Technology

The Covid19 pandemic and the resultant lockdowns / quarantine made everything and everyone and go online. Work from home, study from home and just staying home ensured that everything became accessible online.

Like in Olympics 2020, the Paralympics saw Indians creating history yet again with a 19-medal haul – 5 gold, 8 silver and 6 bronze. From table tennis and badminton to high jump, javelin, discuss throw and shooting, our athletes have proved that disability is only a state of mind! The Covid 19 pandemic crippled the world. Yet a few industry sectors prospered. Let's see what The Law Tree Edition 72 has to offer.

The Covid19 pandemic and the resultant lockdowns / quarantine made everything and everyone and go online. Work from home, study from home and just staying home ensured that everything became accessible online.

Food Tech

Though the initial lockdown adversely impacted the food delivery industry due to apprehensions of safety and health, this sector turned around quickly as the lockdown eased. Delivery services such as Zomato and Swiggy saw their revenue grow 5 times during the pandemic. Innumerable cloud kitchens sprang up across the country. The two waves of the pandemic have made consumers apprehensive of eating out. Instead, they continue to order in from the comfort of their homes. Food tech has seen big gains.

Ed-Tech

The lockdown has effectively kept students home bound since 2020. Education systems moved online seamlessly. Education at every stage from play groups up to research and beyond became online through various learning portals. While education through technology was already present in India for a decade prior, the pandemic accelerated the ed tech industry like never before. Online learning caters to a larger number of students at comparatively lower costs making it a convenient and economically viable option. Byjus, the first and most valuable ed tech in India is a unicorn in educational sector. Great learning, Vedantu, Toppr and other educational platforms earned phenomenal revenues during lockdown despite offering some of their services free to the students.

Online audio video conferencing

Online audio – video conferencing is the new normal of communication. Be it a business meeting, or a family gathering, or an interview or schooling, virtual is the new real. Though service providers like Zoom were in existence nearing a decade before the Covid19 outbreak, the pandemic resulted in travel ban across the world. the only way people could connect was through audio visual services such as Zoom. Probably the biggest success story in the pandemic, Zoom’s revenue zoomed from $ 22 million to almost $ 80 million in the pandemic year alone. Despite concerns of personal data and online security, the hybrid work option that Zoom, Webex, Blue Jeans and the like offer are here to stay. The home grown Jiomeet was launched by Reliance in July 2020. The second wave of the pandemic helped it accelerate growth as it saw 25% additional volume of users added to its kitty despite the presence of players like Zoom.

OTT platforms

OTT really went over the top cashing in on the Covid19 induced lockdown. With nowhere to go, entertainment on OTT platforms seemed the only source of entertainment. With minimal subscription fee and unlimited viewing options, Netflix, Amazon, Hotstar, Disney, Zee, Sun and other streaming services. This form of entertainment is here to stay with analysts predicting a $ 15 billion market share for OTT by 2030. It is safe to say that Covid acted as a catalyst for the rise of OTT platforms. A hybrid form of entertainment.

Online gaming

This sector enjoyed a staggering 50% growth in its business during the lockdown. Estimated to touch almost $ 3 billion by 2022, online gaming industry played big and won bigger during the Covid pandemic. Average gaming time of young and old increased due to stay at home restrictions. Experts are of the view that games involving real money has increased manifold. This feature is here to stay as the world slowly moves towards normal.

The fragile healthcare infrastructure was further stretched with the onset of Covid19 pandemic. Initially caught unawares on how to handle this unprecedented crisis, hospitals – both public and private were battered. Medical supplies, doctors and other healthcare professionals, medical devices and equipment became scarce. Yet the healthcare sector took on the invisible enemy single handed. There seemed to be a good side and a flip side to it. There were countless covid cases, but the other cases requiring medical attention dropped drastically with people staying away from hospitals for the fear of contracting the virus. PPEs suits, gloves, sanitizers, oxygens cylinders and concentrators became an essential commodity. Imports were hit as India depended on other countries such as China for its supplies and raw materials. Though medical companies have experienced dip in revenues, Indian research companies were at work 24/7 ensuring production of effective vaccines within record timelines. Be it the economics or sheer humanity, healthcare sector is a winner.

