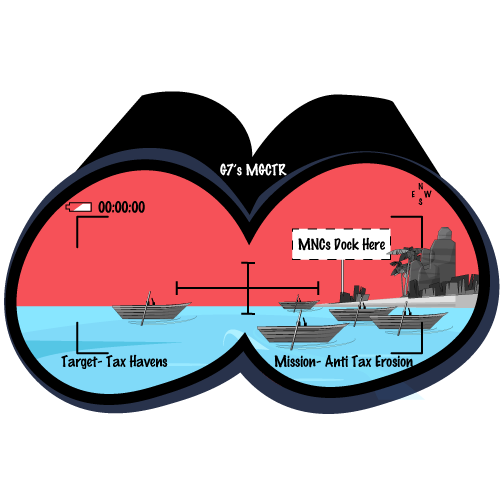

Minimum Global Corporate Tax Rate: A Win-Win Situation?

In a recent move, G-7, an inter-governmental political forum consisting of seven countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) has backed the idea of introducing a Minimum Global Corporate Tax Rate (MGCTR) of at least 15% which is certainly a landmark moment in the International Tax Policy. Mostly these countries fall under the category of advanced economies and therefore, the Finance Ministers of these nations have expressed a sincere need to ensure standardization of taxation of multinational companies with the aim to counter tax avoidance or tax erosion. In the words of U.S. Treasury Secretary Janet Yellen, this historic deal can end a “30-year race to the bottom on corporate tax rates”.1

The current proposal is legally non-binding as the G-7 forum is informal in nature and does not have the mandate of all the nations. However, a certain political influence can be symphonized which can further lead to matters of debate. The G-7 forum has decided to discuss the MGCTR proposal during the G-20 Financial Ministers and Central Bank Governors meeting which is scheduled to take place in July, 2021. It has sought to discuss it thoroughly there so as to gain broader support on this moot point. G-20 consists of countries with the most powerful economies including India, China, Saudi Arabia, European Union, etc.2

What is inside the Deal?

Two major agreements that have been approved are firstly, to force multinationals to pay taxes where they operate and secondly, to incorporate a global minimum corporate tax rate of 15% to avoid countries undercutting each other. As reported by Reuters3 who have seen the communique from G-7 Finance Ministers, the underlying objective is to “commit to reaching an equitable solution on the allocation of taxing rights, with market countries awarded taxing rights on at least 20% of profit exceeding a 10% margin for the largest and most profitable multinational enterprises by providing for appropriate coordination between the application of the new international tax rules and the removal of all Digital Services Taxes, and other relevant similar measures, on all companies”.

Benefits of Minimum General Corporate Tax Rate

Certainly, implementation of MGCTR can overrule the concept of tax erosion to a greater level. The recent trend states that most of the multinationals use their web of subsidiary networks to shift the profit earned from major economies to those states which have low-tax rates or are also known as tax haven countries such as Panama who is one of the famous tax-havens.4 It is because Panama imposes no corporate or income taxes on offshore entities that only engage in business outside of the jurisdiction.5 So basically, these multinationals earn the profit from by selling their products in most of the countries but avoid paying taxes to them and rather conceal the same through diverting the profit to low-tax countries so that their profit earned is taxed at a low percentage. Even more, income from intangible sources such as drug patents, software, and royalties on intellectual property has migrated to these jurisdictions, allowing companies to avoid paying higher taxes in their traditional home countries.

Through implementing MGCTR, tax havens would be bound to enforce a minimum level of taxation on these corporates irrespective of whether the sale was made there or not. However, the percentage rate can still vary from country to country but eventually; the multinationals would have to pay at least 15%. It is because even if a company chooses a nation where the tax rate is low and somehow pays lower rates of tax in that country, the home country where the corporate is established can charge “top-up” taxes to the minimum rate, eliminating the advantage of shifting profits. Thereby, adopting minimum taxation can avoid the disparity of taxation and shall also lead to the regaining of hundreds of billions of dollars of tax revenues to the home country which are currently dipped into losses caused by unprecedented pandemic expenditure. As per one of the reports, a minimum tax with a 15 percent rate would raise roughly $70 billion in new tax revenues according to an analysis by economists at the OECD.6

Effect of The Deal and Conclusion

The measure is suspected to benefit the advanced economies and those economies which already have a high corporate tax rate. On the other hand, this proposal has brought certain disappointment to low-tax countries and countries which are a tax haven. There is a risk that these multinationals would now avoid setting up in these jurisdictions as they would apparently have to pay taxes in all circumstances. This could result in weakening the business incentives to invest cross-borders, therefore negatively affecting the economies of low-tax nations.

However, it has been also seen that this is an attempt by the US to mould the international tax rules in its favour. Nonetheless, the action plan is yet on a base level and has to qualify lot of stages before it turns out to be a worldwide agreement where more than 125+ countries have to accept it. First step is to negotiate before G-20 where countries like China, Brazil, India who are part of G-20 will be hesitant in accepting this agreement on its face and may ask for certain concessions. Moreover, the USA has demanded to even abolish digital service taxes which it is predicted that it will be a problem for countries like India who would the potentially have to drop equalising levy which it currently charges on consideration received/receivable by an e-commerce operator on certain transactions.7

It is necessary that the interest of all the stakeholders should be balanced while making such a proposal. Proper negotiation should be done on coming to any certain rate of taxation percent. Additionally, exemptions should also be discussed in detail so that adverse impact on employment rates can also be calculated. MGCTR can be a step towards global tax reformation and limiting the pitfalls of globalization. Nonetheless, it is a long journey of negotiations and consent with a hope of international agreement.

References