Section 7 of The IBC & The Limitation Act

In the Supreme of India, Civil appellate Jurisdiction

Civil Appeal No.1650 of 2020

Dena Bank (Now Bank of Baroda) …….. Appellant(s)

Vs

C Shivakumar Reddy & Anr ……….. Respondent(s)

On 4th August 2021, a two-Judge Bench of the SC ruled that a final judgment, decree, and /or recovery certificate passed / issued by a court or tribunal would give rise to a fresh cause of action for a financial creditor to initiate proceedings under Section 7 of the Insolvency and Bankruptcy Code, 2016.

A look at relevant details of the significant judgment.

Facts

- In December 2011, Dena Bank (“Bank”) had sanctioned term loan and letter of credit cum buyers’ credit to M/s Kavveri Telecom Infrastructure Limited (“Corporate Debtor”). Mr. C Shivakumar Reddy (“Respondent) is the Director of the said company. The term loan was granted with an upper limit of Rs. 45 Crores to be repaid in 24 quarterly instalments of Rs.187.50 lakhs, which were to commence two years after the date of disbursement, and the entire Term Loan was to be repaid in eight years, inclusive of the implementation period of one year and the moratorium period.

- In September 2013, the corporate debtor defaulted in repayment of loan. In December 2013, the Bank declared the account as “Non-performing Asset” (NPA)

- In January 2015 the Bank filed an application under the Debt recovery Act seeking recovery of its outstanding dues amounting to Rs. 52.12 crores from the corporate debtor. A notice was sent to the corporate debtor. The corporate debtor sent a reply notice seeking restructuring of the loan. While proceedings were in progress in the debt recovery tribunal, the corporate debtor approached the Bank for a one-time settlement. The bank though did not accept the proposal.

- In March 2017, the Debt Recovery Tribunal passed a final judgment and order / decree against the corporate decree for the recovery of loan amount and interest. In May 2017, the Debt Recovery Tribunal issued a recovery certificate in favour of the Bank for recovery of Rs. 52.12 crores for the corporate debtor along with interest. In June 2017, the corporate debtor once again approached the Bank with a one-time settlement proposal. The Bank did not accept it.

- In October 2018, the Bank filed petition u/s 7 of the IBC before Adjudicating Authority – NCLT.

- In January 2019, the Bank further filed an application under Rule 11 of the NCLT Rules, 2016 read with Rule 4 of the said rules seeking permission to place on record additional documents such as:

– The final judgment of the debt recovery tribunal,

– The Recovery Certificate that was issued by the debt recovery tribunal,

– Corporate debtor’ proposal for one- time settlement and

– Financials / Annual Report of the corporate debtor for the years 2016-2017 and 2017-2018 - In January 2019, the Government of India issued a notification for amalgamating Vijaya Bank, Dena Bank and Bank of Baroda. Effective 1st April 2019 all three Banks stood amalgamated and known as Bank of Baroda.

