Hyderabad based Bharat Biotech has been in the forefront of developing an intra nasal spray vaccine (BBV154) as an alternate to the existing Covid vaccine injections.

Rebuilding Hope

As of June 2021, the total vaccines administered in India across all age groups crossed 33 crores. That is approximately the size of USA. A mammoth task for any developing nation of India’s size. A challenge that India is taking head on. As States and economies opened up consequent to decline in Covid cases, Indian start-ups were doing brisk business raising a record $12 billion during the second wave of the pandemic. Governments go about their business optimistically amidst prediction for a possible third wave. It is with the same optimism that we bring to our esteemed readers, this edition of the Law Tree.

Covid Combat

Making The Difference

An intranasal vaccine stimulates a broad immune response at the site of infection – nasal passage which is essential for blocking both infection and transmission of COVID-19. Scientists say this will minimise the virus load in the body as studies show that Covid virus first enters through the nasal cavity before spreading to other parts of the body including lungs.

A nasal spray is an oral / external application. There is no need to use a needle. Hence it can be easily self-administered by adults and children. Trained healthcare workers are not needed to administer this spray.

In September 2020, Bharat Biotech signed an agreement with Washington University School of Medicine, St. Louis, for working on the vaccine. Pre-clinical trials of the vaccine began in March 2021. Final phase of trials are expected to be completed by June 2021. Subject to favourable result, the intra nasal spray vaccine is expected to be made available in India by August 2021.

Being indigenously developed / made in India, it will be easily accessible to our population. Besides, it will ease the burden on our fragile health care system. Equipment such as needles, syringes will not be required thus causing lesser medical waste. Large scale vaccination drive will be the beginning of the end of the pandemic. The intranasal spray vaccine will truly be a game changer in more ways than one.

Insights

Securities Contracts Regulations Rules 2021

On 18th June 2021, the Ministry of Finance notified a new set of rules – Securities Contracts (Regulation) (Amendment) Rules, 2021 to amend the Securities Contract (Regulation) Rules 1957.

The Securities Contracts (Regulation) Act, 1956 (SCRA) was enacted to prevent undesirable exchanges in securities and to control the working of stock exchange in India. The Rules aid the compliance of the Act.

The Securities Contracts (Regulation) Rules were first enacted in 1957 and contain provisions that govern the stock exchanges – from applying to be listed on stock exchanges, qualifications for being listed on a stock exchange, renewal, obligations, audits of members listed on stock exchanges, inquiry, investigation, delisting and other compliances. The rules were amended from time to time in keeping pace with the changing economic environment.

In light of the latest amendments, we bring you an insight into all provisions of SCR Rules while highlighting the amendments.

IBC Cases

A monthly update of the most significant cases on insolvency and bankruptcy and its resolution

What's Brewing

Amendments to E-Commerce Rules 2020

On 23rd July 2020, the Central government notified the Consumer Protection (E-Commerce) Rules, 2020 in order to regulate all commercial transactions such as sale of goods and services on an electronic or digital network by retailers in India or overseas to consumers in India.

In June 2021, the Ministry of Consumer Affairs, Food and Public Distribution (Department of Consumer Affairs) proposed amendment to the E-Commerce Rules 2020. This article highlights the proposed amendments.

Circulars & Notifications

June 04, 2021

Payment of margins for transactions in Government Securities by Foreign Portfolio Investors

June 04, 2021

Submission of returns under Section 31 of the Banking Regulation Act, 1949 (AACS) – Extension of time

June 07, 2021

Transactions in Government securities by Foreign Portfolio Investors: Reporting

June 11, 2021

Risk Based Internal Audit (RBIA)

June 14, 2021

Bharat Bill Payment System – Addition of Biller Category

June 14, 2021

Investment in Entities from FATF Non-compliant Jurisdictions

June 17, 2021

Liberalised Remittance Scheme for Resident Individuals – Reporting

June 23, 2021

Gold (Metal) Loans – Repayment

June 24, 2021

Declaration of dividends by NBFCs

June 25, 2021

Reserve Bank of India (Call, Notice and Term Money Markets) Directions, 2021

June 25, 2021

New Definition of Micro, Small and Medium Enterprises

June 28, 2021

Guidelines for Managing Risk in Outsourcing of Financial Services by Co-operative Banks