The above sectors were but a handful that kept nations and its people going in the hope of things beginning to better. Human resilience is the clear winner.

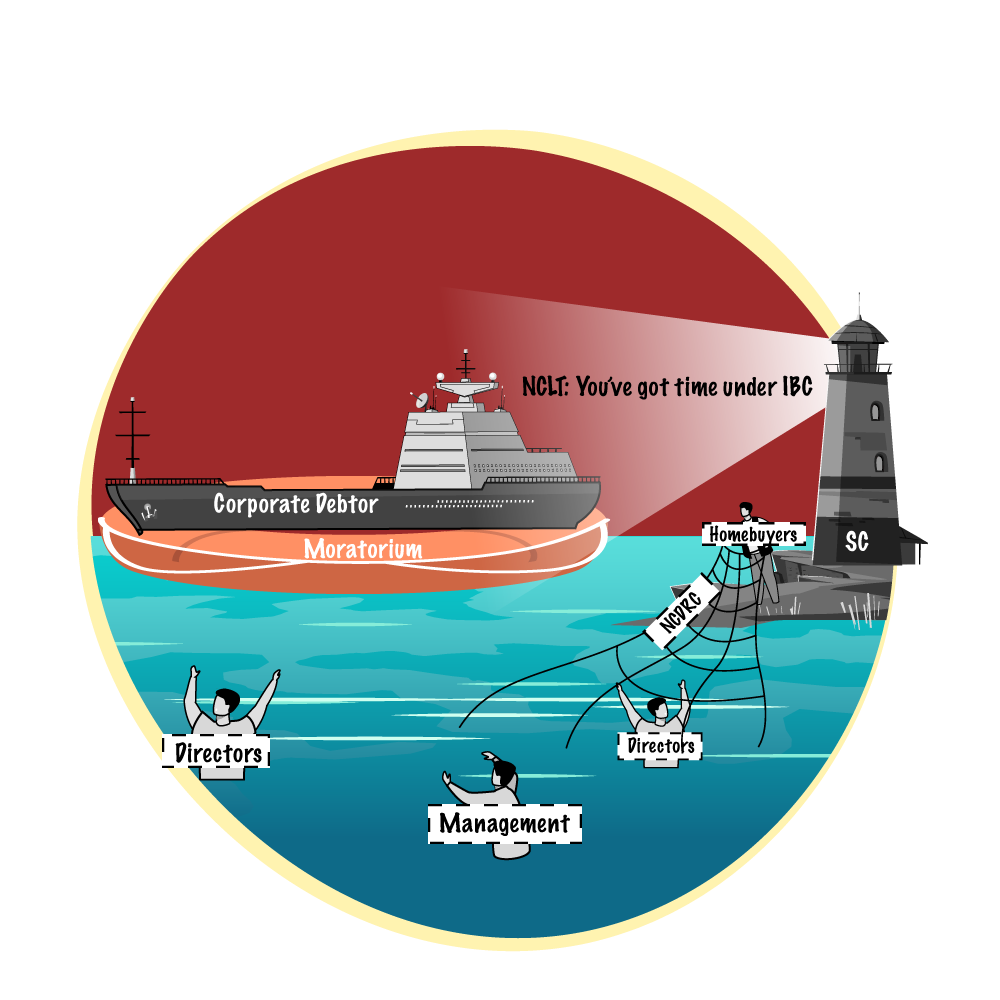

On 16th September 2021, the Supreme Court ruled that moratorium u/s 14 of the IBC applies only to the corporate debtor. It does NOT apply to the directors / management of the corporate debtor. This implies proceedings against directors/management could continue despite moratorium u/s 14 of IBC being in place for the corporate debtor. The Hon’ble Supreme Court passed this ruling while hearing the case of Anjali Rathi and Others Vs Today Homes & Infrastructure Pvt. Ltd. and Others SLP (C) No. 12150 of 2019.