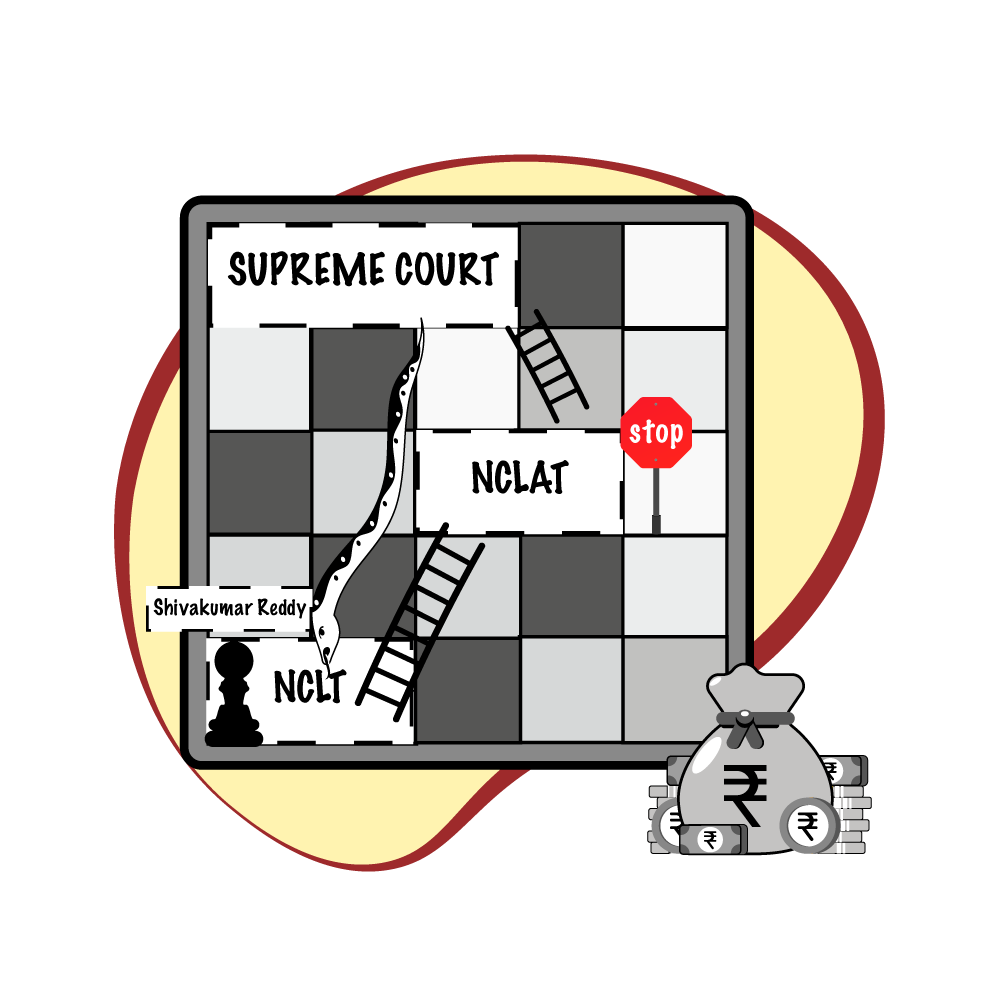

- In February 2019, the corporate debtor filed objection to the petition filed by the Bank u/7 of the IBC contending that the said petition was barred by limitation. In March 2019, the NCLT rejected the contention of the corporate debtor and allowed the admission of the petition by the Bank.

- In April 2019, the corporate debtor filed an appeal u/s 61 of the IBC in the NCLAT against the order passed by the NCLT. The NCLAT set aside the order passed by the NCLT on the grounds that the petition filed by the Bank u/s 7 of the IBC was barred by limitation.

- The Bank has approached the Supreme Court against the order passed by the NCLAT.

Issues

- Whether a Petition under Section 7 of the IBC would be barred by limitation, on the sole ground that it had been filed beyond a period of 3 years from the date of declaration of the loan account of the corporate debtor as NPA, even though the Corporate Debtor might subsequently have acknowledged its liability to the Appellant Bank, within a period of three years prior to the date of filing of the Petition under Section 7 of the IBC, by making a proposal for a one-time settlement, or by acknowledging the debt in its statutory Balance Sheets and Books of Accounts.

- Whether a final judgment and decree of the debt recover tribunal (DRT) in favour of the financial creditor, or the issuance of a Certificate of Recovery in favour of the financial creditor, would give rise to a fresh cause of action to the financial creditor to initiate proceedings under Section 7 of the IBC within three years from the date of the final judgment and decree, and/or within three years from the date of issuance of the Certificate of Recovery.

- Whether there is any bar in law to the amendment of pleadings, in a Petition under Section 7 of the IBC, or to the filing of additional documents, apart from those filed initially, along with the Petition under Section 7 of the IBC in Form-1.

Contentions

Appellant(s)

- Counsel for the appellant submitted that the NCLAT set aside the order of the NCLT on the grounds that there were no documents or records that amounted to acknowledgement of debt by the corporate debtor to the Bank. Additional documents filed by the Bank in January 2019 – Financials, one-time settlement proposal, acknowledgement of part payment of interest on loan, reply to demand notice filed by the Bank and others seemed to have been ignored by the Adjudicating authority.

- Of the additional documents filed by the Bank, there was a document dated 28th March 2014 acknowledging part payment of interest of Rs. 111 lakhs towards loan. This amounts to acknowledgement of debt as it showed that loan was alive. On 3rd March 2017, the corporate debtor made a one-time settlement proposal to the Bank, again indicating acknowledgement of debt. The Bank filed petition u/s 7 of the IBC in October 2018, which was well within the limitation period of 3 years from acknowledgement of debt.