Circulars

June 03, 2021

Circular on Enhancement of Overseas Investment Limits

June 04, 2021

Centralized Database for Corporate Bonds/ Debentures

June 18, 2021

Framework for administration and supervision of Investment Advisers under the SEBI (Investment Advisers) Regulations, 2013

June 18, 2021

Norms for investment and disclosure by Mutual Funds in Derivatives

June 25, 2021

Circular on Prudential norms for liquidity risk management for open ended debt schemes

June 25, 2021

Circular on Amendment to SEBI (Alternative Investment Funds) Regulations, 2012

June 30, 2021

Relaxation in timelines for compliance with regulatory requirements

Nil

Income Tax Notifications

June 08, 2021

Income-tax (17th Amendment) Rules, 2021

June 09, 2021

Establishment of Competition Commission of India

June 15, 2021

Amendment to the Notification vide S.O No. 1790(E), dated the 5th June, 2017

June 22, 2021

Compliance-check-functionality

June 25, 2021

Tax Policy and Legislation Division Note

June 25, 2021

Amendment to the Notification No.85/2020

Income Tax Circulars

June 21, 2021

Circular regarding use of functionality under Section 206AB and 206CCA of the Income-tax Act, 1961

June 25, 2021

Extension of time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic

June 30, 2021

Guidelines under section 1940 of the Income-tax Act, 1961

(A) Central Tax Notifications

June 01, 2021

Extend the due date for FORM GSTR-1 for May, 2021 by 15 days.

June 01, 2021

Provide relief by lowering of interest rate for a specified time for tax periods March, 2021to May, 2021.

June 01, 2021

Rationalize late fee for delay in furnishing of the statement of outward supplies in FORM GSTR-1.

June 01, 2021

Rationalize late fee for delay in filing of return in FORM GSTR-4.

June 01, 2021

Rationalize late fee for delay in filing of return in FORM GSTR-7.

June 01, 2021

Extend the due date for filing FORM GSTR-4 for financial year 2020-21 to 31.07.2021.

June 01, 2021

Extend the due date for furnishing of FORM ITC-04 for QE March, 2021 to 30.06.2021.

June 01, 2021

Make amendments (Fifth Amendment, 2021) to the CGST Rules, 2017.

June 30, 2021

Waive penalty payable for non-compliance of provisions of Notification No. 14/2020 dated 21st March 2020

(B) Central Tax (Rate) Notifications

June 02, 2021

Amend notification No. 1/2017-Central Tax (Rate) to prescribe change in CGST rate of goods.

June 14, 2021

Seeks to provide the concessional rate of CGST on Covid-19 relief supplies, up to and inclusive of 30th September 2021

June 14, 2021

Corrigendum

(C) Circulars under Central Goods and Service Tax

June 17, 2021

Clarification regarding applicability of GST on supply of food in Anganwadis and Schools

June 17, 2021

Clarification regarding GST on supply of various services by Central and State Board (such as National Board of Examination)

June 17, 2021

GST on milling of wheat into flour or paddy into rice for distribution by State Governments under PDS

June 17, 2021

ST on service supplied by State Govt. to their undertakings or PSUs by way of guaranteeing loans taken by them

June 17, 2021

Clarification regarding GST rate on laterals/parts of Sprinklers or Drip Irrigation System

(D) Integrated Tax Notifications

June 01, 2021

Provide relief by lowering of interest rate for a specified time for tax periods March, 2021 to May, 2021.

(E) Integrated Tax (Rate) Notifications

June 02, 2021

Amend notification No. 1/2017- Integrated Tax (Rate) to prescribe change in CGST rate of goods.

June 14, 2021

Provide the concessional rate of IGST on Covid-19 relief supplies, up to and inclusive of 30th September 2021.

June 14, 2021

Corrigendum

(F) Union Territory Tax Notifications

June 01, 2021

Provide relief by lowering of interest rate for a specified time for tax periods March, 2021 to May, 2021.