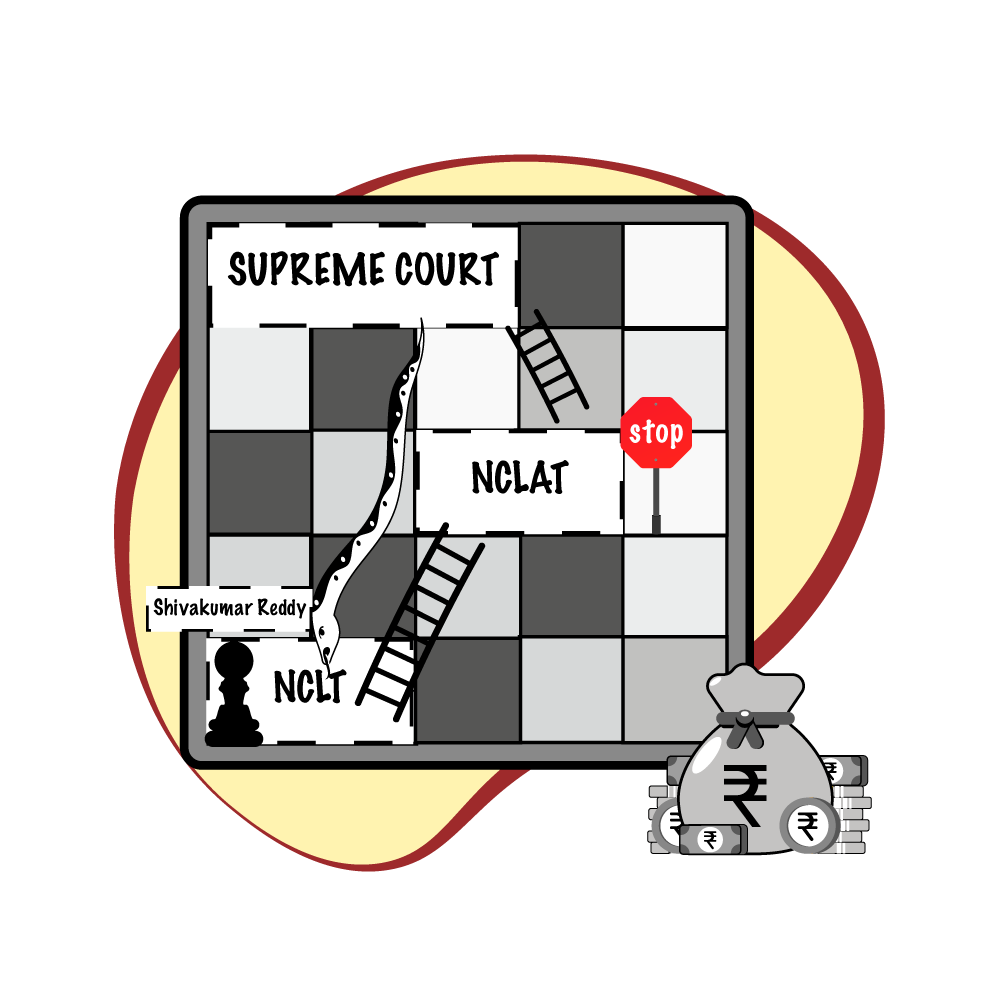

A monthly update of the most significant cases on insolvency and bankruptcy and its resolution

On 11th September 2021, the Ahmedabad bench of the NCLT passed an order approving the liquidation of an insolvent company even when it was a “going concern”. Nitin Jain (for PSL Ltd Vs Ashok Punj & Ors) IA No. 132 of 2020 in CP (IB) No. 37/10/NCLT/AHM /2017.

On 24th August 2021, the Principal NCLT Bench in Delhi passed a similar order in Mohan Gems & Jewels Pvt. Ltd. Vs Vijay Verma & IBBI Company Appeal AT (Insolvency) No. 84 of 2020.

The concept of liquidation of insolvent companies as a going concern is gaining popularity.

August 25, 2021

Frequently Asked Questions (FAQs) on Corporate Social Responsibility (CSR) – reg.

