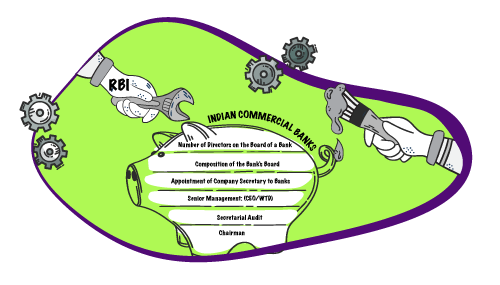

Governance in Indian Commercial Banks: Discussion Paper-RBI

On 12th June 2020, the Reserve Bank of India (RBI) made available to the public, a discussion paper on “governance in commercial banks in India”. The paper seeks to set higher aspirational governance standards for entities engaged in financial intermediation. The discussion paper is open for public comments on or before 15th July 2020.

A look at the several suggestions and recommendations for the Board of the Bank’s governance:

Number of Directors on the Board of a Bank:

Board of a Bank to comprise

- Minimum of 6 directors and

- Maximum of 15 directors

Composition of the Bank’s Board

- Majority of Board to comprise of independent directors.

- The educational qualifications, skill and expertise of such directors shall be commensurate with the size, complexity, and risk exposure of the Bank. At least half of the total number of directors shall have special knowledge or practical experience in respect of one or more of the following matters namely accountancy, agriculture and rural economy, banking, co-operation, economics, finance, law, small scale industry, information technology, payment and settlement systems, human resources, risk management, business management, any other matter in the opinion of the Reserve Bank, be useful to the banking company.

- The Board shall not have more than 3 directors who are entitled to exercise more than 20% of the total voting rights of all shareholders of the Bank.

Chairman

Chairman of the Board to be an independent director. Such Chairman shall be appointed with the previous approval of the Reserve Bank of India (RBI) subject to such terms and conditions as the RBI may specify.

Senior Management: (CEO/WTD)

- Senior Management roles such as CEO/ WTD shall be appointed according to their high standards of knowledge and experience in handling Banking issues in accordance with the Nomination & Remuneration Committee (NRC) and subject to approval by the Board. The Bank shall have an internal policy and framework governing such appointments including succession planning.

- The upper age limit for an CEO / WTD shall be 70 years. The tenure of such CEO / WTD of commercial banks shall be 10 years if such person is from the promoter group and 15 years otherwise. Such persons shall be eligible for re-appointment only after expiration of 3 years from the tenure.

Appointment of Company Secretary to Banks

- All Banks – Listed or otherwise shall appoint a Company Secretary who is bound by the professional standards of a Company Secretary. Such Company Secretary shall report to the Board.

- The Company Secretary shall closely function with the compliance function of the Bank. The company secretary must ensure that the management makes available the agenda items within the time frame stipulated by the board, its committees and the minutes of the meetings of the board as well as the committees of the board are recorded as per the professional standards required.

- The role shall be specific to the role expected of the Bank being an entity governed by the RBI while the rendering the role of a Company Secretary in view of the fact that the Bank is also a Company or body corporate. The roles, duties and reporting authority(s) shall be distinct.

- The performance assessment of such Company shall be undertaken by the NRC. (The Board has no role to play in it)

- The compensation shall be governed by the NRC along with the Audit Committee of the Board (ACB)

Secretarial Audit

- All banks including those not listed and/ or operating as branches shall undertake secretarial audit in line with provisions of section 204 of the Companies Act, 2013. Compliance guidelines being suggested in this discussion paper shall have to be considered as well.

- The Secretarial Audit report shall be made available to the Audit Committee of the Board (ACB). The ACB shall plug various gaps reported by the audit.

Comments are invited on or before 15th July 2020 and based on the feedback, fresh guidelines shall be issued. The new norms will come into effect within six months after being placed on the RBI’s website or April 1, 2021, whichever is later.

Observations / Comments

The immediate industry reaction to the proposed norms in the discussion paper has been with respect to limiting the tenure of the Chief Executive Officers (CEOs) and Whole Time Directors (WTDs). The Rules propose to limit the true of CEOS and WTDs to a maximum of 10 years (if the person id form the promoter group) and 15 years (if from non promoter group).

On the date of issuance of the directions on the matter by the Reserve Bank, it said, “banks with WTDs or CEO who have completed 10 or 15 years should be given two years or up to the expiry of the current tenure, whichever is later, to identify and appoint a successor”.

The fallout of this proposed norms will be immediately felt on two most prominent Banks in the Country – Kotak Mahindra Bank and HDFC Bank.

HDFC bank’s MD (who was the longest serving in office) will officially step down in October 2020. The bank has already submitted names of three prospective successors to the RBI and is awaiting approval.

However, the CEO of Kotak Bank, another longest serving CEO will have to be replaced once these norms are approved and in place.

Industry experts however are of the view that instead of limiting the tenure of those heading the Banks, it is prudent to take a call on each of their merits, expertise, and capabilities in heading the Banks.

The discussion paper by the RBI has been prompted by the downfall of the Yes bank in the last two years. Governance issues and failure to restructure the Management were key faux pas areas.

Not just in India, world over Banks are actively restructuring skills of Boards’, Board members and their responsibilities.

Be it the European Central Bank (ECB) or Commonwealth Bank of Australia (CBA), across Banks the new mantra is promoting sound governance practices, risk management practices strong risk-appetite, experienced qualified Board members, culture and accountability”

Banks in Spain, Germany, Italy and Finland are emphasising on building Boards that will be all round in enhancing a Bank’s performance

The objective of the RBI’s discussion paper is to align the current regulatory framework with global best practices while keeping in line with the domestic financial system. To this end, the discussion paper includes several suggestions – strengthening the Board, separating the ownership from management, empowering the governance of the Board. There have been several suggestions / guidelines relating to strengthening the various committees and also the exposure of the bank to risk. However, the most important suggestion has been to appoint a Company Secretary to ensure effective governance. Clearly the role of a Company Secretary is two-fold – comply with the Companies Act and related legislations with respect to the Bank as an entity – Company and also ensure the compliance functions of the Bank as under the Reserve Bank of India. An effective suggestion to ensure better Bank’s governance and also the role of a Company Secretary in the Bank.