(G) Union Territory Tax (Rate) Notifications

June 02, 2021

Amend notification No. 1/2017- Union Territory Tax (Rate) to prescribe change in CGST rate of goods

June 14, 2021

Provide the concessional rate of UTGST on Covid-19 relief supplies, up to and inclusive of 30th September 2021.

June 14, 2021

Corrigendum

(H) Tariff Notifications

June 14, 2021

To rescind notification No. 30/2021-Customs, dated 01.05.2021.

(I) Non – Tariff Notifications

June 03, 2021

Exchange rates Notification No.51/2021-Cus (NT) dated 03.06.2021

June 07, 2021

Appointment of CAA by Pr. DGRI

June 15, 2021

Tariff Notification in respect of Fixation of Tariff Value of Edible Oils, Brass Scrap, Areca Nut, Gold and Silver- Reg

June 16, 2021

Tariff Notification in respect of Fixation of Tariff Value of Edible Oils- Reg

June 16, 2021

Corrigendum

June 17, 2021

Exchange rates Notification No.54/2021-Cus (NT) dated 17.06.2021- Reg

June 23, 2021

Appointment of CAA by Pr. DGRI

June 30, 2021

Fixation of Tariff Value of Edible Oils, Brass Scrap, Areca Nut, Gold and Silver - Reg.

June 30, 2021

Seeks to amend Sea Cargo Manifest and Transhipment Regulations 2018.

(J) Anti-Dumping Duty Notifications

(K) Circulars

June 30, 2021

Implementation of the Sea Cargo Manifest and Transhipment Regulations.

(L) Instructions

June 21, 2021

Regulating movement of Indian sailing vessels

MHA instruction dated 18-02-2021

June 21, 2021

CRCL module- forwarding of samples using electronic test memo to CRCL and other test laboratories – reg

June 30, 2021

Requirement of COVID -19 testing in live animals before importing into India-reg

The Verdict

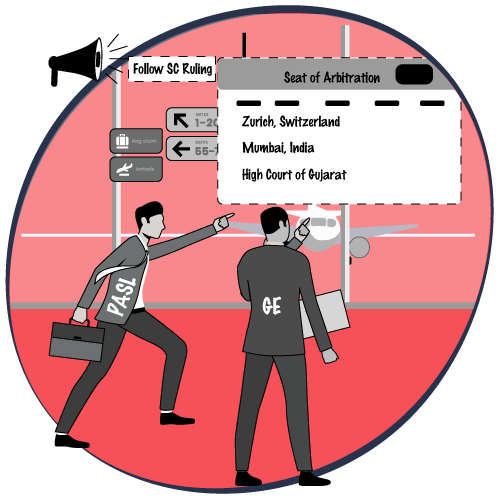

The liberty of Party Autonomy in Arbitration Act 1996

In April 2020, a three Judge bench comprising Justice Rohinton Fali Nariman, Justice B.R. Gavai, and Justice Hrishikesh Roy ruled that it is not violative of the public policy of India for two Indian national parties to designate a seat of arbitration outside India. A look at this verdict which has significant bearing on Arbitration.

Apex Rulings

Apex Rulings look at the Supreme Court Judgments that have profound bearing on the society.

Go Figure

The Start-up Ecosystem &

Its Related Statistics

Lawtitude

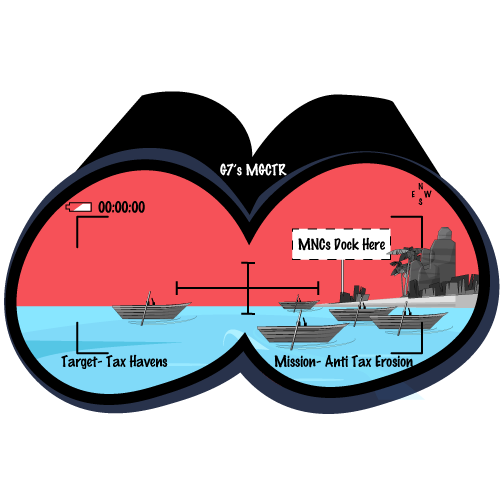

Minimum Global Corporate Tax Rate:

A Win-Win Situation?