August 02, 2021

Maintenance of State Government Accounts – Recovery of Interest on Excess put through/ Double claim (State Government Transactions)

August 03, 2021

Framework for Outsourcing of Payment and Settlement-related Activities by Payment System Operators

August 04, 2021

Guidelines for Implementation of the circular on Opening of Current Accounts by Banks

August 05, 2021

Exim Bank's Government of India supported Line of Credit (LoC) of USD 30.00 million to the Government of the Republic of Sierra Leone

August 06, 2021

Export Credit in Foreign Currency – Benchmark Rate

August 06, 2021

Resolution Framework for COVID-19-related Stress – Financial Parameters – Revised timelines for compliance

August 06, 2021

Prudential Norms for Off-Balance Sheet Exposures of Banks – Restructuring of derivative contracts

August 09, 2021

Enhancement of collateral free loans to Self Help Groups (SHGs) under DAY-NRLM from ₹10 lakh to ₹20 Lakh

August 10, 2021

Monitoring of Availability of Cash in ATMs

August 12, 2021

Exim Bank's Government of India supported Line of Credit (LoC) of USD 100 million to the Government of the Republic of Mauritius

August 18, 2021

Safe Deposit Locker/Safe Custody Article Facility provided by the banks - Revised Instructions

August 19, 2021

Exim Bank's Government of India supported Line of Credit (LoC) of USD 20.22 million to the Government of the Republic of Guinea

August 19, 2021

Exim Bank's Government of India supported Line of Credit (LoC) of USD 170 million to the Government of the Republic of Guinea

August 19, 2021

Exim Bank's Government of India supported Line of Credit (LoC) of USD 20.51 million to the Government of the Republic of Guinea

August 24, 2021

Formation of new district in the State of Punjab – Assignment of Lead Bank Responsibility

August 25, 2021

Tokenisation – Card Transactions : Extending the Scope of Permitted Devices

August 25, 2021

Master Direction - Classification, Valuation and Operation of Investment Portfolio of Commercial Banks (Directions), 2021

August 27, 2021

Review of incentive and other measures to enhance distribution of coins

August 27, 2021

Enhancements to Indo-Nepal Remittance Facility Scheme

August 27, 2021

Master Directions on Prepaid Payment Instruments (PPIs)

August 30, 2021

Guidelines on Compensation of Whole Time Directors/ Chief Executive Officers/ Material Risk Takers and Control Function staff – Clarification

August 30, 2021

Master Direction on Financial Statements - Presentation and Disclosures

Nil

August 03, 2021

Permitting non-scheduled Payments Banks to register as Bankers to an Issue

August 04, 2021

Modification in Operational Guidelines for FPIs and DDPs pursuant to amendment in SEBI (Foreign Portfolio Investors) Regulations, 2019

August 04, 2021

Requirement of minimum number and holding of unit holders for unlisted Infrastructure Investment Trusts (InvITs)

August 09, 2021

Calendar Spread margin benefit in commodity futures contracts

August 13, 2021

Disclosure of shareholding pattern of promoter(s) and promoter group entities

August 13, 2021

Tendering of shares in open offers, buybacks and delisting offers by marking lien in the demat account of the shareholders

August 13, 2021

‘Security and Covenant Monitoring’ using Distributed Ledger Technology

August 17, 2021

Penalty for Repeated Delivery Default

August 26, 2021

Circular on Modalities for implementation of the framework for Accredited Investors

August 31, 2021

Extension of time for seeking membership of BSE Administration & Supervision Limited

August 31, 2021

Disclosure of risk-o-meter of scheme, benchmark and portfolio details to the investors

Nil

Nil

Nil

August 04, 2021

The Central Government Notifies National Council of Science Museums, Kolkata under Section 10 (46) of the Income Tax Act, 1961.

August 04, 2021

The Central Government Notifies ‘Real Estate Regulatory Authority under Section 10 (46) of the Income Tax Act, 1961.

August 09, 2021

Income tax Amendment (22nd Amendment), Rules, 2021.

August 10, 2021

the Central Government hereby establishes the Interim Boards for Settlement.

August 10, 2021

Income tax (23rd Amendment), Rules, 2021.

August 18, 2021

Income tax (24th Amendment), Rules, 2021.

August 31, 2021

Income tax (24th Amendment), Rules, 2021.

August 31, 2021

Income-tax (25th Amendment) Rules, 202

August 03, 2021

Extension of Time lines for Electroniv filing for various forms under the Income Tax Act, 1961.

August 29, 2021

Extension of Time lines for Electroniv filing for various forms under the Income Tax Act, 1961.

