Law Banning Private Cryptocurrency: In the Offing

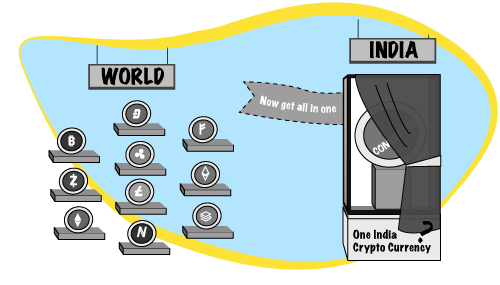

At the end of January 2021, the Indian government announced that it is mulling over banning private cryptocurrencies in India. Instead, it seeks to create an official digital currency issued (and consequently governed) by the Reserve Bank of India.

Until 2018, private and unregulated cryptocurrencies such as bitcoin were allowed to be traded privately. In 2018-19 budget, the government categorically stated that it does not consider cryptocurrency as legal and would take all measures to eliminate their use in their trading. The RBI notified that entities regulated by it could not deal with cryptocurrencies / virtual currencies.

A panel was set up to look into how the working of this niche virtual currency could be regulated and brought under the ambit of the RBI to prevent its possible misuse and such currency being used for illegitimate purposes (terror funding , money laundering etc)

The RBI policy banning the cryptocurrency was overruled by the Supreme Court in its order dated 5th March 2020. The order effectively lifted the ban on trading in virtual currency, cryptocurrency and bitcoins.

However, less than a year later, the government stated its intention to ban all such private cryptocurrency. The government has listed the proposed Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 for discussion / debate in the lower house of the Parliament. The Bill creates a facilitative framework for creation of the official digital currency to be issued by the Reserve Bank of India and prohibits all private cryptocurrencies in India.

While the Bill still in its formative stages, we look at key points:

- The bill seeks to prohibit all private cryptocurrencies in India. Cryptocurrency will be prohibited from being used as legal tender in India. Any form of issuing, buying, selling and or holding such currency shall be strictly prohibited.

- There may be some exceptions in order to promote the development, experiment and research of crypto technology and regulate its governance by the RBI.

- The bill is said to contain the manner and mode of declaration by existing holders of cryptocurrency and how it should be dealt with – reconciled or surrendered to central bank or disposed off. A timeline of 90 days is provided by the Bill for such transition.

- It is proposed to impose hefty fine or imprisonment or both on holders who hold it beyond the timelines mentioned in the Bill.

World over crypto currency is being used. Developed countries like the U.S, EU, Canada and Australia are among the developed nations that recognize the use of cryptocurrency especially the bitcoin. Developing nations like India hitherto banned cryptocurrency as it was not regulated by any government authority. The government was of the view that the virtual currency had no intrinsic value thus posing risk to its investors. Also, consequent to demonetisation, several fraudulent transactions came to light. This led to the RBI issuing a directive to all banks and other entities regulated by it to not entertain any cryptocurrency transactions.

Millions of dollars were invested and generated world over in the last couple of years. Back in India, there was sizeable investment after the SC order lifting the cryptocurrency ban. Despite the Covid 19 pandemic and the consequent lockdown impacting the economy, crypto / bitcoin industry saw a successful industry.

The proposed Bill is being awaited to see what it offers to legalize and regulate the cryptocurrency industry. One hopes for a win -win situation for both the crypto currency users and the regulator.