Deposit Insurance and Credit Guarantee (Amendment) Bill 2021

Background

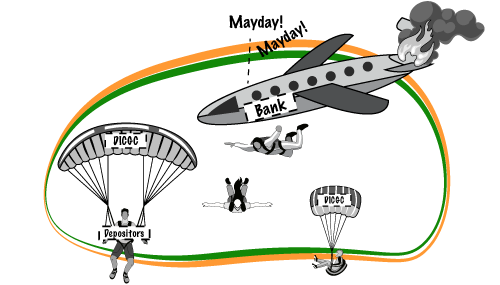

The Deposit Insurance and Credit Guarantee Corporation (DICGC) Act was enacted in 1961 to establish a Corporation to provide insurance to citizens for their bank deposits and guaranteeing credit facilities given by banks and financial institutions. The objective of the Act is to provide time bound access to their deposits in case they face any restrictions from accessing such deposits.

Salient features of the DICGC Act 1961

- The Corporation established under the DICGC Act 1961 and is a wholly owned subsidiary of the Reserve Bank of India (RBI). It is governed by the RBI and has the onus of paying the insured deposit amount to depositors of an insured bank.

- This Act will cover all banks including regional rural banks, foreign banks with branches in India and co-operative banks.

- The DICG Corporation insures all bank deposits, including savings, fixed, current and recurring deposits of all banks in India. Certain deposits are excluded from this Act such as deposits of foreign governments, or Central / state governments, inter-bank deposits and any amount which has been specifically exempted by the Corporation with the previous approval of the RBI.

- Such insured deposit amount becomes liable to be paid when the insured bank undergoes (i) liquidation or (ii) reconstruction / scheme of arrangement or (ii) merger / acquisition of the insured bank by another bank.

- Once the Corporation makes the payment of insured deposit amount to the citizens who make deposits in an insured bank, such bank becomes liable to repay the same to the corporation.

- Originally the insurance coverage for deposits was Rs. 1 lakh. In the Budget 2020, the Corporation was permitted to increase deposit insurance coverage for a depositor from Rs. 1 lakh to Rs. 5 lakhs per depositor per bank, to provide a greater measure of protection to depositors in banks.

Developments in the last few years

The last few years have seen a spate of cases where banks (particularly co-operative banks) which have failed to fulfil their financial obligations due to liquidity crisis, non-performing assets and consequently being placed under moratorium.

Banks such as PMC, YES bank and Lakshmi Vilas Bank have been in the news for all the wrong reasons. Increasing non-performing assets led to severe liquidity crunch resulting in freezing depositors accounts and capping the limit on withdrawing their own funds. This put small depositors in severe distress. In order to address this crucial concern, the government proposed amendment(s) to the DICGC Act 1961.

The DICGC (Amendment) Bill 2021 was introduced in the Rajya Sabha on 30th July 2021 and approved on 4th August 2021 after a brief debate.

A look the amendments:

Section 15

This section states that every insured bank for as long as it is registered, be liable to the corporation, a premium on its deposits at such rates not exceeding 15 paise per annum for every Rs. 100 of the total amounts of the deposits in that bank at the end of that period or the date of its cancellation.

The latest amendment to proviso to section 15(1) of the Act enables the Corporation to raise the ceiling on the amount of premium with previous approval of the Reserve Bank of India. This is an enabling provision to revise the premium rates keeping in mind the financial situation of the economy and the interests of the banking sector. This will be done in consultation with the RBI and after approval by the Central government.

Section 18

This section deals with the manner of payment by Corporation in case of scheme of compromise or arrangement or of reconstruction or amalgamation in respect of an insured bank. The latest amendment has introduced / inserted Section 18A.

In a nutshell, section 18A allows for payment of the insured deposit amount to depositors on an interim basis.

- The Corporation will be liable to make such payment:

– When the depositors are restricted from accessing their bank accounts / deposits.

– If such restrictions get imposed under any order or scheme under the Banking Regulation Act, 1949

– If such order or scheme is made before the enactment of the Bill, but the business of the insured bank remains suspended at the time of enactment. - The Corporation will NOT be liable to make payment if:

– the Reserve Bank of India (RBI) removes the restrictions put on the bank for payment to depositors, and

– the insured bank or transferee bank is in a position to pay the depositors without any restrictions. - The Corporation shall pay the insured amount to the depositors within a period not exceeding 90 days form the date when such liability arises.

– The insured bank must furnish details of all outstanding deposits to the Corporation withing the first 45 days.

– The Corporation will verify the authenticity of the claims within the next 30 days and check with each depositor if they are willing to receive the insured deposit amount.

– The Corporation must make the payment to such depositors within 15 days thereafter - The Corporation may be given an additional 90 days if RBI finds it expedient for finalising a scheme for the reconstruction, arrangement, merger, or acquisition of the insured bank.

- Once the Corporation make such interim payment to a depositor, the value of his deposit in the insured bank will reduce by the amount paid. The insured bank will become liable to pay that amount to the corporation.

Section 21

This section deals with repayment of the amount by the insured bank to the corporation. Where any amount has been paid by the Corporation to the insured depositor, it shall furnish to the insured bank or liquidator, or transferee bank information of the amount(s) paid. The liquidator shall pay the said amount to the Corporation within the prescribed time and manner. The insured bank or transferee bank as the case may be, shall make the payment to the Corporation within such time and manner after coming into force of the scheme of compromise, arrangement, merger or amalgamation as contained in section 18.

The amendment to section 21 incudes introduction of sub sections (3) and (4).

Section 21(3) states that the Corporation may defer or vary the time limit for receipt of repayments due from the insured bank / transferee bank for such time periods as may be decided by the Board (RBI) in accordance with rules made in this behalf. Provided that such regulations also provide for prudential principles to assess the capability of the bank to repay the Corporation, and prohibition on the bank to discharge other specified liabilities until repayment.

Section 21(4) provides power to the Corporation to charge penal interest for delay in repayment up to 2% points higher than repo rate (the rate at which RBI lends money to banks).

Pros & Cons of the amendments

The Bill has expressly set a timeline not exceeding 90 days in payment of insurance deposit amount to depositors. This is a very welcome move for depositors especially small depositors who are to wait endlessly for the moratorium / resolution process of stressed banks to end for being repaid their own money. Prior to these amendments, the budget 2020 increased the limit of insurance from Rs. 1 lakh to Rs.5 lakhs. This is estimated to cover over 95% of depositors.

However, some experts are up in arms as they believe that banks will have an easy way out by seeking recourse to the DICG Corporation for repayments (upto Rs. 5 lakhs) when they are under stress / distress.

The road ahead

The amendments to the DICGC Act have been proposed to protect interests of depositors especially small depositors to withdraw their own funds within a time frame from banks which are unable to fulfil their obligations due to being under moratorium or reconstruction. The finance minister stated that these amendments will apply to PMC bank which is currently under reconstruction. The amendments are aimed to safeguard interest of most several co-operative banks which are distressed.