August 29, 2021

Seeks to make seventh amendment (2021) to CGST Rules, 2017.

August 29, 2021

Seeks to extend FORM GSTR-3B late fee Amnesty Scheme from 31.08.2021 upto 30.11.2021.

August 30, 2021

Seeks to amend notification No. 28/2021-Customs to extend the exemptions under the said notification up to 30th September, 2021.

August 05, 2021

Exchange rates Notification No.65/2021-Cus (NT) dated 5.8.2021

August 13, 2021

Fixation of Tariff Value of Edible Oils, Brass Scrap, Areca Nut, Gold and Silver – Reg

August 17, 2021

Corrigendum

August 12, 2021

Appointment of CAA by Pr. DGRI

August 12, 2021

Appointment of CAA by Pr. DGRI

August 19, 2021

Exchange rates Notification No.68/2021-Cus (NT) dated 19.8.2021.

August 31, 2021

Fixation of Tariff Value of Edible Oils, Brass Scrap, Areca Nut, Gold and Silver- Reg

August 31, 2021

Seeks to amend Sea Cargo Manifest and Transhipment Regulations 2018

August 16, 2021

De-notification of Inland Container Depots/Container Freight Stations/Air Freight Stations -reg.

August 16, 2021

De-notification of Inland Container Depots/Container Freight Stations/Air Freight Stations -reg.

August 09, 2021

Regarding Import of Split Cassia label as Cinnamon-reg.

August 17, 2021

Instructions and clarifications by Directorates/Commissionerates/Audit: Scope of Section 151 A of the Customs Act, 1962 - reg.

On 4th August 2021, a two-Judge Bench of the SC ruled that a final judgment, decree, and /or recovery certificate passed / issued by a court or tribunal would give rise to a fresh cause of action for a financial creditor to initiate proceedings under Section 7 of the Insolvency and Bankruptcy Code, 2016. A look at relevant details of the significant judgment.

Apex Rulings look at the Supreme Court Judgments that have profound bearing on the society.