In a recent move, G-7, an inter-governmental political forum consisting of seven countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) has backed the idea of introducing a Minimum Global Corporate Tax Rate (MGCTR) of at least 15% which is certainly a landmark moment in the International Tax Policy. Mostly these countries fall under the category of advanced economies and therefore, the Finance Ministers of these nations have expressed a sincere need to ensure standardization of taxation of multinational companies with the aim to counter tax avoidance or tax erosion.

Legal-ease

in pari causa

Refers to a case where all parties stand equal in right according to law

jus tertii

It is a right of a third party (as to property in another's possession). Can also refer to the right to assert the rights of another in a lawsuit

libel

A defamatory statement, depiction or representation which is especially in the form of written or printed words. In particular libel refers to a false published statement that injures an individual's reputation or otherwise exposes him or her to public contempt.

knock and announce rule

Basically a rule of criminal procedure that requires the police to announce their authority and purpose before entering a premises in execution of a search or arrest warrant unless special circumstances (as risk of harm to the police) warrant unannounced or forcible entry.

Infographic

The Win-Win Legal Mechanisms

Lawlipop

Independence Day

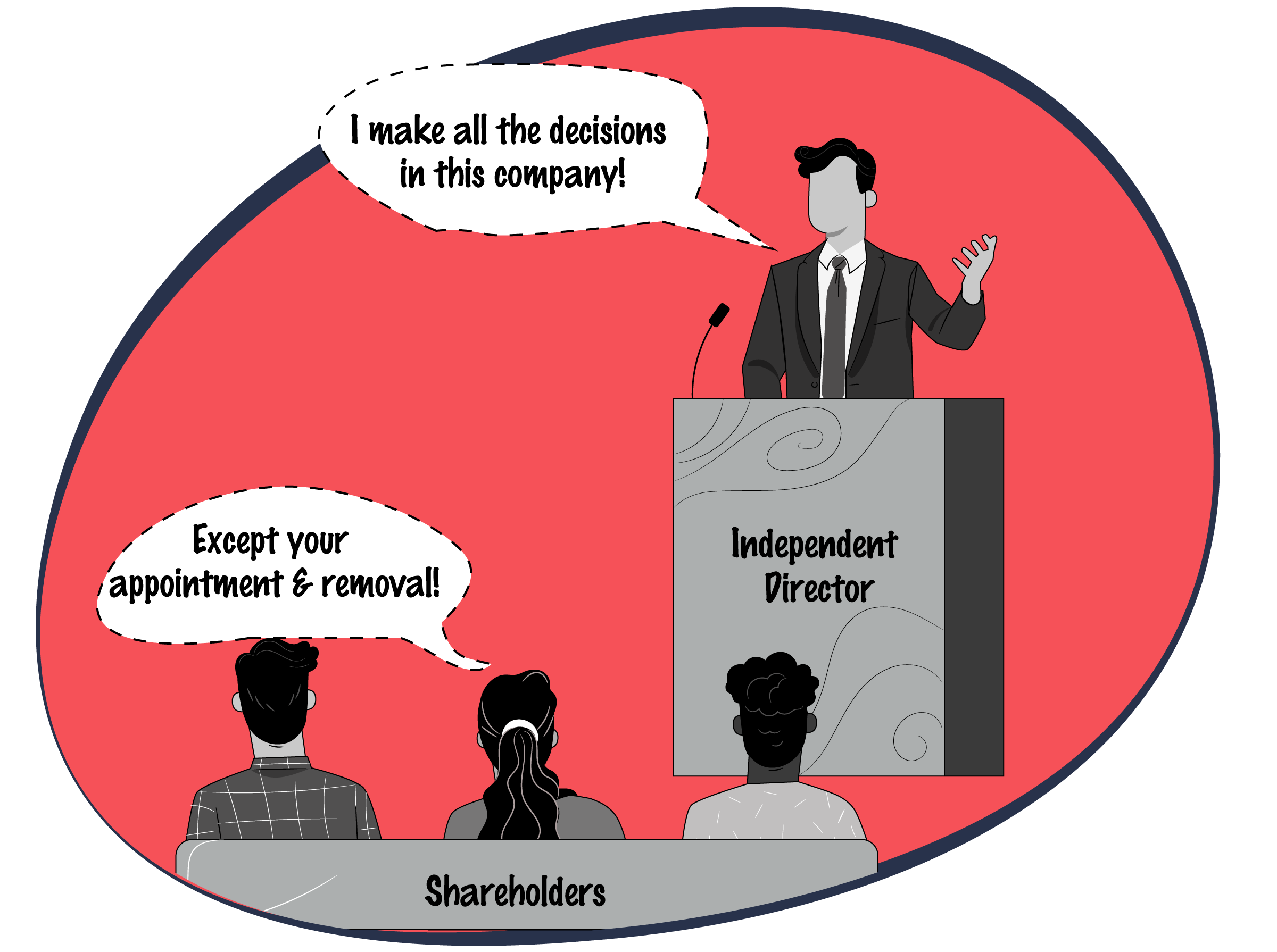

Companies to disclose resignation letters of independent directors to SEBI

No D(is)P(lay)

