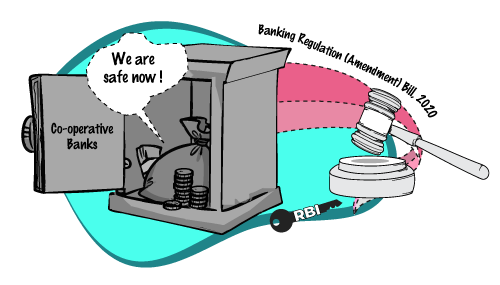

The Banking Regulation (Amendment) Bill, 2020

In the first week of March 2020 (few weeks before the country came to a standstill due to the covid-19 epidemic), Hon’ble Finance minister introduced in Lok Sabha “The Banking Regulation (Amendment) Bill, 2020” to amend the Banking Regulation Act, 1949. The amendments primarily focused on co-operative banks. A look at the salient features of the proposed amendments:

Objective:

The objective of the Banking Regulation (Amendment) Bill 2020 is to improve governance, promote effective regulation and management of Co-operative Banks.

Amendments – inclusion of provisions:

- The amendments seek to bring co-operative banks under the ambit of the Reserve Bank of India (RBI). The administration of co-operative banks will continue to be guided by the Registrar of Co-operatives.

- The Bill expressly states that the amendments shall not apply to (i) primary agricultural credit societies, (ii) cooperative societies whose principal business is long term financing for agricultural development and (iii) any other cooperative societies (except those specified in the Act). The RBI may exempt a cooperative bank or a class of cooperative banks from certain provisions of the Act through notification.

- The amendments provide that subject to prior approval of the RBI and any other conditions as may be specified by it, a cooperative bank may issue equity shares, preference shares, or special shares on face value or at a premium to its members or to any other person residing within its area of operation.

- The Amendments expressly state that in cases where public interest or depositor interest is involved, the RBI has the power to supersede the functioning of Board of Directors of a Co-operative bank for up to a period of 5 years. If a Cooperative bank is also registered with the Registrar of Cooperatives, then, after consultation with the concerned State government, the RBI can supersede the Board of Directors for specified period of time.

- A co-operative bank may issue unsecured debentures or bonds or similar securities with maturity of ten or more years to such persons.

- A co-operative bank cannot withdraw or reduce its share capital, except as specified by the RBI.The Bill states that no person will be entitled to demand payment towards surrender of shares issued to him by a co-operative bank.

- The amendments omits provisions from relating to restriction on cooperative banks from making loans or advances on the security of its own shares, grant of unsecured loans or advances to its directors, and to private companies where the bank’s directors or chairman is an interested party.

Amendments – omission of existing provisions:

- The amendments omit provisions relating to pre-conditions for unsecured loans or advances to be granted by cooperative banks and the manner in which the loans may be reported to RBI.

- The amendments omit provisions relating to obtaining permission of the RBI by a co-operative bank for opening new place of business or change in location of the Bank outside the city, town or village where it is presently located.

- The amendments omit provisions requiring co-operative banks to maintain assets with a value not exceeding 40% of its total demand and liabilities within India.

Conclusion

The proposed amendments to the Banking Regulations (Amendment) Bill 2020 by brining co-operative banks under the RBI ambit is primarily with objective of protecting interests of small depositors. The amendments are aimed at increased professionalism, easier access to capital and sound banking practices.With over 1,500 co-operative banks and almost 9 crore small depositors, the amendments are very much the need of the hour to ensure there is no repeat of the Punjab and Maharashtra Co-operative Bank (PMC bank) scam.