- The counsel relied on the judgments passed by the Hon’ble Supreme Court in (i) Sesh Nath Singh and Anr. v. Baidyabati Sheoraphuli Cooperative Bank Ltd. and Anr. 2021 SCC Online SC 244 (ii) Laxmi Pat Surana v. Union Bank of India and Ors. 2021 SCC Online SC 267 and (iii) Asset Reconstruction Company (India) Limited. v. Bishal Jaiswal and Ors 2021 SCC Online SC 321 in submitting that Section 18 of the Limitation Act applied to proceedings IBC.

Respondent(s)

- Counsel for respondents that petition u/s 7 of the IBC was filed way after the limitation period of 3 years. He contended that the additional documents were submitted by the Bank after the expiry of the 14 days period u/s 7 of the IBC for the ascertainment of default. The Adjudicating authority seemed to have ignored this fact. It was in the background of this fact that NCLAT made the finding that there was nothing on record to the effect of acknowledgement of debt by the corporate debtor.

- They further submitted that though it is well-established that section 18 of the Limitation Act is applicable to proceedings of section 7 of the IBC, he contended that sufficient material was not placed on record (for acknowledgement of debt) for section 18 of the Limitation Act to become applicable to Section 7 of IBC in this case.

- Counsel further submitted that Section 62 of IBC (under which this appeal is filed) is restricted only to question of law (and not an appeal on fact and law). In doing so the judgment in the case Nazir Mohamed vs J Kamala & Ors 2020 SCC online SC 676 was relied upon.

Analysis

The Hon’ble Apex Court made the following observations:

- A financial creditor is required to apply in the prescribed Form I while filing a petition u/7 of the IBC. They can fill only those details as contained in the Form. There is no scope for elaborate pleadings. Hence, it cannot be compared with the plaint in a suit. Such application cannot be judged by the same standards, as a plaint in a suit, or any other pleadings in a Court of law.

- Section 7(4) of the IBC casts an obligation on the Adjudicating Authority to ascertain the existence of a default from the records of an information utility or on the basis of other evidence furnished by the financial creditor within 14 days of the receipt of the application under Section 7. The application does not lapse for non-compliance of the time schedule. Nor can the Adjudicating authority dismiss the application unless due process has been followed.

- In Ferro Alloys Corporation Limited v. Rajhans Steel Limited 1999 SCC online PAT 1196 it was held that a decree and or final adjudication would give rise to a fresh period of limitation for initiation of corporate insolvency resolution process.

- A One Time Settlement offer of a live claim, made within the period of limitation, shall be construed as an acknowledgment to attract Section 18 of the Limitation Act.

- A careful reading of IBC provisions, in particular Section 7(2) to 7(5) of the IBC read with Adjudicating Authority Rules 2016 can be inferred that there is no bar on filing of documents at any time until a final order is passed – either admitting or dismissing the application. The time stipulation of 14 days u/s 7(4) is only directory and not mandatory. If default is not ascertained within stipulated period, the Adjudicating Authority has to record its reasons in writing. No other penalty is stipulated. Even assuming that the additional documents were submitted beyond the stipulated time, the Adjudicating authority was not precluded from considering them. In this case, the additional documents were submitted before any final decision was taken u/s 7 of the IBC. However, if there was inordinate delay in filing documents, the Adjudicating authority can at best decline the request for filing additional documents.

Judgement

Based on the analysis, the Hon’ble Apex court ruled that:

- Section 7 of the IBC would not be barred by limitation, on the ground that it had been filed beyond a period of 3 years from the date of declaration of the loan account of the corporate debtor as NPA, if there were an acknowledgement of the debt by the corporate debtor before expiry of the period of limitation of 3 years, in which case the period of limitation would get extended by a further period of 3 years.

- An order / decree of the DRT and Recovery certificate will give rise to a fresh cause of action to the Bank to initiate fresh petition u/s 7 of the IBC.

Therefore, the Supreme Court set aside the order passed by the NCLAT.

Full text of the Judgment:

https://main.sci.gov.in/supremecourt/2020/5402/5402_2020_40_1501_29049_Judgement_04-Aug-2021.pdf