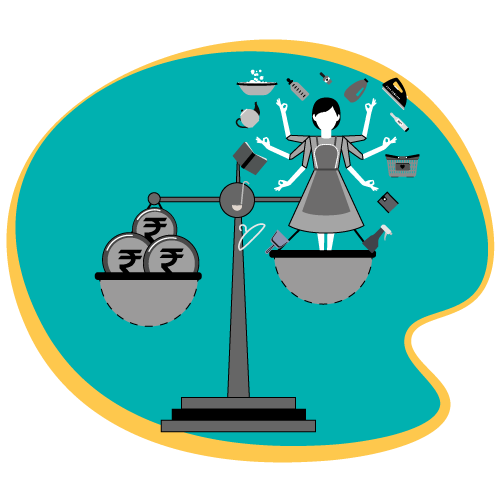

Notional income of a homemaker

Civil Appeal No.s 19-20 of 2021

[Arising out of Special Leave Petition(C) Nos.1872829 of 2018]

KIRTI & Anr….. Appellant(s)

Vs

ORIENTAL INSURANCE COMPANY LTD….. Respondent(s)

On 5th January 2021, a three Judge bench of the Supreme Court ruled that calculation of notional income of homemakers must be based on their work, labour and sacrifices. This decision was pronounced while determining insurance compensation to be paid to a deceased couple under the Motor Vehicles Act, 1988.

Facts

- On 12th April 2014, a young couple Poonam and Vinod aged 26 years and 29 years respectively were commuting on their motorcycle when they were hit by a Santro car. The couple deceased from severe brain damage and accident induced trauma. They left behind two toddler / minor children and septuagenarian parents.

- A claim petition was filed under Section 166 of the MV Act by the remaining family of the deceased. The respondent insurance company offered a settlement compensation of a total of Rs. 17 lakhs for the couple (Rs. 6.47 lakhs for the death of Poonam and Rs. 10.71 Lakhs for Vinod)

- Based on eyewitness account and evidence, the driver of the car was held guilty of negligence and rash driving.

- The Motor Accident Claims Tribunal, (“Tribunal”) computed the quantum of compensation. While doing so, they took into account their age, the minimum wage in Delhi, additional income for future prospects (of Vinod), deduction towards personal expenses and a lump sum amount towards loss of love and affection, estate, funeral and estate expenses. Based on this, the Tribunal decided on a sum of Rs. 40.71 lakhs as amount of compensation to be paid by the insurance company to the family of the deceased.

- This was challenged by the respondent insurance company on the grounds that since the deceased were residents of Haryana, the minimum wage of Haryana (and not Delhi) should be considered. Also, the addition of future prospects as well as non-deduction of personal expenses for Poonam was prayed to be reversed. Further, compensation was sought to be halved on grounds of contributory negligence. (Contributory negligence is a concept where the injured party fails to exercise reasonable care for their safety). A categorical submission was made highlighting that in 2018 payment of ‘future prospects’ to non-permanent employees was not allowed.

- The Delhi High Court concurred with the contentions of the insurance company and re computed the compensation while allowing 25% additional gratuitous income to her salary considering her contribution to her household. Accordingly, the Delhi HC brought down the compensation payable to Rs. 22 lakhs (from Rs. 40.71 lakhs).

Contention

The appellants: Counsel for appellants have sought re-computation of compensation on grounds of loss of dependency.

The respondent: Counsel for the insurance company claimed that the decision of the Delhi HC was a consent order where the counsel for appellant accepted the lower compensation and hence cannot be challenged.

Analysis

While deciding on the matter, the court took into account the following:

- The number of dependents on the deceased should be the number as it existed at the time of the death of the deceased. Subsequent death of a dependent cannot be taken into account for reduced compensation. Claims and legal liabilities crystallize at the time of the accident itself. Post changes will not affect pending proceedings. It is settled advocates cannot throw away legal rights or enter into arrangements contrary to law. Any compensation awarded by a Court ought to be just, reasonable and be guided by principles of fairness, equity, and good conscience.

- Preserving the existing standard of living of a deceased’s family is a fundamental endeavour of motor accident compensation law. At the very least the minimum wages of the state of residence of the deceased should be applied while computing compensation. The court further observed that it is unreasonable for the respondent insurance company to contest the computation of addition of future prospects. It was decided by a constitutional bench in the National Insurance Co Vs Pranay Sethi case (2017) 16 SCC 680 that a fixed percentage shall be calculated for considering additional future prospects – whether salaried class or self- employed people. A slab has been laid down. Future prospects must be computed and paid as per the slab. Non computation of future prospects on the ground that it cannot be calculated for notional income is incorrect in law. Due consideration and weightage has to be given for constant inflation induced wages.

- Justice N.V Ramana, while agreeing to the judgment, additionally shared his elaborate reasoning on the question of notional income of a housewife and whether future prospects should apply to the same or not. He observed that notional income would be calculated for two categories of victims– the employed and the non- employed.

For the employed, the computation is based on substantiated income documents and where no documents are provided, calculated on the basis of the guessing / estimation based on lifestyle etc. The challenge of computation of notional income is with respect to the non-employed / non– earning victims – child, student, homemaker etc.

In particular, computation of notional income for home makers has been coming up before courts for consideration often. Several decided case laws has dealt with this issue –

- Lata Wadhwa v. State of Bihar, (2001) 8 SCC 197

- Arun Kumar Agrawal v. National Insurance Co. Ltd., (2010) 9 SCC 218

- Rajendra Singh v. National Insurance Co. Ltd., 2020 SCC Online SC 521

A common thread of thought in judgments of the above cases was the fact that a home maker renders multifarious services to the home/ family. Be it cooking, cleaning, care giving, helping with studies, housekeeping, women indulge in plethora of activities as compared to men. Gratuitous services rendered by homemaker cannot be rendered by others. It is impossible to quantify the contribution made by a home makers in terms of money. Yet, the general conception that homemakers do not “work” or add economic value to a family. This long prevailing problematic idea must be overcome. Some pecuniary estimate has to be attributed to the services rendered by her.

Quantifying/ computing notional income of homemakers serves extremely purpose. While it recognizes the multitude of roles played by a women and services rendered by her, it signals to the society at large of the acceptance that such rendered by a homemaker (indirectly) actually contribute to the economic condition of the family and the nation. It is a reflection of changing attitudes and mind set and is a step towards the constitutional vision of social equality and ensuring dignity of life to all individuals.

With respect to the present case, Justice NV Ramana viewed that several decided cases laid down methods of computation for homemakers. However, these were only suggestions. He observed that while computing income for homemakers, courts should rely on facts and circumstances of the case. The compensation should neither be conservative nor very liberal. It should be just.

On the question of calculating income on future prospects, Justice Ramana was of the view that the principles / provisions which apply to self-employed / salaried persons should apply to home makers as well as improvement in skill and experience will come in the domain of household work also.

Judgment

The appeal was allowed in part. The accident compensation has been revised to Rs. 33.20 Lakhs (as against Rs. 40.17 Lakhs). The enhanced sum to be paid with interest @9% within a stipulated time.

This judgment could go a long way in promoting gender equality and justice and further our constitutional vision of social equality and ensuring dignity to all.

For the text of the Judgement, refer:

https://main.sci.gov.in/supremecourt/2018/16762/16762_2018_32_1501_25229_Judgement_05-Jan-2021.pdf