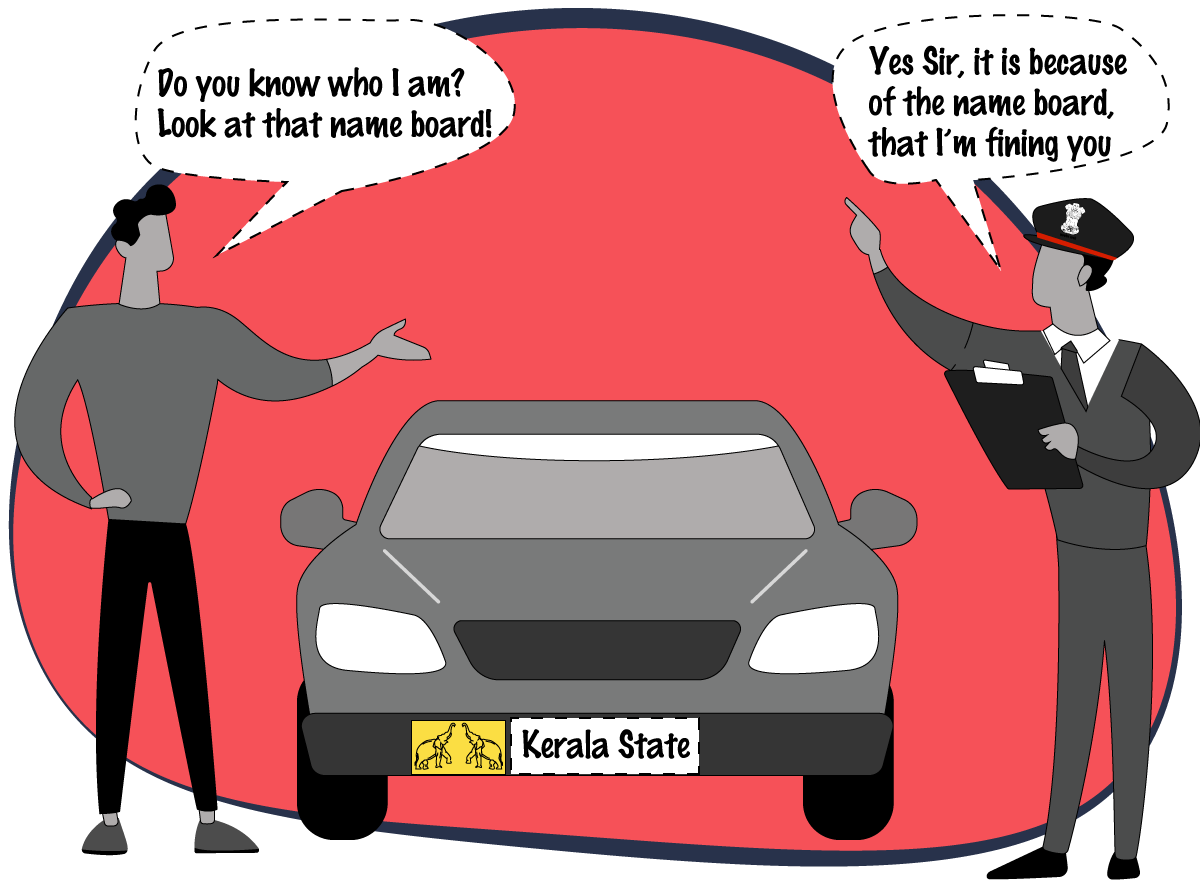

Law Officers & Central Govt Counsel Can’t Display Name Of Court in the name boards of their Vehicles : Kerala High Court

(P)Review

Movie

Trial by Fire (2018)

The American movie is biographical drama based on the real-life story of Cameron Todd Willingham.

In December 1991, Willingham (played brilliantly by Jack O Connell), sleeping in his modest Texas home is woken up by his young daughter’s screams only to realize that the house was up in flames. At that time only Willingham and his daughters are at home. His wife Stacy is out for Christmas shopping. Unfortunately, he is not able to save his daughters and they die in the ravaging fire. Willingham escapes with minimal burn injuries.

Two weeks later Willingham is arrested for causing arson and killing his young daughters. Unable to afford lawyers, the State assigns him legal help. However, arson investigating experts and the prosecution is able to prove that the pattern of fire was not natural. The investigating team concludes that some liquid accelerant was used to deliberately fuel the fire. A refrigerator is also found moved to block the door. Willingham’s own violent and criminal past coupled with testimonies from neighbours and prison inmate makes the case airtight. Willingham is offered a reduced sentence of life imprisonment (as against death) if he pleaded guilty of committing the crime. Willingham does not agree to plead guilty. He is sentenced to death.

Even as he gets used to cruel prison life, he begins learning and writing and eventually reaches out a letter to playwright Elizabeth Gilbert (played by Academy winning actress Laura Dern). She is sympathetic towards him even as the rest of the world has concluded on his guilt. She slowly begins questioning witnesses and believes that Willingham is not guilty of causing arson and killing his young daughters. Despite her best efforts, she is unable to save him from being executed.