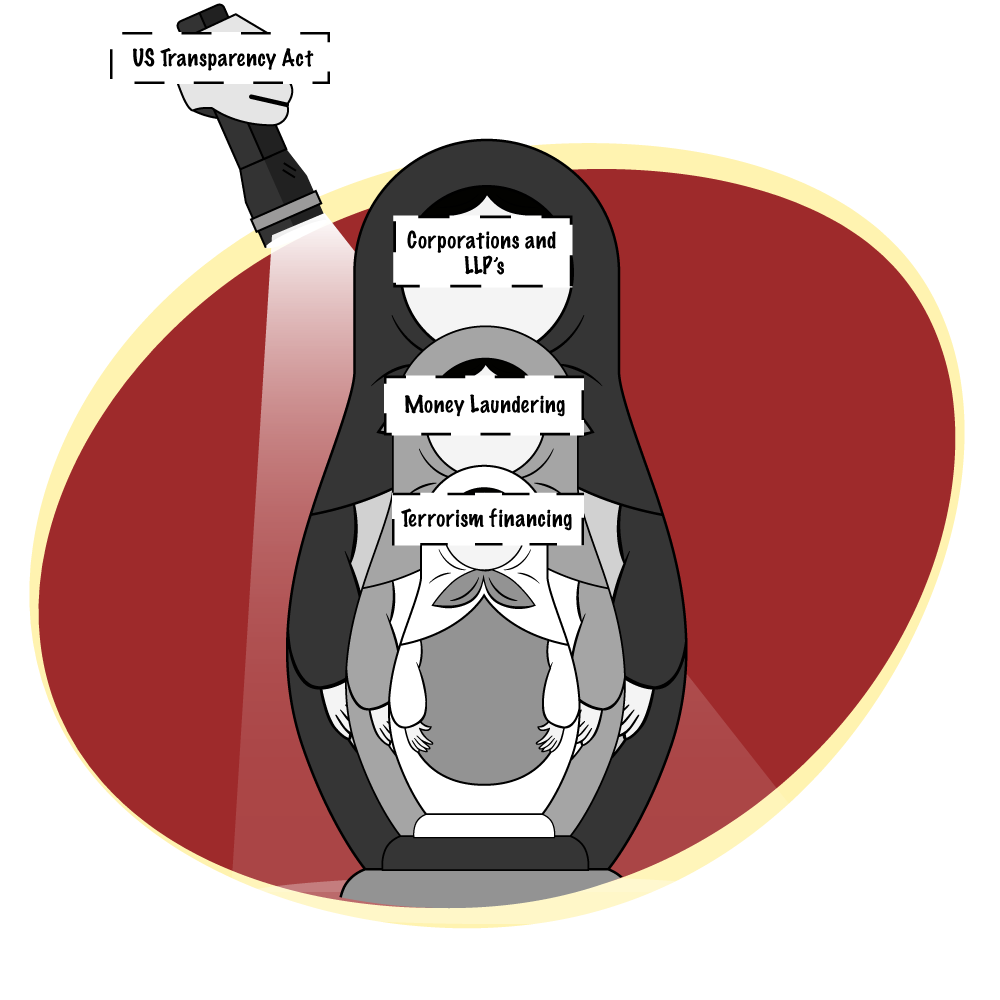

With the start of this year 2021, the United States assured itself of gearing up against the incessant rise of frequent activities of economic crimes like money laundering, terrorism financing, etc., and promised to reduce the same. One such move was to give effect to the Corporate Transparency Act, 2021 as it got passed and enacted as part of the National Defense Authorization Act.

It is something given or received for something else

The principle or rule that constitutes the basis of a decision of a Court of Law

A tort in which there is personal injury or damage to property due to exposure to certain toxic substances.

A clause in a contract that provides that provisions are severable. Also, a clause in a statute that makes the statute's parts or provisions severable so that one part can be invalidated without invalidating the whole

10-year professional experience = lifelong proficient ID

Declare Cow National Animal- Allahabad High Court

Does law supersede love? This movie is an American biographical – legal drama based on the historic decision of the U.S Supreme Court in the case of Loving Vs. Virginia. 388 U.S. 1 (1967).

The true story revolves around Mildred Delores, a coloured woman and a white man Richard Perry Loving. Both grew up in Virginia, lived in an area which had substantial mixed-race community. Both were family friends, studied together in high school, fell in love and wanted to get married. Virgina adhered to Racial Integrity Act of 1924, which made inter racial marriage / same sex marriages a crime. Hence, they married in Washington in 1958. However, a few weeks later they were arrested and sentenced to imprisonment for a year citing anti- miscegenation laws. The Judge suspended the sentence on condition that they do not return to Virginia together for at least 25 years.

Mildred then approached the Attorney General Robert F Kennedy for help who referred them to the American Civil Liberties Union. Constitutional experts rule that their ordeal could be presented in the Supreme Court of United States. After several hearings and based on other similar cases, in 1967, the US Supreme Court unanimously overturned the conviction of the Lovings’ and struck down the anti-miscegenation laws as unconstitutional. Landmark civil rights case poignantly depicted in the critically acclaimed award-winning movie.

Alejandrao “Sandy” Stern is one of the best criminal defense lawyers. At 85, he finally decides to call it a day. But his old friend Dr. Kiril Pafko asks Sandy to defend one last case. Dr. Pafko, the Nobel prize winning cancer researcher is accused of fraud, insider trading and murder. Sandy has to start from scratch – learning and unlearning everything he knew (or thought he knew) of his good friend. As the case commences, Sandy begins to investigate and learns that evidence and reality are glaringly apart. Sandy has to prove his mettle as a lawyer while protecting his friend. A page turning thriller from the celebrated lawyer – author Scott Turow.

The series showcases the professional lives of the Chicago State Attorney’s prosecutors who traverse through local politics, media perception and the law to provide justice.

61, TTK Road

Alwarpet, Chennai 600 018

Bootstart - Cabin 1, 2nd Floor, Doulatram Mansion Building, Rambhau Salgaonkar Road, Badhwar Park, Mumbai 400 005

2283, 14th A Main Road, HAL 2nd Stage

Indiranagar, Bengaluru 560 008

965, Harita Centre

Avinashi Road, Coimbatore 641 037

Phone: +919841011111

Email: subathra@akmllp.com