Preferential transactions under the IBC

In the Supreme Court of India Civil Appellate Jurisdiction

Civil Appeal nos. 8512-8527 of 2019 WITH Civil Appeal Nos. 6777-6797 of 2019; Civil Appeal Nos. 9357-77 of 2019

ANUJ JAIN

Interim resolution professional for Jaypee Infratech Limited ……. Appellant(s)

Versus

AXIS BANK LIMITED ETC. ……. Respondent(s)

On 26th February 2020, a division bench comprising Justice A.M Khanwilkar and Justice Dinesh Maheshwari passed a judgment providing several clarifications relating to preferential transactions under the Insolvency and Bankruptcy Code. A look at the highlights of the case.

Facts of the Case

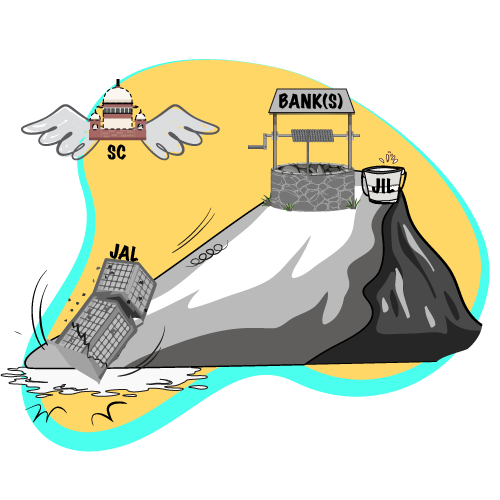

Jaypee Infratech Limited (“JIL”) was set up as a special purpose vehicle whose main object is to engage in and carry on the business of construction and infrastructure development projects. Its holding /parent company Jayaparkash Associates Limited (“JAL”) holds approximately 71% of its total shares. Besides, JIL had also mortgaged some of its properties in favor of certain banks for JAL to secure loans.

IDBI Bank, a Creditor of JIL filed an application to initiate insolvency proceedings against its corporate debtor JIL alleging default in repayment of dues to the tune of Rs. 526 crores. An interim professional was duly appointed. During the CIRP, the interim professional noticed the said transactions and approached the NCLT, Allahabad Bench seeking relief for JIL on grounds that such properties were mortgaged by JIL on behalf of JAL. Such transactions were undervalued, fraudulent and preferential transactions under sections 43,45 & 66 of the IBC. The interim professional further sought the discharge of interest security to be paid by JIL and prayed to the NCLT to vest the mortgaged properties in the name of JIL. The NCLT, Allahabad Bench directed discharge of the security interest and the properties involved therein vested in the corporate debtor (JIL), with release of encumbrances. On appeal, the NCLAT set aside the order passed by the NCLT and held that the said transactions do not fall as preferential transactions. They were not undervalued or fraudulent in nature. Aggrieved, the interim professional and others have approached the Hon’ble Supreme Court seeking relief.

Key Issues

- Whether transactions of mortgaging properties of JIL for loans to be procured by JAL would be considered as preferential transactions under the IBC and hence undervalued and fraudulent?

- Whether lenders of JAL could be considered as financial creditors of JIL because properties of JIL were mortgaged for JAL to obtain loans from lenders?

The Analysis

The Supreme Court delved into the meaning of “preferential transactions” drawing reference not only from the Insolvency Code but also from legislations from the US and UK besides various mercantile laws. After a detailed analysis, the apex court held that for a transaction to be preferential, it has to satisfy the following conditions:

(i) The transaction should involve a transfer of property of the corporate debtor for the benefit of a creditor, for or on account of an antecedent financial debt owed by the corporate debtor to the creditor,

(ii) The transfer has the effect of putting the creditor in a more beneficial position than it would have been, in the event of distribution of assets of the corporate debtor in the usual course as per the in accordance with Section 53 of the Code,

(iii) Such transactions had to have been entered during the “look back “ period i.e., either (1) during the two year period preceding the insolvency commencement date in case the beneficiary was a related party, or (2) during the one year period preceding the insolvency commencement date in case the beneficiary was an unrelated party.

The apex court ruled that if a transaction satisfied the above conditions, it was considered as preferential transaction between the corporate debtor and the creditor. The apex court further held that such transaction would be considered preferential in nature, irrespective of whether the parties to the transaction intended or even anticipated for it to be so. The SC further reiterated that unlike in the Companies Act, 2013, Section 43 of the Insolvency & Bankruptcy Code did not mandate to establish intent of fraud in a transaction.

Exclusions from preferential transactions

- Any transfer made in the ordinary course of business/financial affairs of the corporate debtor and the transferee.

- The transaction creating a security interest secured a new value in the property acquired by the corporate debtor, i.e., in monetary terms, or in terms of goods, services, new credit, or secured the release of a previously transferred property.

The Judgment

Based on the above, the Supreme Court, in its 180 page judgment concluded that the transactions between JIL (Corporate debtor) and JAL (Operational creditor) were preferential transactions due to the following:

- JAL received working capital from lender banks based on mortgage of JIL’s assets. This amounted to JAL reducing its liability towards its own lenders.

- JAL was an operational creditor of JIL. As an operational creditor, JAL ranked much lower in priority other financial creditors and other stakeholders of JIL, in the event of liquidation distribution of assets of JIL under Section 53 of the Code.

- By mortgaging the assets in favour of JAL, the SC observed that to that extent, assets would not be available to the other creditors for distribution during liquidation.

- JAL was the promoter of JIL and almost 72% shareholder. Since JIL’s inception, JAL extended technical, financial and Bank guarantees to JIL. Therefore JIL had previous obligations towards JAL. Hence it could be inferred that JIL’s transfer of assets was towards its antecedent debt obligation towards JAL.

- It is evident that JAL was related party of JIL based on the above transactions.

- The SC further observed that all the impugned transactions were entered into in the 2 years preceding the commencement of insolvency proceedings. They were entered during the “look back” period.

- The SC observed that it is important to understand the intent of enacting a provision and not go only by its strict interpretation. Hence it opined that the transactions between JIL and JAL were not in the ordinary course of business as JIL was an SPV set up by JAL for the purpose executing the infrastructure and housing projects. So it could not be considered as having entered into in the ordinary course of business.

On the issue of whether lenders of JAL could be considered as financial creditors of JIL, the apex court held that JAL lenders could NOT be considered as financial creditors of JIL due to the following observations:

The main ingredients of a “financial debt” were established in the Pioneer Urban Land & Infrastructure Vs. UOI. Borrowing by one party, Disbursement by the other party and time value of money were considered essential to a construe a “financial debt”. The SC opined that in this case, JAL’s lenders had not directly lent any money to JIL. Therefore JIL did not incur “financial debt” and therefore JAL’s lenders could not be considered as financial creditors of JIL. The court further observed that the role of a financial creditor does not merely include having a security interest on the assets of the Corporate debtor. It is more than that. It must be interested in the revival of the corporate debtor (and not mere recovery of its debt). Hence the apex court stated that JAL’s lenders could not be considered as financial creditors of JIL.

Consequent to the above, the Supreme Court set aside the order passed by the NCLAT. The impugned transactions were preferential transactions. It directed the release and discharge of the security interested created by JIL and vested the properties mortgaged through the impugned Transactions be back to JIL.

Through this judgment, the Supreme Court has provided the much-needed clarity on key issues pertaining to preferential transactions and status of third-party mortgages in the course of insolvency proceedings. The need of the hour.

Note: For full text of the Judgment

https://main.sci.gov.in/supremecourt/2019/35907/35907_2019_7_1501_20906_Judgement_26-Feb-2020.pdf