Insolvency: Effect of Increase in Default Threshold

The Amendment:

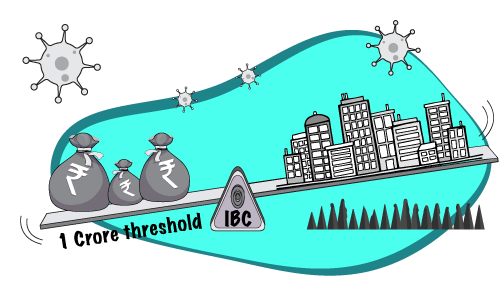

The ‘Default Amount’ to trigger insolvency proceedings has been increased to ₹1.00 crore.

Purpose stated:

To protect small companies from defaults due to coronavirus related lockdown.

Applicability:

The amendment applies not only to small companies but to all companies.

Effect:

The Amendment is prospective in nature. Therefore,

a. Cases already filed should be maintainable as such; and

b. Cases to be filed in future have to meet the revised minimum threshold.

c. Fresh filings before NCLT’s will reduce drastically. NCLT’s will be able to dispose cases in a quicker manner.

What to expect going forward

This is a Temporary Amendment in the context of the Finance Minister having stated that this is due to the coronavirus issue.

The threshold limit will therefore be amended once again going forward.

The Government was already contemplating an increase in the threshold even prior to the present Amendment. It is therefore possible that the Threshold limit may be different than the earlier limit of Rs.1.00 Lakh.

– P.S. Suman

Note:

This is general guide to the subject matter and is not to be construed as the opinion, view, advice, suggestions etc., of AKM. You should seek specialist advice on your specific circumstances.