Moratorium Under IBC: Not For Directors / Management

The Latest

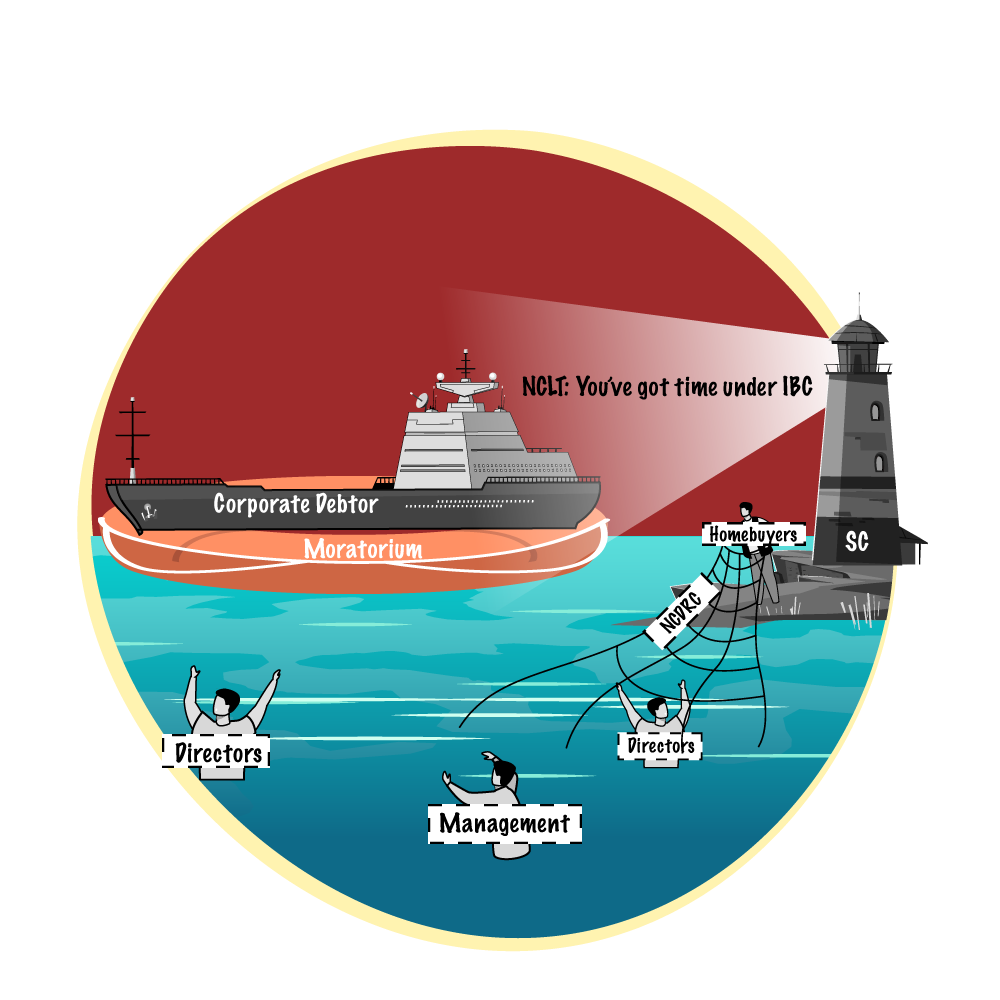

On 16th September 2021, the Supreme Court ruled that moratorium u/s 14 of the IBC applies only to the corporate debtor. It does NOT apply to the directors / management of the corporate debtor.

This implies proceedings against directors/management could continue despite moratorium u/s 14 of IBC being in place for the corporate debtor.

The Hon’ble Supreme Court passed this ruling while hearing the case of Anjali Rathi and Others Vs Today Homes & Infrastructure Pvt. Ltd. and Others SLP (C) No. 12150 of 2019.

The Case

The case pertained to a group of home buyers (Anjali Rathi ten others) who entered into agreements with the builder/ developer (Today Homes) in Gurgaon for purchase of apartments. The clauses of the agreement indicated that the home buyers will get possession of their respective apartments by 2014. However, they did not get possession even in 2018. In fact, they alleged that the construction was abandoned by the developer.

