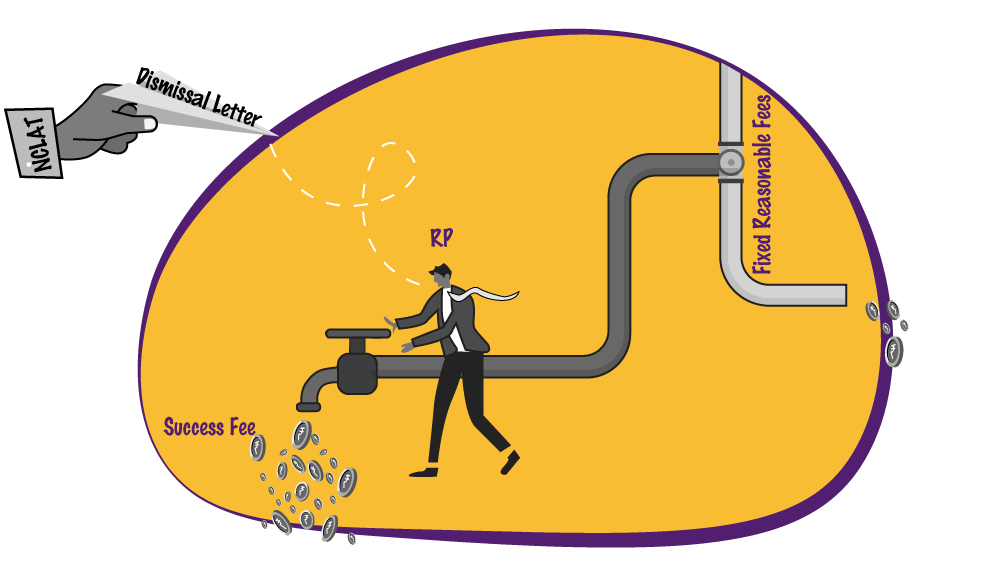

Success Fee: The Price For Insolvency Resolution?

In September 2021, the Principal Bench of the National Company Law Appellate Tribunal (NCLAT) expressed concern on the growing instances of ‘success fee’ being charged by resolution professional(s) on successful completion of the resolution process.

This observation was made while disposing off the appeal filed before the NCLAT by Mr. Jayesh Sanghrajka, the resolution professional (RP) of Ariisto Developers Private Limited. (Company Appeal (AT) (Insolvency) No. 392 of 2021).

In the Ariisto Developers case, while approving the resolution plan submitted by the successful applicant, the Adjudicating Authority (NCLT, Mumbai) disagreed with the Committee of Creditors (CoC) for approving a “success fee” to the resolution professional fee amounting to Rs. 3 Crores.

The Adjudicating authority was of the view that Rs. 3 crores as success fee to the RP was exorbitant, unreasonable and included in the resolution plan as an afterthought based on the approval of the resolution plan. On these grounds, the Adjudicating Authority directed the CoC and the RP to proportionately redirect the amount of Rs. 3 crores to be distributed between employees, underpaid operational creditors/ unsecured creditors of the corporate debtor.

The resolution professional (RP) filed the above appeal against the observations and findings of the Adjudicating Authority.

The Adjudicating Authority appointed an Amicus Curiae in the matter to analyse the issue of whether the ‘success fees’ could be charged, and the manner in which it has been charged.

The RP contended that success fee was a commercial decision of the CoC and the Adjudicating Authority cannot look into this aspect as it is part of the commercial wisdom of the CoC. He further submitted that the fee was for the various efforts were made by the RP including ascertaining and safeguarding total debt of the corporate debtor, convening meetings / hearings of the CoC and co-ordinating with different classes of stakeholders and harmoniously resolving their issues. Counsel for the RP further submitted that the IBBI vide its circular dated 12.06.2018 bearing No. IBBI/IP/013/2018 on “fee and other charges during the CIRP” made it permissible to charge success fee.

The Amicus Curiae submitted in detail that:

- There is no express provision under the IBC or its Rules for the grant of the success fee. He stated that section 5 (13) of the Code contains that the fees payable to resolution professional and any costs incurred by the resolution professional in running the business of the corporate debtor as a going concern is considered as “insolvency resolution process costs”.

- The First Schedule of Insolvency Regulations 2016 states that an insolvency professional must provide services for remuneration which is charged in a transparent manner, is a reasonable reflection of the work necessarily and properly undertaken, and is not inconsistent with the regulations. The regulations are based on reasonableness. Though the Code or Regulations do not quantify fee, it is implied that the fee must be reasonable.

- The RPs fee is discussed, fixed and approved in a transparent manner in the first meeting where the RP is appointed. It is against against transparency if at the last moments when Resolution Plan is being approved higher amounts as fees are squeezed in it and then to hide behind Resolution Plan.

- A harmonious reading of the provisions of the Code and Regulations makes it clear that the fee charged by resolution professional and the manner /mode of payment shall be approved by the CoC by prescribed majority, be a reasonable reflection of work undertaken by the RP, be disclosed item wise and RP shall take all care and diligence in performing his duties.

- The IBBI Circular dated 12.06.2018 only seeks to guide the stakeholders as to what could constitute “reasonable” in the matter of charging fees. It does not provide, prescribe, recommend, promote, endorse or sanctify payment of success fees. The IBBI cannot, by way of a circular, provide for charging success fees when no such provision exists in the regulations. The IBBI circular is only a statement of best practices.

- The Code and the Regulations do not contain express provisions for quantifying the fee. However, the quantum of fees payable is a subject which is justiciable before the Adjudicating Authority if it is found to be unreasonable and if the manner, method of payment is inconsistent with the Regulations.

- There are decided case laws to the effect that Adjudicating authority does not have the authority to question the commercial wisdom of the CoC. But these cases did not bar the jurisdiction of the Adjudicating Authority to review the quantum of fee approved by the CoC. Fees unreasonably high or low or disproportionate can be looked into by the Adjudicating Authority.

After considering the above submissions, the NCLAT held that ‘success fees’ is more contingency and speculative in nature. It is not part of the provisions of the IBC and the Regulations and the same is not chargeable. Accordingly, the appeal of the resolution professional was dismissed.