Willingham refused to plead guilty until his execution and filed several appeals unsuccessfully Willingham was administered lethal injection in February 2004.

Years after his execution, controversy arose on the guilty verdict handed over to Willingham and the interpretation of evidence by the arson forensic investigation team. Firstly, the arson theory was rubbished. The testimony of a fellow jail inmate of Willingham was also questioned as he was found to be suffering from bipolar disorder and hallucination. A tattoo of a skull and serpent on Willingham’s shoulder indicated that he was a sociopath as testified by a psychiatrist. All these confirmed that the investigation was not objective and there was no scientific evidence of arson. But Willingham was dead. Truth was ravaged by fire?

Book/Novel

A Covenant With Death

by Stephen Becker (1961)

Louise Talbot is a beautiful and flirtatious woman married to Bryan Talbot. All men in the small town of New Mexico lust after her. She is found dead outside her home one evening. When the investigation uncovers her affair with another man, her husband Bryan is the obvious prime suspect for having murdered her in a fit of rage and jealousy.

29-year Ben Lewis is appointed as a Judge by the Governor as an act of gratitude to Ben’s father for saving his life many years ago. Ben, fighting with his own personal demons and inexperienced to handle the case nearly concludes that Bryan Talbot is guilty of murdering his wife. However, a twist of incidents makes Ben question Bryan’s guilt. Ben must serve justice while deciding on the guilt or otherwise of a man. A thrilling suspense.

TV Series

American Crime Story (2016-2019)

An American anthology series on true crime stories, the American crime story features some of the most high-profile cases – from OJ Simpson double murder case, the Gianni Versace case, the Clinton impeachment case. In each of this case, the prosecution and defence arguments and legalese are explored besides offence / crime and its morality.