As a result, in July 2018, the petitioners approached the National Consumer Dispute Redressal Commission (NCDRC). The Commission ordered the developer to refund the principal amount along with interest for failure to hand over possession with a 4-week period.

In September 2018, the petitioners-initiated execution petition u/s 25and 27 of the Consumer protection Act against the developer for failure to comply with the order of the NCDRC. A similar set of execution petitions were filed by another group of home buyers against the builder. The developer challenged this set of execution petitions in the Delhi HC which granted a stay against the execution petition. In the meanwhile, some settlement terms were offered by the developer and hence the execution petitions were adjourned. Such settlement terms were not acceptable to home buyers and in March 2019, the Managing Director of the developer was asked to appear personally before the NCDRC.

The MD of the developer filed a petition in the Delhi HC challenging the NCDRC order requiring his personal appearance / presence. In March 2019, the Delhi HC passed an order directing no action / coercive steps be taken against the MD in this regard.

Consequently, the home buyers preferred a special level petition (SLP) before the Hon’ble Supreme Court. In April 2019 the NCDRC passed an order directing the developer to refund the entire amount with interest and on failure to do so, taking into custody the director and attaching the developer’s properties and the directors’ properties. It further stated that the NCDRC order will be given effect only after the outcome of the petition filed by the developer in the Delhi HC. The home buyers filed appeals against this order of the NCDRC pertaining to appearance of the MD and his liability.

In September 2019, the Hon’ble Apex Cout stayed the order of the Delhi HC (asking for director not to be proceeded upon). Also 7 out of the 11 home buyers settled their dispute with developer. The remaining were likely to be settled.

In October 2019, an operational creditor initiated an insolvency petition against the developer under the Insolvency & Bankruptcy Code (IBC). The petition was admitted, and moratorium was initiated u/s 14 on the developer. A group of other home buyers filed an SLP in the Supreme Court challenging the order of the NCLT. The ground of challenge – the NCLT order initiating moratorium stalled the refund of monies to the home buyers as per the NCDRC order.

The home buyers formed a consortium, and their resolution plan was approved by the Committee of Creditors (CoC) and submitted for approval by the Adjudicating Authority u/s 31 (1) of the IBC. The counsel appearing for the petitioner argued that since settlement was arrived at, the promoters the developer / corporate debtor (Today Homes), should be made personally liable to honour such settlement arrived at.

While dealing with this matter, the Hon’ble Supreme Court expressly observed that since moratorium was initiated u/s 14 of the IBC, no new litigation shall be initiated against the developer / corporate debtor. However, they also pointed out that the provisions of section 14 of IBC relating to moratorium are applicable only to the corporate debtor and NOT in respect of the directors/management of the Corporate Debtor, against whom proceedings could continue. The Apex court stated that the petitioners have the liberty to seek recourse of remedies which are available in law after the Adjudicating Authority’s decision on approval of the resolution plan u/s 32(1) of the IBC.

Precedence

This is not the first case in which such judgment was pronounced.

In the case of P. Mohan vs Shah Bros. Ispat (P)Ltd. (2021) 6 SCC 258, a 3-Judge bench of the Supreme Court held that proceedings u/s 138 and 141 of the Negotiable instruments Act can be initiated or continued against the persons mentioned in Sections 141(1) and (2) of the Act. It is clear that the moratorium provision contained in Section 14 IBC would apply only to the corporate debtor, the natural persons mentioned in Section 141 continue to be statutorily liable under Chapter XVII of the Negotiable Instruments Act.

In the case of Ayan Mallick & another Vs State Bank of India & others W.P.O No. 23 of 2021, Calcutta High Court held that section 14 contemplates a moratorium in respect of all proceedings against the corporate debtor as it would conflict with decisions taken by the resolution professional in managing the affairs of the corporate debtor. Hence no proceedings can be instituted against the corporate debtor after moratorium in initiated. However, the same is not applicable for directors / promoters / management of the corporate debtor. The role of directors ceases after the commencement of the CIRP as powers of managing the corporate debtor is handed over to the IRP. Hence the moratorium applicable to corporate debtor will not extend to the directors.

Existence of Corporate Veil

The latest case re-affirms the existence of corporate veil. It is a reiteration that the promoters/ directors / management cannot enjoy the immunity that moratorium offers. That is available only to the corporate debtors, not their promoters / directors / management.